Breaking Down A Dollar Of Your County Property Taxes Fy 2025

Fy 2025 Adopted Budget Grants Pass Or Official Website Fy 2025 recommended budget breaking down a dollar of your county property taxes fy 2025 ad valorem revenue $203,089,453 $1.00 (based on recommended budget) general fund millage breakdown county departments offi ces 1.3531 cras outside entity funding 0.2911 debt service 0.1010 judicial support 0.1292 medical examiner 0.0504 constitutional. Breaking down a dollar of your county property taxes fy 2025 adopted budget $.28 total .05 05 .04 .05 .02 .02 .01 $.12 $.02 property appraiser $.03 tax collector $.30 sheriff road patrol operations $.16 sheriff detention corrections $.03 judicial support s .06 cras outside entity funding $.02 debt service $1.00 2025 ad valorem revenue.

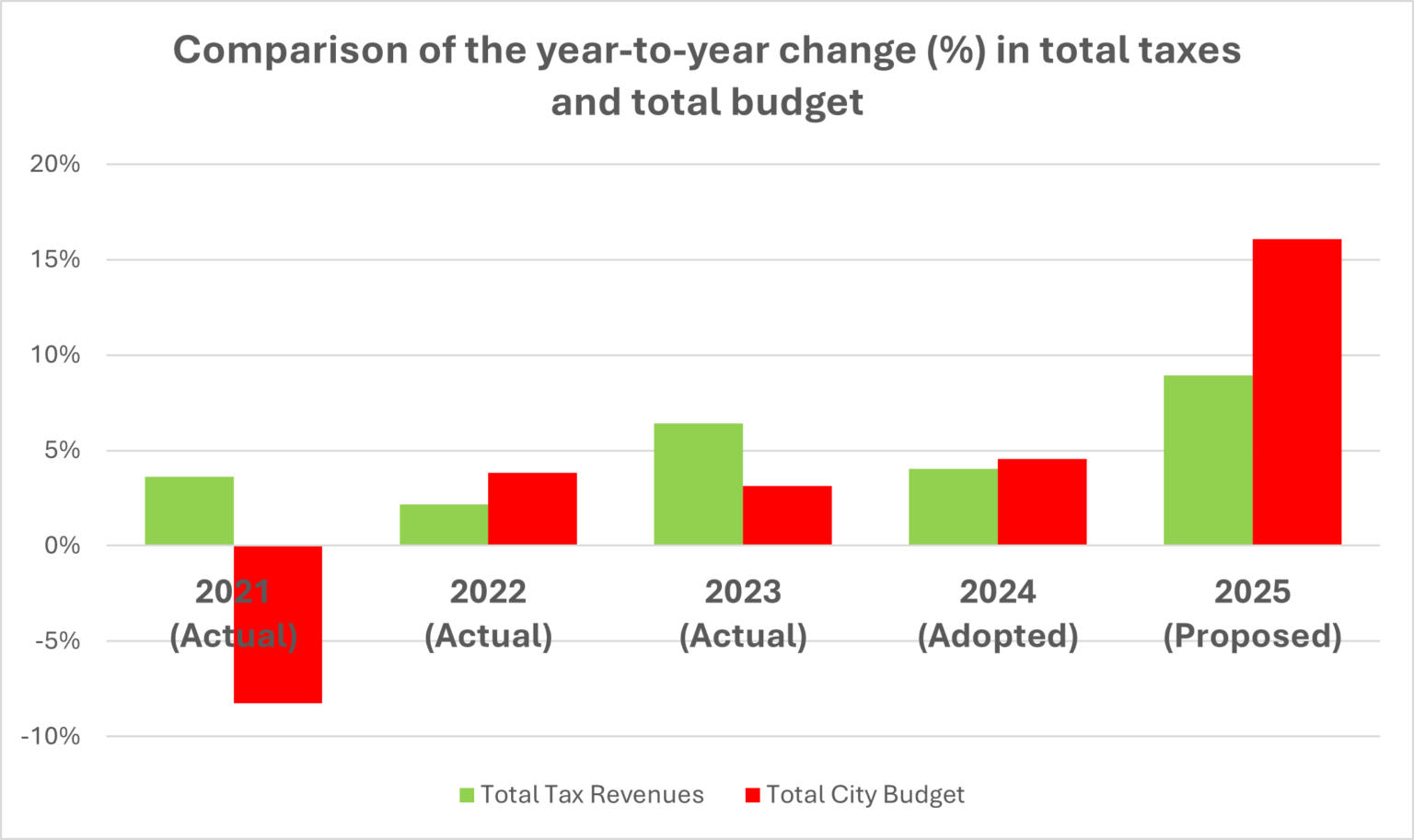

A Review Of The Proposed Fy 2025 Budget Falls Church Pulse The first looks at median property tax bills and effective property tax rates in each county in the united states, and the second compares effective tax rates across states. how does your county and state compare?. To calculate your property taxes, start by typing the county and state where the property is located and then enter the home value. press calculate to see the average property tax rate, along with an estimate of the monthly and yearly property tax costs. On tax rates.org, our data allows you to compare property taxes across states and counties by median property tax in dollars, median property tax as percentage of home value, and several other benchmarks. The first looks at median property tax bills and effective property tax rates in each county in the united states, and the second compares effective tax rates across states. how does your county and state compare?.

Do Your County Property Taxes Increase Every Year O Connor2023 Medium On tax rates.org, our data allows you to compare property taxes across states and counties by median property tax in dollars, median property tax as percentage of home value, and several other benchmarks. The first looks at median property tax bills and effective property tax rates in each county in the united states, and the second compares effective tax rates across states. how does your county and state compare?. In this episode, we break down why property taxes are increasing, common but flawed solutions, and why the property tax remains an economically efficient revenue source. data. property taxes by state and county, 2025. property taxes are the primary tool