How To Appeal Your Property Tax Valuation Cincinnati Northern

Property Tax Appeal Letter Sample Template With Examples Lettering If you believe your property has been overvalued, leading to a higher tax bill, you have the right to appeal your property’s valuation. this section will guide you through the two main routes: requesting an informal review and filing a formal appeal with the county board of revision. In order to appeal your property valuation with your county pva you must file on or before the end of the open inspection period of the tax rolls (usually may). you must first file for property tax valuation adjustment with your county pva along and provide any supporting documentation with your application.

Property Tax Valuation Appeal Workshop Commerce City North Event Begin by clearly stating your intention to appeal the assessed value of your property and cite the specific assessment you are contesting. For homeowners who think their local government may have assessed their property's value too high, there are ways to appeal and potentially win a lower assessment, which may save hundreds or even thousands of dollars annually in future taxes. 1,2. Ssp provides comprehensive strategies to reduce your property tax bill, bringing aggressive and creative challenges to tax valuations. for tax valuation challenges, examples of our satisfied clients include: · commercial and residential property owners · lenders · property managers. Property values are challenged via a “complaint against valuation” that is filed with the local county board of revision (bor). the same complaint form is used statewide. it can be downloaded from nearly all county auditor websites or the ohio department of taxation’s website.

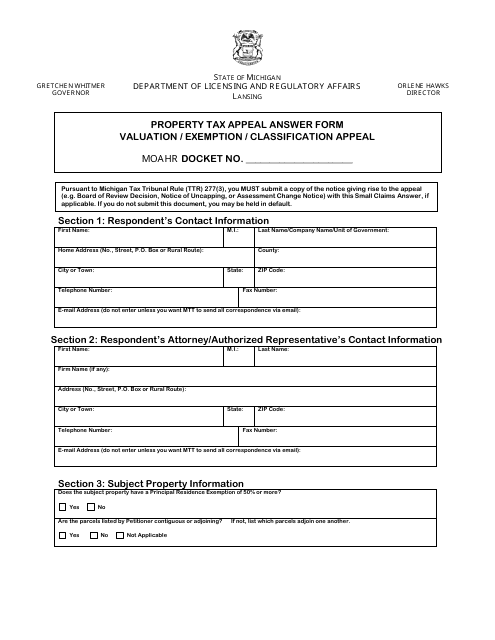

Michigan Property Tax Appeal Answer Form Valuation Exemption Ssp provides comprehensive strategies to reduce your property tax bill, bringing aggressive and creative challenges to tax valuations. for tax valuation challenges, examples of our satisfied clients include: · commercial and residential property owners · lenders · property managers. Property values are challenged via a “complaint against valuation” that is filed with the local county board of revision (bor). the same complaint form is used statewide. it can be downloaded from nearly all county auditor websites or the ohio department of taxation’s website. Ohio homeowners are looking at 10% to 20% jumps in their home values. how to fight the change and keep your property taxes from increasing.

Comments are closed.