Financing Credible Transitions A Climate Bonds Credit Suisse

Climate Bonds Credit Suisse Publish Financing Credible Transitions Define transition as a concept by presenting a starting point for the market to see a credible brown to green transition as ambitious, inclusive and aligned with the paris agreement (thereby avoiding greenwash), providing the definition and meaning of transition finance. This whitepaper presents a framework for identifying credible transitions aligned with the paris agreement. climate bonds jointly produced this work with credit suisse. this paper has two purposes: 1.

Financing Credible Transitions White Paper Climate Bonds Initiative London zurich, september 8, 2020 – climate bonds initiative and credit suisse announce today the publishing of the ‘financing credible transitions’ paper, a document which presents a framework for defining ambitious and credible transition pathways for companies that will collectively reduce global emissions and deliver the goals of the. Climate bonds initiative and credit suisse announced today that they have published a paper, financing credible transitions, presenting a framework aiming to assist in the mobilization of global capital flows towards activities which enable the transition to a paris agreement aligned economy, by expanding the market beyond traditional green. This whitepaper presents a framework for identifying credible transitions aligned with the paris agreement. climate bonds jointly produced this work with credit suisse(link is external). this paper has two purposes:. Is a transition bond label still needed now that the sustainability linked bond principles have been published? yes, argues marisa drew of credit suisse. first, let me explain why we launched in september the financing credible transitions white paper with the climate bonds initiative (cbi).

