How Can Governments Implement Taxes To Capture The Rising Value Of

Taxes And Fees Rising Ecb Publishing Inc Taxing land and properties allows city authorities to capture the enormous wealth generated by the urbanisation, and use it for the public good. for cities to become engines of growth, they require massive public investments. Academics, economists, and experts have proposed numerous options for aligning the tax code to current and future trends, and some governments are passing legislation to implement these ideas. as the trends outlined above play out, the taxable base of economic activity will change.

Describe The Two Ways Governments Use Taxes Aria Has Church Governments worldwide use taxation to shape economic and social outcomes. beyond revenue generation, taxes influence behavior, redistribute wealth, and regulate economies. the design and implementation of tax policies are integral to achieving societal goals. Economic shifts significantly alter tax revenue streams, directly affecting government budgets and fiscal planning. during expansions, increased business activity and consumer spending typically boost tax collections. State administrations and state legislatures can act to close the loopholes, put a brake on economic inequality and concentrations of wealth, and generate significant revenue. here is a menu of some of the most promising options. taxes on high income earners. the strong majority of americans support progressive taxes on the rich. Land value capture ensures that government action generates broader public benefits. how can governments apply land value capture? one common tool used by cities to apply land value capture is through property taxes, which can provide stable revenue for local governments.

Daily Chart Can Countries Lower Taxes And Raise Revenues Graphic State administrations and state legislatures can act to close the loopholes, put a brake on economic inequality and concentrations of wealth, and generate significant revenue. here is a menu of some of the most promising options. taxes on high income earners. the strong majority of americans support progressive taxes on the rich. Land value capture ensures that government action generates broader public benefits. how can governments apply land value capture? one common tool used by cities to apply land value capture is through property taxes, which can provide stable revenue for local governments. Policymakers can directly increase revenues by increasing tax rates, reducing tax breaks, expanding the tax base, improving enforcement, and levying new taxes. they can indirectly increase revenues through policies that increase economic activity, income, and wealth. Taxing land and properties allows city authorities to capture the enormous wealth generated by the urbanisation, and use it for the public good. as cities grow, the wealth they create becomes capitalised in the rising land. Taxing land and properties allows city authorities to capture the enormous wealth generated by the urbanisation, and use it for the public good. as cities grow, the wealth they create becomes capitalised in the rising land values of the city. Governments are adopting innovative strategies to address the complexities of modern economies. a key approach is the implementation of progressive tax systems, which ensure that individuals and corporations contribute to public finances in proportion to their income levels.

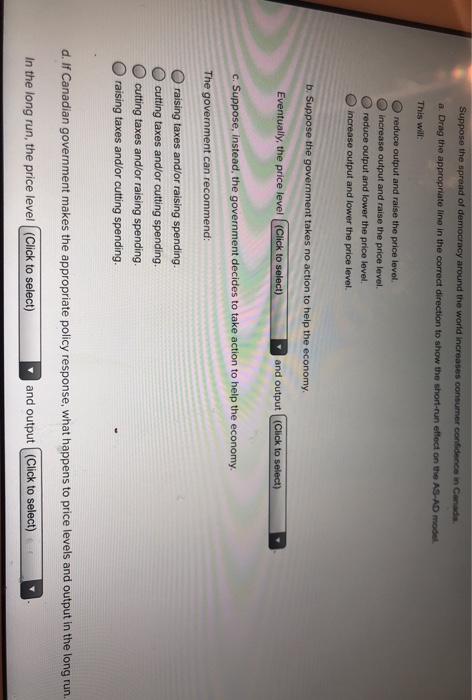

Solved B The Government Can Raising Taxes And Or Raising Chegg Policymakers can directly increase revenues by increasing tax rates, reducing tax breaks, expanding the tax base, improving enforcement, and levying new taxes. they can indirectly increase revenues through policies that increase economic activity, income, and wealth. Taxing land and properties allows city authorities to capture the enormous wealth generated by the urbanisation, and use it for the public good. as cities grow, the wealth they create becomes capitalised in the rising land. Taxing land and properties allows city authorities to capture the enormous wealth generated by the urbanisation, and use it for the public good. as cities grow, the wealth they create becomes capitalised in the rising land values of the city. Governments are adopting innovative strategies to address the complexities of modern economies. a key approach is the implementation of progressive tax systems, which ensure that individuals and corporations contribute to public finances in proportion to their income levels.

Options For Raising Taxes Institute For Fiscal Studies Taxing land and properties allows city authorities to capture the enormous wealth generated by the urbanisation, and use it for the public good. as cities grow, the wealth they create becomes capitalised in the rising land values of the city. Governments are adopting innovative strategies to address the complexities of modern economies. a key approach is the implementation of progressive tax systems, which ensure that individuals and corporations contribute to public finances in proportion to their income levels.

Do Lower Taxes Stimulate Growth Synchronix Ltd

Comments are closed.