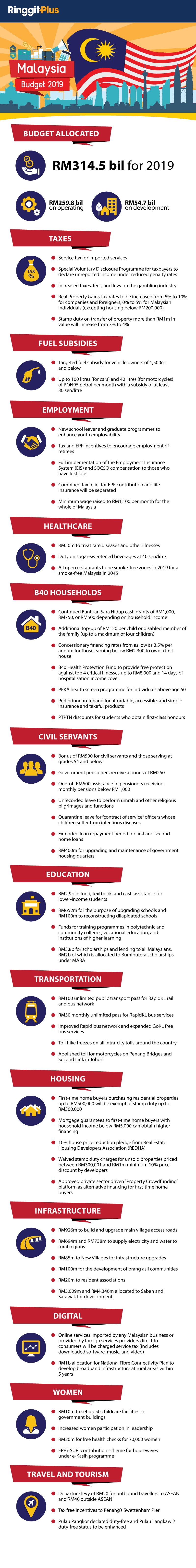

Budget 2019 Budget 2019 And You

2019 Budget Passes Budget of the united states government, fiscal year 2019 contains the budget message of the president, information on the president’s priorities, and summary tables. pdf details. The united states federal budget for fiscal year 2019 ran from october 1, 2018, to september 30, 2019. five appropriation bills were passed in september 2018, the first time five bills had been enacted on time in 22 years, with the rest of the government being funded through a series of three continuing resolutions .

Budget 2019 Budget 2019 And You Budget 2019: highlights of bill morneau's fourth federal budget; how to watch cbc's coverage of federal budget 2019; as liberals slip in key demographics, they hope the budget can stop. Net spending by the government was $4.4 trillion in 2019—$339 billion (or 8 percent) more than in 2018. outlays amounted to 21.0 percent of gdp in 2019, compared with 20.2 percent in 2018, and above the 50 year average (20.4 percent). if not for the shift in the timing of certain payments, outlays in 2018 would have equaled 20.4 percent of gdp. Budget of the united states government, fiscal year 2019 contains the budget message of the president, information on the president’s priorities, and summary tables. Budget fy 2019 budget of the u.s. government, budget of the united states government, fiscal year 2019 contains the budget message of the president, information on the president’s priorities, and summary tables.

