3 Things To Know About Truth In Taxation Kansas Policy Institute

3 Things To Know About Truth In Taxation Kansas Policy Institute The new truth in taxation legislation is now in effect, and there are three things that taxpayers should know about the process to maximize the benefits and reduce taxes. 1. local officials can reduce taxes or hold them flat if they wish. Since 2021, kansas’s truth in taxation laws have been a strong tool for taxpayers to voice their opinion and oppose tax increases in their community. here’s three ways that citizens are empowered to keep property taxes affordable. 1. local officials must be transparent with their communities.

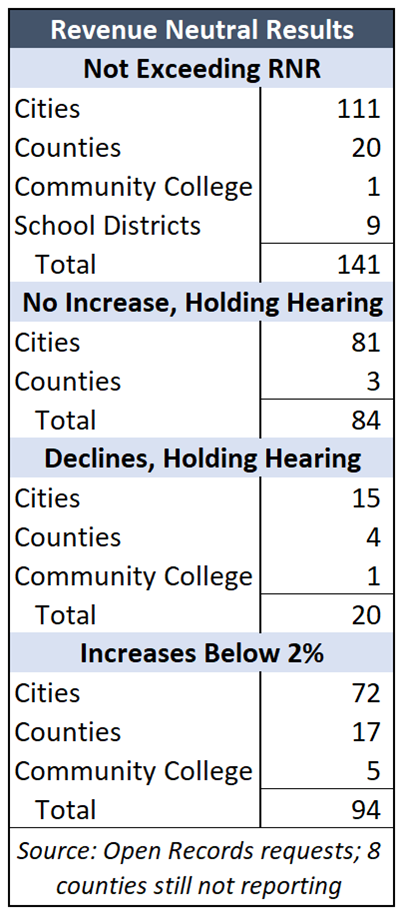

3 Things To Know About Truth In Taxation Kansas Policy Institute Truth in taxation, including a prohibition on valuation increases solely for routine replacement and repairs, and our other reforms quickly passed the senate, but progress stalled in the house, and then covid shortened the session. Hutchinson — a limited government advocate says the truth in taxation law in kansas is working. "for years, people had complained loudly about being told by local officials that they were. •dr. arthall,a history of tax policy in kansas, 2006 •“the kansas economy suffers from an odd anomaly that has direct consequences for the economic well being of kansans. According to kansas policy institute, truth in taxation characterized “model for legislative change” because it holds local officials accountable when it comes to property tax increases that saves kansan millions.

Kansas Policy Institute Wikipedia •dr. arthall,a history of tax policy in kansas, 2006 •“the kansas economy suffers from an odd anomaly that has direct consequences for the economic well being of kansans. According to kansas policy institute, truth in taxation characterized “model for legislative change” because it holds local officials accountable when it comes to property tax increases that saves kansan millions. The truth in taxation law is reaping profound benefits for kansas taxpayers. and it's getting the attention of other states that need the same property. It passes! the "truth in taxation" bill passed the senate 34 1 and a similar version passed the house 120 3. differences are expected to be resolved next week so the bill can be sent to the. Kansas’s truth in taxation legislation from 2021 is being hailed as a model example for property tax reform. transparency and accountability are central. How can kansas cut waste and protect taxpayers? what’s going on with the federal farm bill? what does effective tax relief look like? what does the farm bill’s lapse mean for kansas? what is a flat tax? what does esg mean for kansas? viva la flat tax revolution! what does “dark store theory” debate mean for kansas property taxes?.

Comments are closed.