Buyer Beware These 10 States Have The Highest Property Tax In The Nation

Buyer Beware These 10 States Have The Highest Property Tax In The Nation Median property taxes in the u.s. rose by an average of 10.4% in two years, according to a recently released report. Connecticut, new york, new hampshire and massachusetts rounded out the top five states with the most expensive median property tax bill. homeowners in west virginia paid the smallest.

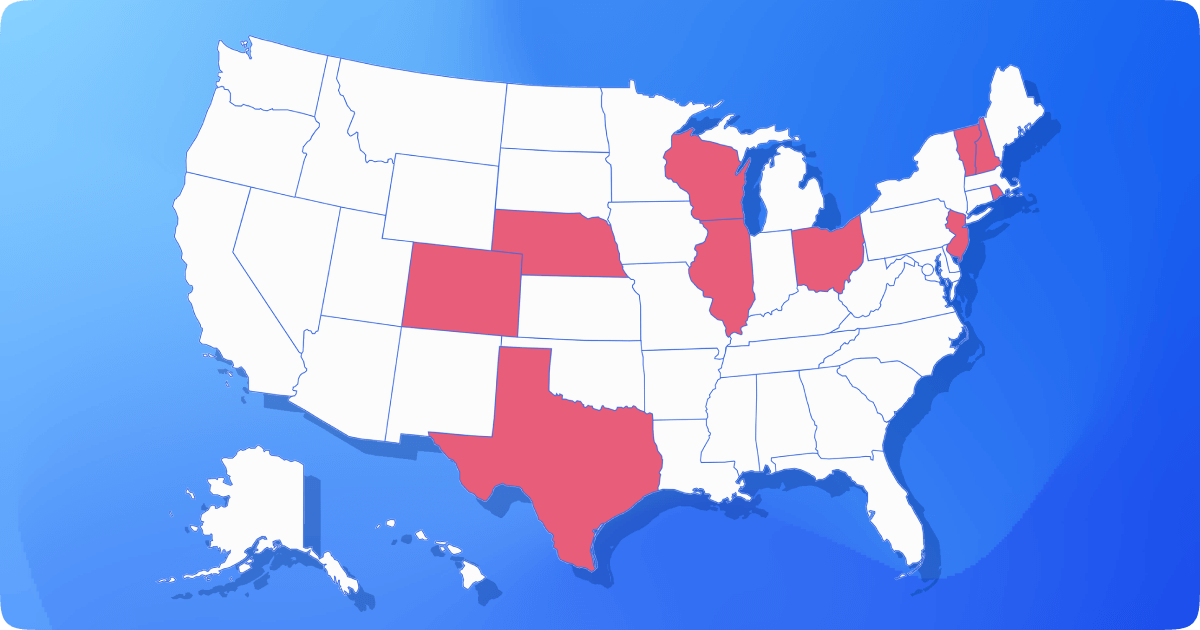

States With The Highest Property Taxes American Property Owners Alliance New jersey was found to have the highest effective property tax rate in the country at 2.23%, with the average homeowners paying nearly $10,000 each year based on the state’s median home value. However, because the state also has the highest median home value, at $1,602, per capita property tax collections are higher in hawaii than in 19 other states. We took a look at recent u.s. property tax figures broken down by state and ranked the 15 current highest below, including the median home value for the state, to give you a clearer idea of housing costs in these areas. In this article, we have covered some of the u.s. states with the highest property tax rates. if you're looking to move to a new state or aspiring to buy your first property, keep reading to make as informed a decision as possible.

States With Highest And Lowest Property Taxes In America Money We took a look at recent u.s. property tax figures broken down by state and ranked the 15 current highest below, including the median home value for the state, to give you a clearer idea of housing costs in these areas. In this article, we have covered some of the u.s. states with the highest property tax rates. if you're looking to move to a new state or aspiring to buy your first property, keep reading to make as informed a decision as possible. The report found that hawaii has the lowest real estate tax rate in the nation at 0.27%. for a home with a median value of $808,200, homeowners pay about $2,183 in property taxes. Here are the 10 best and 10 worst states for property taxes — and how much you might spend per year, according to data gathered from attom, a curator of land, property, and real estate data. Using data from the tax foundation, 24 7 wall st. identified the states where people pay the most in property taxes. states are ranked by the effective property tax rate, or the average. A new lendingtree analysis shows that property taxes rose in every major us metro between 2021 and 2023, with some cities seeing hikes of more than 20%.