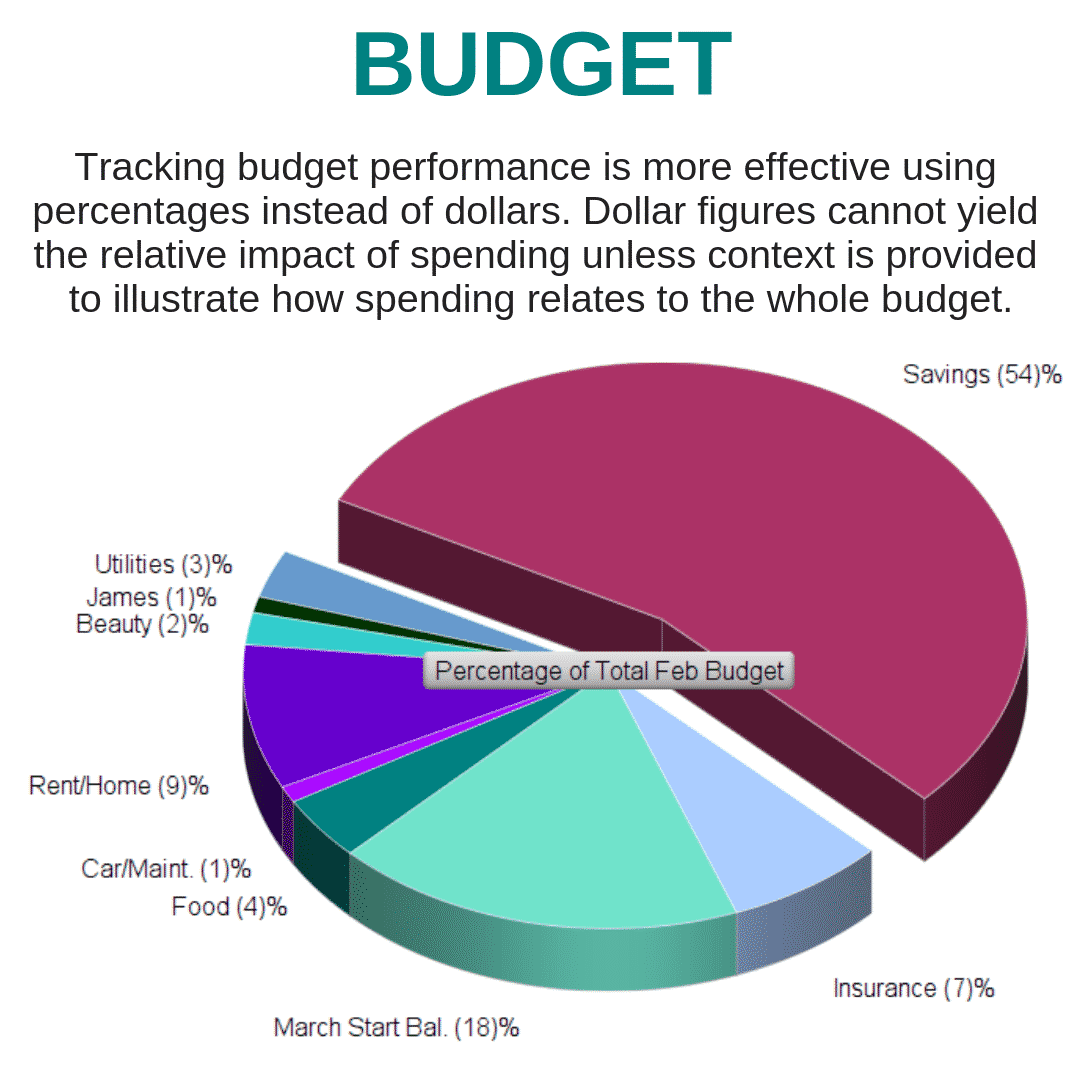

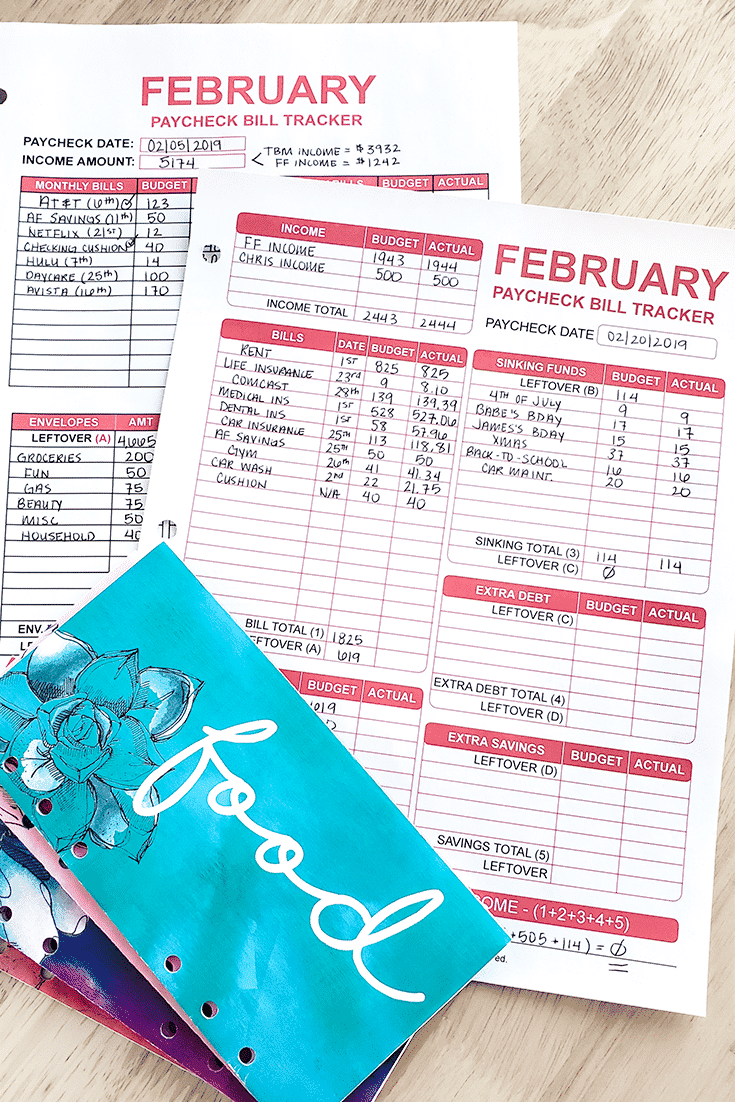

February 2019 Budget Recap The Budget Mom Budget of the united states government, fiscal year 2019 contains the budget message of the president, information on the president’s priorities, and summary tables. Budget fy 2019 budget of the u.s. government, budget of the united states government, fiscal year 2019 contains the budget message of the president, information on the president’s priorities, and summary tables. In 2019, cbo estimates, the deficit under the president’s budget would rise to $955 billion (or 4.5 percent of gdp)—about $17 billion less than the shortfall pro jected in the baseline. that diference is largely attrib utable to proposals to reduce funding for nondefense discretionary programs. 2019 has been a dramatic year for budget policy, with policymakers this year adding $2.2 trillion to the debt by 2029. we will be continuing our analysis into the new year of both pending legislation and 2020 presidential campaign proposals , advocating for fiscal responsibility in washington. The treasury department released final budget numbers for fiscal year (fy) 2019 today, showing last year's deficit totaled $984 billion, a $205 the budget deficit will be almost $900 billion this year according to projections from the congressional budget office (cbo). by our estimates, 60. The information presented in the fy 2019 budget in brief is accurate and complete as of february 12, 2018. any updates will be reflected in the budget available on the department of the treasury website, treasury.gov.

February 2019 Budget Recap The Budget Mom In 2019, cbo estimates, the deficit under the president’s budget would rise to $955 billion (or 4.5 percent of gdp)—about $17 billion less than the shortfall pro jected in the baseline. that diference is largely attrib utable to proposals to reduce funding for nondefense discretionary programs. 2019 has been a dramatic year for budget policy, with policymakers this year adding $2.2 trillion to the debt by 2029. we will be continuing our analysis into the new year of both pending legislation and 2020 presidential campaign proposals , advocating for fiscal responsibility in washington. The treasury department released final budget numbers for fiscal year (fy) 2019 today, showing last year's deficit totaled $984 billion, a $205 the budget deficit will be almost $900 billion this year according to projections from the congressional budget office (cbo). by our estimates, 60. The information presented in the fy 2019 budget in brief is accurate and complete as of february 12, 2018. any updates will be reflected in the budget available on the department of the treasury website, treasury.gov.

Comments are closed.