Considering A Cut To Utah S Income Tax Utah Foundation

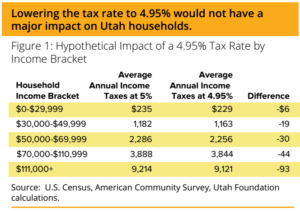

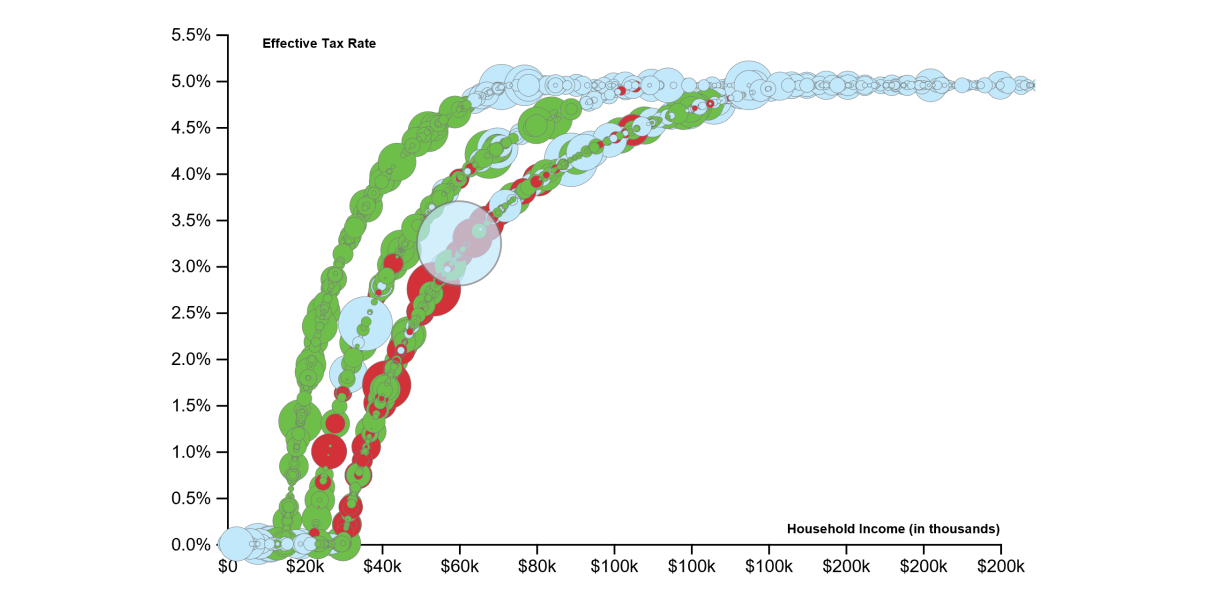

Considering A Cut To Utah S Income Tax Utah Foundation State lawmakers are currently considering a small personal and corporate income tax cut for utahns that would reduce the state income tax to 4.95%. don't expect much. it would only be about $25 annually for the median household in utah. State lawmakers are currently considering a small personal and corporate income tax cut for utahns that would reportedly reduce the state income tax from 5% to 4.95%. lawmakers are considering these tax cuts.