Top 10 U S States With The Highest Property Tax Rates The report found that hawaii has the lowest real estate tax rate in the nation at 0.27%. for a home with a median value of $808,200, homeowners pay about $2,183 in property taxes. Here are the 10 best and 10 worst states for property taxes — and how much you might spend per year, according to data gathered from attom, a curator of land, property, and real estate data. Using data from the tax foundation, 24 7 wall st. identified the states where people pay the most in property taxes. states are ranked by the effective property tax rate, or the average. A new lendingtree analysis shows that property taxes rose in every major us metro between 2021 and 2023, with some cities seeing hikes of more than 20%.

States With Highest Property Tax Rates Dpgo Using data from the tax foundation, 24 7 wall st. identified the states where people pay the most in property taxes. states are ranked by the effective property tax rate, or the average. A new lendingtree analysis shows that property taxes rose in every major us metro between 2021 and 2023, with some cities seeing hikes of more than 20%.

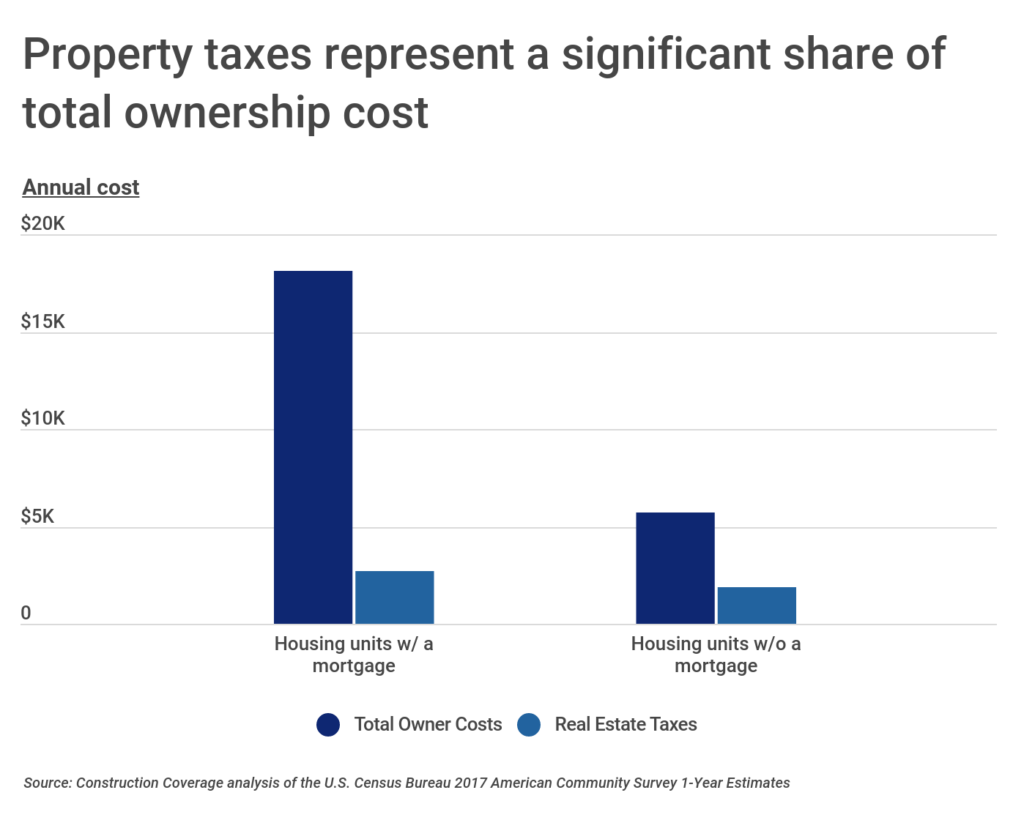

States With The Highest Property Taxes Construction Coverage

Comments are closed.