for financing local governments. (fy 2020) the mix of tax sources states choose can have. As a result, the following states have new or expanded property tax breaks that took effect in 2025. the measure: amendment no. 5. when it took effect: jan. 1, 2025. who supported it: florida’s amendment no. 5 passed with about 66% of voters in favor of it. For instance, if your property’s assessed value in 2025 was $300,000 and the tax rate was 15 mills (or 0.015), your property tax bill would be: $300,000 x 0.015 = $4,500 keep in mind that this is a simplified example. Understanding property tax by state 2025 requires awareness of individual state deadlines. to effectively manage your property tax obligations, consult a comprehensive resource for estimated taxes due dates 2025 which provides crucial information on timely payment.

Fiscal Year 2025 Budget Documents Biddeford Me In this episode, we break down why property taxes are increasing, common but flawed solutions, and why the property tax remains an economically efficient revenue source. data. property taxes by state and county, 2025. property taxes are the primary tool for financing local governments. (fy 2020) the mix of tax sources states choose can have. As a result, the following states have new or expanded property tax breaks that took effect in 2025. the measure: amendment no. 5. when it took effect: jan. 1, 2025. who supported it: florida’s amendment no. 5 passed with about 66% of voters in favor of it. For instance, if your property’s assessed value in 2025 was $300,000 and the tax rate was 15 mills (or 0.015), your property tax bill would be: $300,000 x 0.015 = $4,500 keep in mind that this is a simplified example. Understanding property tax by state 2025 requires awareness of individual state deadlines. to effectively manage your property tax obligations, consult a comprehensive resource for estimated taxes due dates 2025 which provides crucial information on timely payment.

Stage 3 Tax Cuts For 2025fy And What They Mean For You Pekada For instance, if your property’s assessed value in 2025 was $300,000 and the tax rate was 15 mills (or 0.015), your property tax bill would be: $300,000 x 0.015 = $4,500 keep in mind that this is a simplified example. Understanding property tax by state 2025 requires awareness of individual state deadlines. to effectively manage your property tax obligations, consult a comprehensive resource for estimated taxes due dates 2025 which provides crucial information on timely payment.

Comments are closed.