How To File A Cobb County Property Tax Assessment Appeal

Property Tax Assessment Appeals Faq Pdf Property Tax Real Estate Appeals may be filed online: please note: the online appeal option is a courtesy. file early in case there are any system issues, as we cannot extend the deadline to file an appeal. to start an online appeal: 1. please review the tutorial for the appeal you want to file: download residential online appeals tutorial. To do so, simply fill out and submit the appropriate form on the tax assessors' website. having said that, you should still make an effort to better understand how this process works, and where your own valuation may have gone wrong.

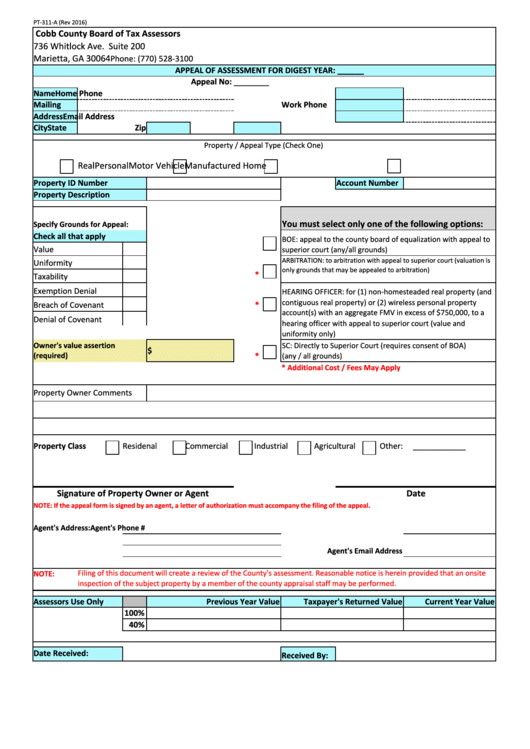

How To File A Cobb County Property Tax Assessment Appeal Step 5. review and submit your appeal review the documents under the following sections that will be submitted for your appeal: • appeal form • supporting documents • comparable property reports. Appeals can only be filed in response to an assessment notice. if you received an assessment notice, you have until the expiration of the appeal period to file an appeal. filing an appeal is easy! appeal link. a standard appeal form is available on the tax assessors website at cobbassessor.org under the tab “forms.”. When i began filing my own property tax appeals over a decade ago, i never knew one of the benefits of filing property tax appeals in georgia is that property owners are able to get a 3 year property tax freeze. how this is allowed is buried in the georgia statutes. specifically, ocga § 48 5 299 (c). § 48 5 299 (c). •appeal must be filed with oard of tax assessors by the owner or his her attorney; settlement conference held within 30 days of notice sent by ta. • appellant pays $25.00 filing fee.

Cobb County Property Tax Form Countyforms When i began filing my own property tax appeals over a decade ago, i never knew one of the benefits of filing property tax appeals in georgia is that property owners are able to get a 3 year property tax freeze. how this is allowed is buried in the georgia statutes. specifically, ocga § 48 5 299 (c). § 48 5 299 (c). •appeal must be filed with oard of tax assessors by the owner or his her attorney; settlement conference held within 30 days of notice sent by ta. • appellant pays $25.00 filing fee. How can i appeal my property? if you feel your property value is not reflective of the fair market value, you may file an appeal with the tax assessors office. please refer to their website at cobbassessor.org for more information. You can appeal your tax assessment, but you need to act fast. you have 45 days from when your tax assessment was sent out to appeal your assessment. the county said the easiest way to appeal is online, but you can also do so by written letter or in person at the assessor’s office. Cobb county has a tutorial on their website that walks you through the process, just do it before the deadline. the date for the deadline can be found in the top right hand corner of the. Here are the steps to appeal property taxes in cobb county: free analysis of your home! file your appeal as soon as you receive your tax assessment notice. check your property tax assessment for when you need to appeal by. typically its approximately 40 45 days but check your assessment notice.

Cobb County Property Tax Form Countyforms How can i appeal my property? if you feel your property value is not reflective of the fair market value, you may file an appeal with the tax assessors office. please refer to their website at cobbassessor.org for more information. You can appeal your tax assessment, but you need to act fast. you have 45 days from when your tax assessment was sent out to appeal your assessment. the county said the easiest way to appeal is online, but you can also do so by written letter or in person at the assessor’s office. Cobb county has a tutorial on their website that walks you through the process, just do it before the deadline. the date for the deadline can be found in the top right hand corner of the. Here are the steps to appeal property taxes in cobb county: free analysis of your home! file your appeal as soon as you receive your tax assessment notice. check your property tax assessment for when you need to appeal by. typically its approximately 40 45 days but check your assessment notice.

Cobb County Property Tax Form Countyforms Cobb county has a tutorial on their website that walks you through the process, just do it before the deadline. the date for the deadline can be found in the top right hand corner of the. Here are the steps to appeal property taxes in cobb county: free analysis of your home! file your appeal as soon as you receive your tax assessment notice. check your property tax assessment for when you need to appeal by. typically its approximately 40 45 days but check your assessment notice.

Comments are closed.