Housing Market Chaos Sellers Are Slashing Prices

Atlanta Home Sellers Are Slashing Prices According to altos data, an increasing number of sellers nationwide are lowering their asking prices to attract reluctant buyers, with 33.5 percent of homes currently listed for sale on the. Lower interest rates have drawn both buyers and sellers into the market, and sellers who have already listed their homes are now forced to offer more competitive prices to compete with new.

We Re Seeing Buyers Backing Out Sellers Slash Home Prices In Five years on, as bauman goes through the process of selling that house, he’s finding the market is ice cold. bauman, who works in the aerospace industry, paid $386,000 for the nearly 3,900. Home sellers continued cutting their prices in february in a bid to contend with a growing number of properties lingering on the market, along with stubbornly high 30 year fixed mortgage. Sellers are being forced to drop home prices because of continued high mortgage rates and more days of sitting on the market. realtor ’s chief economist predicts this could “signal. Home sellers continued to cut prices last month at a historic pace, as they sought to lure spring homebuyers in a market overshadowed by affordability concerns and rising economic uncertainty.

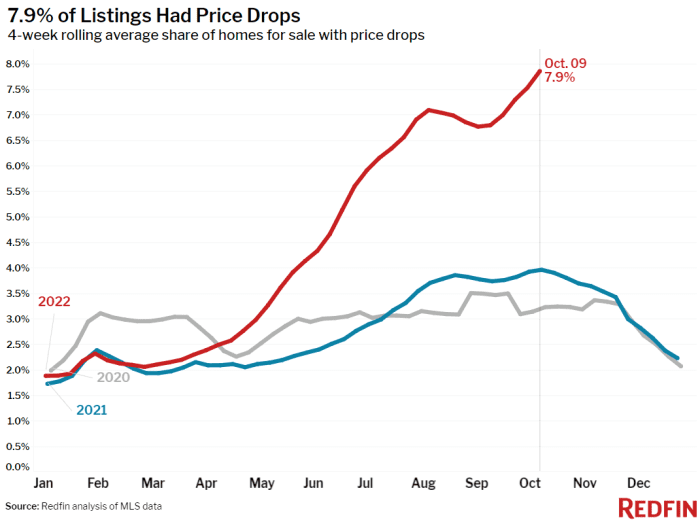

Is The Housing Market Going To Crash Sellers are being forced to drop home prices because of continued high mortgage rates and more days of sitting on the market. realtor ’s chief economist predicts this could “signal. Home sellers continued to cut prices last month at a historic pace, as they sought to lure spring homebuyers in a market overshadowed by affordability concerns and rising economic uncertainty. A growing number of home sellers are slashing their prices as they try to lure back lukewarm buyers who are facing both high costs and steep interest rates. What happened: the median sale price of a home hit an all time high of $390,613 in a recent report from redfin corp (nasdaq:rdfn). while the overall price of homes sold was strong, there could. U.s. home prices are growing half as fast as they were at the end of last year. nationwide, the median home sale price rose 2.6% year over year during the four weeks ending april 13. that’s roughly the same as the increases we’ve seen over the past month, but down from 5% to 6% growth at the end of 2024 and the start of 2025. About 6.4 percent of sellers decided to lower the price of their properties during the four weeks ending may 26, the highest level since november 2022, according to real estate platform redfin. the.

Will The Housing Market Crash In The Future A growing number of home sellers are slashing their prices as they try to lure back lukewarm buyers who are facing both high costs and steep interest rates. What happened: the median sale price of a home hit an all time high of $390,613 in a recent report from redfin corp (nasdaq:rdfn). while the overall price of homes sold was strong, there could. U.s. home prices are growing half as fast as they were at the end of last year. nationwide, the median home sale price rose 2.6% year over year during the four weeks ending april 13. that’s roughly the same as the increases we’ve seen over the past month, but down from 5% to 6% growth at the end of 2024 and the start of 2025. About 6.4 percent of sellers decided to lower the price of their properties during the four weeks ending may 26, the highest level since november 2022, according to real estate platform redfin. the.

The 10 U S Cities Where Sellers Are Slashing Home Prices The Most And U.s. home prices are growing half as fast as they were at the end of last year. nationwide, the median home sale price rose 2.6% year over year during the four weeks ending april 13. that’s roughly the same as the increases we’ve seen over the past month, but down from 5% to 6% growth at the end of 2024 and the start of 2025. About 6.4 percent of sellers decided to lower the price of their properties during the four weeks ending may 26, the highest level since november 2022, according to real estate platform redfin. the.

Real Estate Housing Market Crash

Comments are closed.