10 Controllable And Uncontrollable Factors In Property Tax Increase

10 Controllable And Uncontrollable Factors In Property Tax Increase The property tax increase as reflected on your tax bill is affected by these 10 controllable and uncontrollable factors. this is vital information in reducing your tax bill, too. Struggling with rising property tax bills? learn how to challenge unfair assessments, find exemptions, and take control of your tax burden.

Ways To Improve The Mechanism Of Property Tax On Individuals Pdf Here are five home improvement projects that will likely result in an increase in your property taxes, especially when the tax assessor hears about them. lest you think that you can keep it a secret, you may not be able to do so for certain projects. Property taxes increased by seven percent in 2023 alone, leaving the average homeowner with a tax bill of more than $4,000. spending by local governments has more than doubled over two decades, exceeding $2 trillion. cities across the country show how local governments have lost control of spending. 2. north carolina. some counties in north carolina could potentially see higher property tax bills after property values in certain counties rose in value. The rise in uncontrollable operating expenses can be attributed to various factors: inflation: general increases in the cost of goods and services affect building maintenance and operations. energy costs: fluctuating energy prices can lead to unpredictable utility expenses.

A Tale Of Two Counties Facing Possible Property Tax Increases Graphic 2. north carolina. some counties in north carolina could potentially see higher property tax bills after property values in certain counties rose in value. The rise in uncontrollable operating expenses can be attributed to various factors: inflation: general increases in the cost of goods and services affect building maintenance and operations. energy costs: fluctuating energy prices can lead to unpredictable utility expenses. The issue property values are increasing. property values have skyrocketed in recent years, rising almost 27 percent faster than inflation since 2020, which yields dramatically higher property taxes in jurisdictions that fail to adjust millages (rates) downward. Uncontrollable expenses are costs that are outside the landlord’s control. they are often dictated by external factors such as market conditions, government regulations, or contractual obligations. examples of uncontrollable expenses include property taxes, insurance premiums, and mortgage payments. On average, many property owners should not see a substantial increase in their taxes when there are reassessments, but for those who are further outside the average could see a significant increase or decrease. what can you do? the argument should begin with the municipalities and schools when they plan their budgets for the current year. Property taxes go up as a result of one or a combination of a few factors: home improvements leading to increases in your home value, recent home sales showing increasing property values in your market or changes in government policies leading to higher tax rates.

Uncontrollable Factors That Impact Property Prices Homeinsiderz The issue property values are increasing. property values have skyrocketed in recent years, rising almost 27 percent faster than inflation since 2020, which yields dramatically higher property taxes in jurisdictions that fail to adjust millages (rates) downward. Uncontrollable expenses are costs that are outside the landlord’s control. they are often dictated by external factors such as market conditions, government regulations, or contractual obligations. examples of uncontrollable expenses include property taxes, insurance premiums, and mortgage payments. On average, many property owners should not see a substantial increase in their taxes when there are reassessments, but for those who are further outside the average could see a significant increase or decrease. what can you do? the argument should begin with the municipalities and schools when they plan their budgets for the current year. Property taxes go up as a result of one or a combination of a few factors: home improvements leading to increases in your home value, recent home sales showing increasing property values in your market or changes in government policies leading to higher tax rates.

Controllable And Uncontrollable Factors Affecting Marketing On average, many property owners should not see a substantial increase in their taxes when there are reassessments, but for those who are further outside the average could see a significant increase or decrease. what can you do? the argument should begin with the municipalities and schools when they plan their budgets for the current year. Property taxes go up as a result of one or a combination of a few factors: home improvements leading to increases in your home value, recent home sales showing increasing property values in your market or changes in government policies leading to higher tax rates.

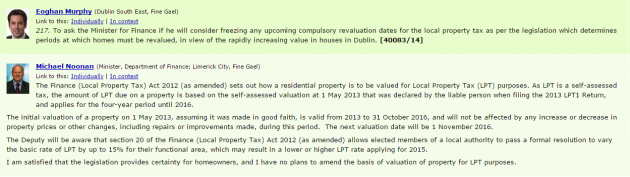

Warnings Of An Uncontrollable Rise In Local Property Tax

Comments are closed.