4 States Where Homeowners Can Expect A Property Tax Increase

Property Tax Increase What To Do About It Propertytaxes Law Property taxes are also growing due to increased home values and changes to local tax rates, a new report from realtor ® has found. the median tax bill in the u.s. in 2024 was $3,500, up 2.8%. Though the median home list price in dallas fell 4.4% in april 2025, to $430,000, with days on the market going up 7.5%, homebuyers here should expect property taxes to be heftier than average.

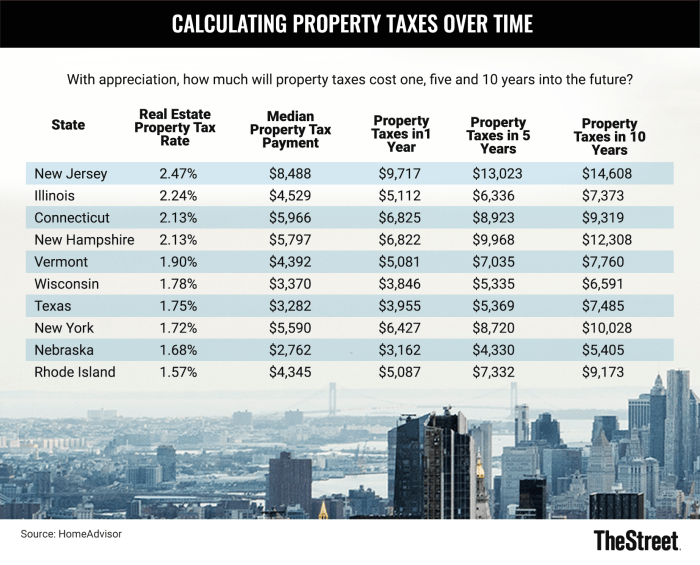

10 Controllable And Uncontrollable Factors In Property Tax Increase Home prices may have flattened across the u.s. —but that will bring minimal relief to homeowners whose property taxes have spiked yet again, rising by an average of 2.7% across the country in. Homeowners in many states are in for a financial shock as major property tax increases loom on the horizon. rising […]. States with the highest property tax rates include new jersey, illinois, connecticut, and new hampshire. for example, illinois’ median property tax payment is $4,529. with illinois’ average home appreciation, this number would reach $7,373 in ten years at its current property tax rate (2.24%). So far this year, alabama, wyoming, and kansas have enacted new laws designed to limit future property tax hikes for homeowners. other states are looking at more limited carve outs and.

Homeowners Face The Biggest Property Tax Hikes In 4 Years Here S States with the highest property tax rates include new jersey, illinois, connecticut, and new hampshire. for example, illinois’ median property tax payment is $4,529. with illinois’ average home appreciation, this number would reach $7,373 in ten years at its current property tax rate (2.24%). So far this year, alabama, wyoming, and kansas have enacted new laws designed to limit future property tax hikes for homeowners. other states are looking at more limited carve outs and. Colorado homeowners faced a 10.6% rise in property taxes from 2023 to 2024 and a staggering 52.9% increase since 2019. during the same period, home prices in colorado climbed 47%. georgia and florida have followed similar trends. Alabama, wyoming and kansas have passed laws limiting future property tax increases. in november, colorado and georgia residents will vote on similar proposals. other states are exploring. Average property tax bills rose the most in western states, including colorado (40.2%), utah (34.7%), and washington (33.2%). though average property tax bills rose in nearly 97% of cities, effective property tax rates increased in only about 17% of the cities we considered. A new lendingtree study shows that median property taxes rose in every major us metro between 2021 and 2023, with the national average increase hitting 10.4%. homeowners in some cities saw far.

These States Have The Highest Property Tax Rates Thestreet Colorado homeowners faced a 10.6% rise in property taxes from 2023 to 2024 and a staggering 52.9% increase since 2019. during the same period, home prices in colorado climbed 47%. georgia and florida have followed similar trends. Alabama, wyoming and kansas have passed laws limiting future property tax increases. in november, colorado and georgia residents will vote on similar proposals. other states are exploring. Average property tax bills rose the most in western states, including colorado (40.2%), utah (34.7%), and washington (33.2%). though average property tax bills rose in nearly 97% of cities, effective property tax rates increased in only about 17% of the cities we considered. A new lendingtree study shows that median property taxes rose in every major us metro between 2021 and 2023, with the national average increase hitting 10.4%. homeowners in some cities saw far.

States With The Lowest Property Taxes In 2024 Average property tax bills rose the most in western states, including colorado (40.2%), utah (34.7%), and washington (33.2%). though average property tax bills rose in nearly 97% of cities, effective property tax rates increased in only about 17% of the cities we considered. A new lendingtree study shows that median property taxes rose in every major us metro between 2021 and 2023, with the national average increase hitting 10.4%. homeowners in some cities saw far.

Comments are closed.