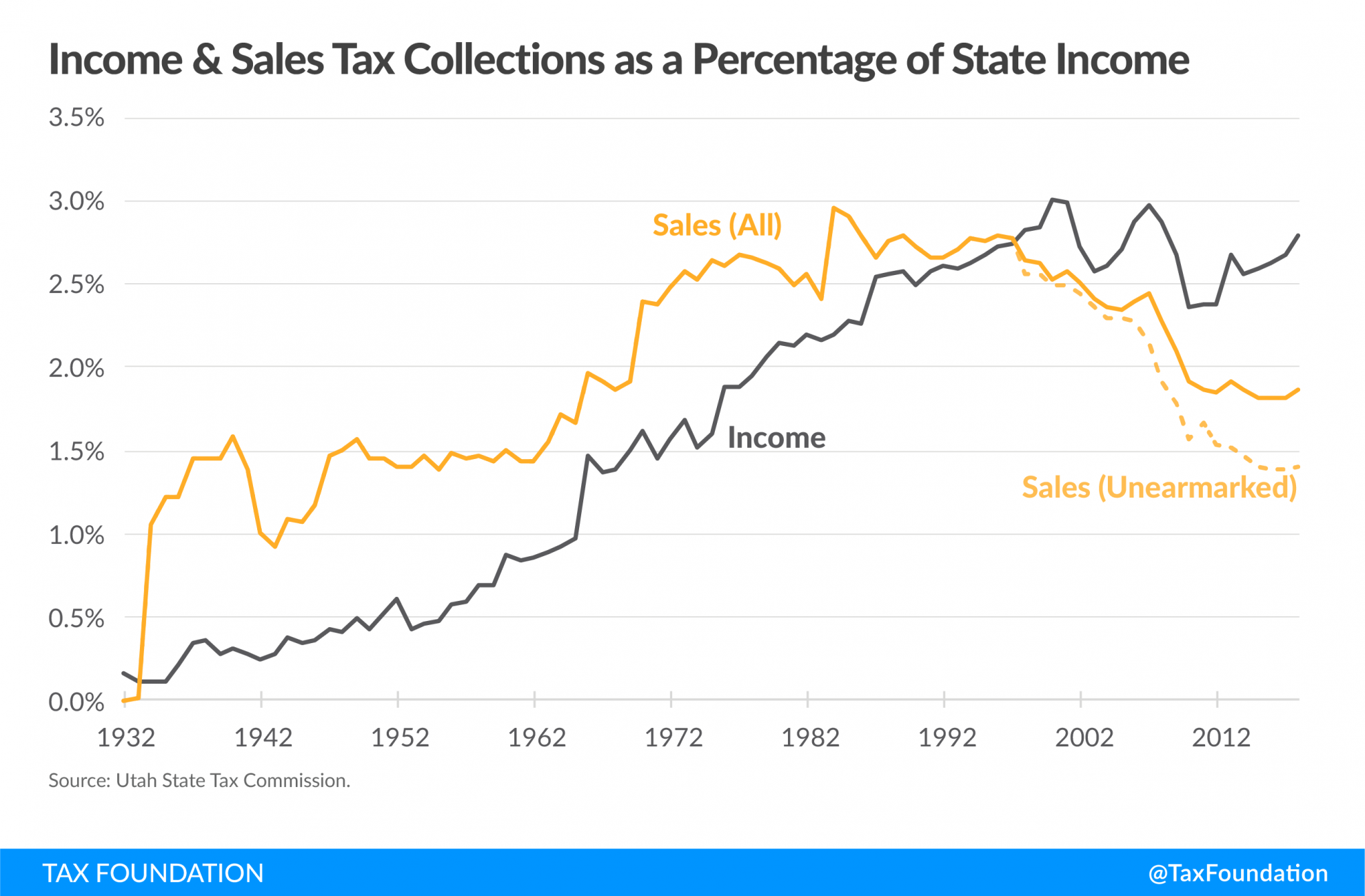

Considering A Cut To Utah S Income Tax Utah Foundation Legislative leaders also plan to reduce utah’s income tax from 4.55% to 4.5%, expanding the child tax credit and adding a tax credit to businesses that provide childcare for their employees. The utah legislature has passed a tax cut package, reducing income tax, social security tax, and expanding child tax credits in the waning days of the 2025 legislative session. In five years, utah lawmakers have cut income taxes to the tune of about $1.4 billion. many conservatives believe the income tax inhibits growth and productivity. there is some truth to the old saw that says if you want less of something, tax it more. 2025 tax relief for all utahns: income tax: reducing the income tax rate to 4.5%, promoting upward mobility for all utahns. social security tax: eliminating social security tax for those earning up to $90,000, strengthening financial security for utah’s retirees.

Utah 2018 State Income Tax Calculator Utah Foundation In five years, utah lawmakers have cut income taxes to the tune of about $1.4 billion. many conservatives believe the income tax inhibits growth and productivity. there is some truth to the old saw that says if you want less of something, tax it more. 2025 tax relief for all utahns: income tax: reducing the income tax rate to 4.5%, promoting upward mobility for all utahns. social security tax: eliminating social security tax for those earning up to $90,000, strengthening financial security for utah’s retirees. 2025 tax relief for all utahns: income tax: reducing the income tax rate to 4.5%, promoting upward mobility for all utahns. Utah’s republican controlled legislature is poised to cut taxes in some way yet again — for a fifth year in a row. while the governor has his preferences, lawmakers will have their own ideas. After two consecutive years of income tax cuts in utah, they used the 2024 legislation to provide even more income tax relief. this pro growth rate cut, sponsored by sen. chris wilson and rep . Republican legislative leaders announced a $400 million tax cut package on thursday afternoon. the proposed cuts are skewed toward the state’s top income earners, with modest reductions for.

Utah State Tax Commission Official Website 2025 tax relief for all utahns: income tax: reducing the income tax rate to 4.5%, promoting upward mobility for all utahns. Utah’s republican controlled legislature is poised to cut taxes in some way yet again — for a fifth year in a row. while the governor has his preferences, lawmakers will have their own ideas. After two consecutive years of income tax cuts in utah, they used the 2024 legislation to provide even more income tax relief. this pro growth rate cut, sponsored by sen. chris wilson and rep . Republican legislative leaders announced a $400 million tax cut package on thursday afternoon. the proposed cuts are skewed toward the state’s top income earners, with modest reductions for.

Encouraging Informed Public Policy The Utah Foundation After two consecutive years of income tax cuts in utah, they used the 2024 legislation to provide even more income tax relief. this pro growth rate cut, sponsored by sen. chris wilson and rep . Republican legislative leaders announced a $400 million tax cut package on thursday afternoon. the proposed cuts are skewed toward the state’s top income earners, with modest reductions for.

Utah Passes Tax Reform Legislation S B 2001 Tax Foundation

Comments are closed.