A Tale Of Two Counties Facing Possible Property Tax Increases Graphic

A Tale Of Two Counties Facing Possible Property Tax Increases Graphic A tale of two counties facing possible property tax increases graphic free download as pdf file (.pdf), text file (.txt) or read online for free. frisco isd passed a $775 million bond which may increase their i&s property tax rate in 2015 to fund 14 new schools. Some washington county homeowners will see double digit jumps in their property taxes this year, including a few communities facing some of the largest increases in the metro area. among.

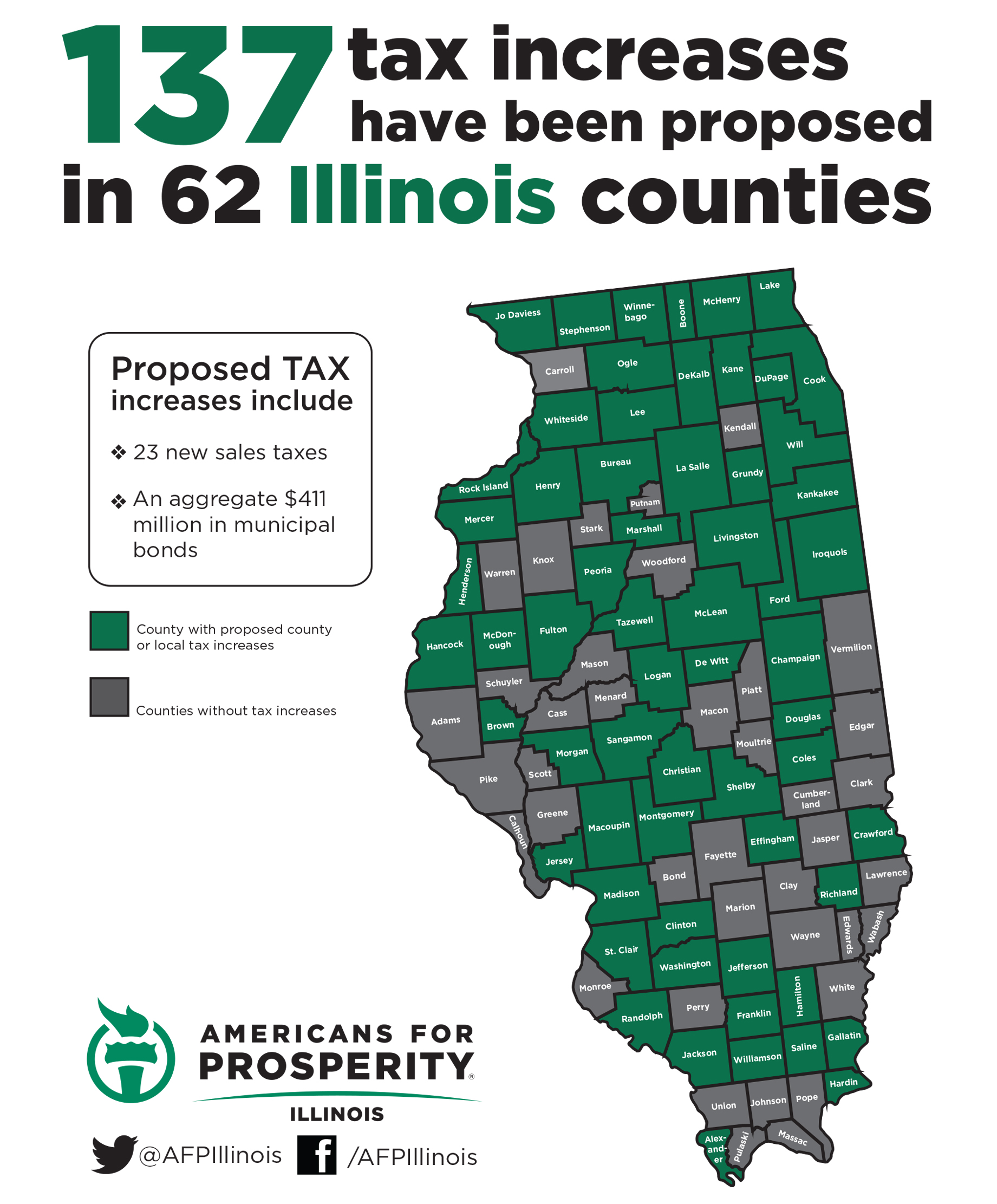

137 Tax Increases Proposed In 62 Illinois Counties Property taxes increased by seven percent in 2023 alone, leaving the average homeowner with a tax bill of more than $4,000. spending by local governments has more than doubled over two decades, exceeding $2 trillion. cities across the country show how local governments have lost control of spending. The chart below shows these two measures in montgomery county over the last twenty years. the great recession reversed years of growth in the two pillars of the county’s budget. the assessable base supports property taxes, the county’s top revenue source, and it fell from $188 billion in 2010 to $163 billion in 2013. New jersey had the highest effective property tax rate at 2.2%, followed by illinois (2.18%), texas (2.15%), vermont (1.97%) and connecticut (1.92%). hawaii had the lowest rate in the country. It is great to see geauga county concerned about the ever increasing property taxes pricing citizens out of their homes. the mandatory sexennial property revaluation happened geauga county in 2024 with the taxes to be collected in 2025.

Toronto S News Biggest Property Tax Increases Expected In Davenport New jersey had the highest effective property tax rate at 2.2%, followed by illinois (2.18%), texas (2.15%), vermont (1.97%) and connecticut (1.92%). hawaii had the lowest rate in the country. It is great to see geauga county concerned about the ever increasing property taxes pricing citizens out of their homes. the mandatory sexennial property revaluation happened geauga county in 2024 with the taxes to be collected in 2025. Lancaster county, s.c. in the rapidly urbanizing indian land area in lancaster county’s panhandle, south carolina’s lower taxes and proximity to upscale charlotte neighborhoods have sparked a growth wave that officials are racing to control. “it’s almost like a tale of two cities,” says county administrator steve willis. “how can the value increase so much in a year?” she asked herself. her community hadn’t increased much, and her house hadn’t been extensively renovated. nonetheless, the appraisal had increased. Property tax increases can feel overwhelming, but homeowners have more control over their tax burden than they may realize. taking the time to review your assessment, challenge inaccuracies, and explore available exemptions can lead to significant savings. Despite a recent decision by the scott county fiscal court to lower property tax rates for 2022, most homeowners actually will experience increases on their property tax bills officials project. the reason is two fold.

Maine Seniors Property Tax Increases May Be Thing Of The Past Lancaster county, s.c. in the rapidly urbanizing indian land area in lancaster county’s panhandle, south carolina’s lower taxes and proximity to upscale charlotte neighborhoods have sparked a growth wave that officials are racing to control. “it’s almost like a tale of two cities,” says county administrator steve willis. “how can the value increase so much in a year?” she asked herself. her community hadn’t increased much, and her house hadn’t been extensively renovated. nonetheless, the appraisal had increased. Property tax increases can feel overwhelming, but homeowners have more control over their tax burden than they may realize. taking the time to review your assessment, challenge inaccuracies, and explore available exemptions can lead to significant savings. Despite a recent decision by the scott county fiscal court to lower property tax rates for 2022, most homeowners actually will experience increases on their property tax bills officials project. the reason is two fold.

Comments are closed.