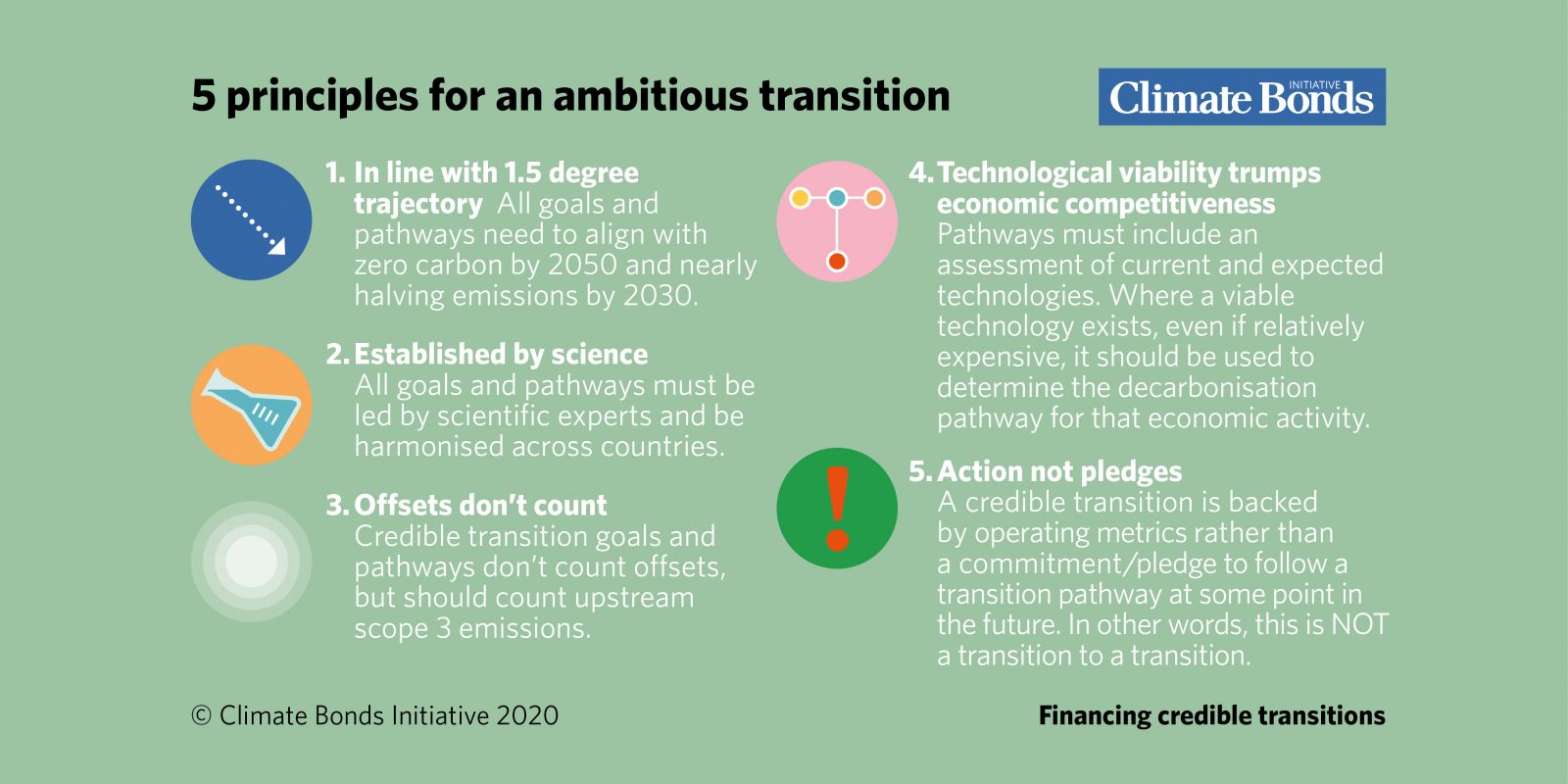

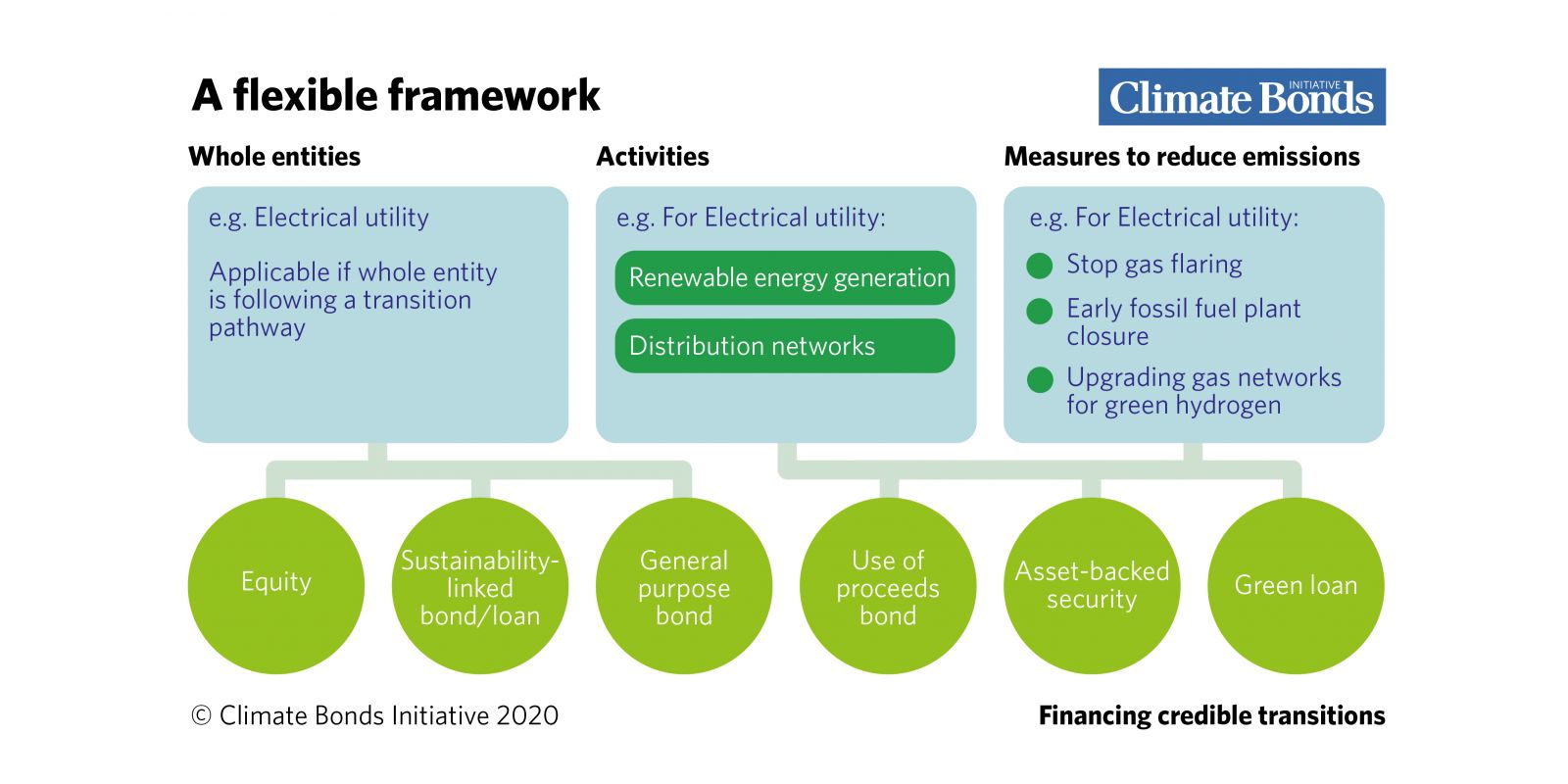

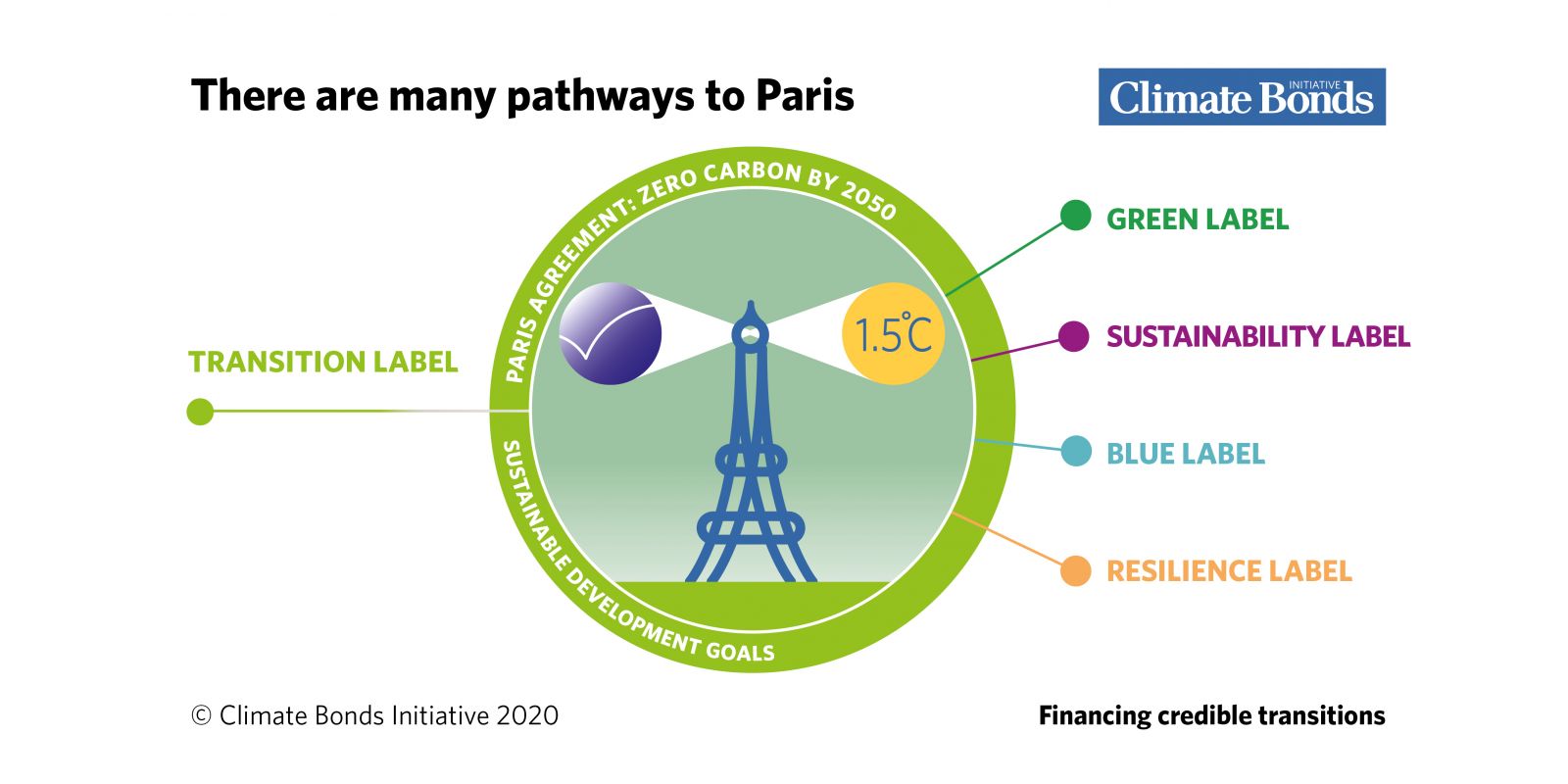

Financing Credible Transitions A Framework For Identifying Credible This whitepaper presents a framework for identifying credible transitions aligned with the paris agreement. climate bonds jointly produced this work with credit suisse(link is external). this paper has two purposes:. Is a transition bond label still needed now that the sustainability linked bond principles have been published? yes, argues marisa drew of credit suisse. first, let me explain why we launched in september the financing credible transitions white paper with the climate bonds initiative (cbi). Green bond market have utilised the ‘transition bond’ concept and label, and have provided a valuable solution for high carbon emitting sectors to finance their transition. Whilst change can be delivered in a number of ways, a robust framework needs principles that signal the credibility of transition. our, financing credible transitions paper, launched in september with credit suisse, is the very first body of work that establishes five core principles for transition. Transition bonds are like other knowns bonds, such as green bonds or sustainability linked bonds. green bonds, in their broadest definitions, are essentially transition bonds given that they are enabling climate transitions;. This pioneering report presents an ambitious framework for identifying credible, paris aligned transitions. the aim is to support the rapid growth of a transition bond market as part of larger and liquid climate related market.

Financing Credible Transitions A Framework For Identifying Credible Green bond market have utilised the ‘transition bond’ concept and label, and have provided a valuable solution for high carbon emitting sectors to finance their transition. Whilst change can be delivered in a number of ways, a robust framework needs principles that signal the credibility of transition. our, financing credible transitions paper, launched in september with credit suisse, is the very first body of work that establishes five core principles for transition. Transition bonds are like other knowns bonds, such as green bonds or sustainability linked bonds. green bonds, in their broadest definitions, are essentially transition bonds given that they are enabling climate transitions;. This pioneering report presents an ambitious framework for identifying credible, paris aligned transitions. the aim is to support the rapid growth of a transition bond market as part of larger and liquid climate related market.

Comments are closed.