Illinois Income Tax Plan Proposed By Governor Jb Pritzker Faces Uphill

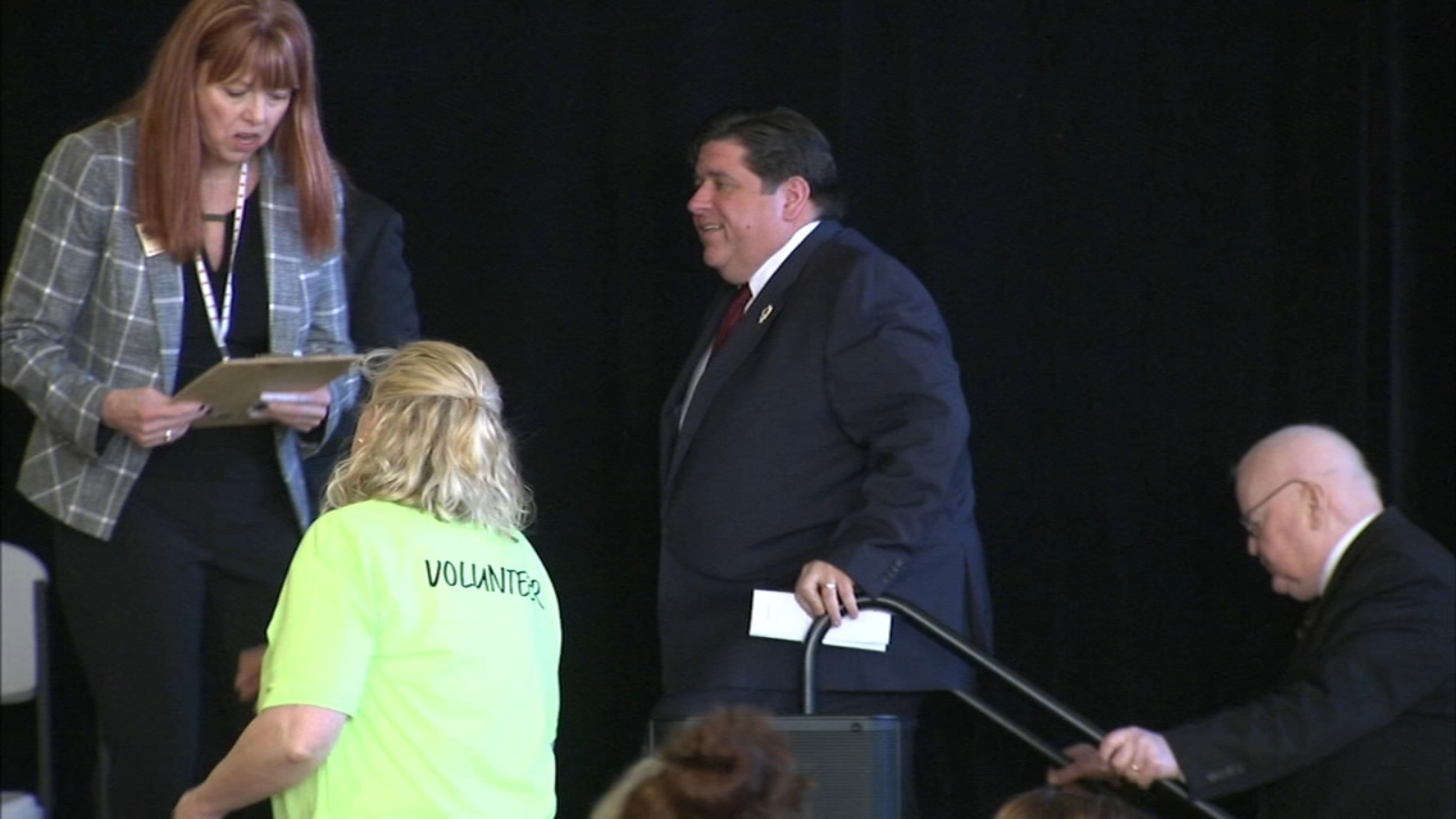

Illinois Income Tax Plan Proposed By Governor Jb Pritzker Faces Uphill Governor pritzker remains confident his graduated income tax plan will get approved this legislative session after it passed overwhelmingly out of the senate this week. Update: illinois gov. jb pritzker signed the tax bill into law friday. springfield (wgem) illinoisans could see some changes coming to their state taxes. to balance the state’s fiscal year 2025 budget, gov. jb pritzker and democratic lawmakers are raising some taxes while cutting others.

Illinois Gov Jb Pritzker Confident His Fair Income Tax Plan Will A provision in the fiscal year 2025 budget proposed by illinois gov. j.b. pritzker could result in a higher tax bill for most of the state’s residents. according to the text of the budget, pritzker. Gov. j.b. pritzker’s push for a graduated income tax constitutional amendment gets the attention, but lurking nearby are 18 other proposed taxes and fees – all waiting to pull $6.9 billion away. Pritzker campaigned on a promise to push for a constitutional amendment to enact a progressive income tax in illinois. he unveiled new proposed tax rates last thursday, along with tax. Illinois gov. jb pritzker is set to unveil a balanced budget proposal with no tax increases, but republicans question the claim due to increased state spending. gop leaders criticize the push.

Illinois Governor Pritzker Announces Significant Payment Toward Pritzker campaigned on a promise to push for a constitutional amendment to enact a progressive income tax in illinois. he unveiled new proposed tax rates last thursday, along with tax. Illinois gov. jb pritzker is set to unveil a balanced budget proposal with no tax increases, but republicans question the claim due to increased state spending. gop leaders criticize the push. As he promised in his campaign for governor, pritzker is proposing a graduated rate income tax that he says will raise revenue and be more fair. the current flat tax rate in illinois is 4.95. Gov. jb pritzker on wednesday proposed growing state spending by about $1.8 billion in the upcoming fiscal year while making a handful of corporate, sports wagering and other tax changes to pay for the increase. Illinois lawmakers debated monday the merits of gov. jb pritzker's proposal to implement a progressive income tax plan that would revamp the state's tax code. Illinois governor jb pritzker proposed several new tax increases to help the state deal with a budget deficit, and one of them could affect your income tax filings. in 2023, the.

Pritzker Releases Proposed Structure For Graduated State Income Tax As he promised in his campaign for governor, pritzker is proposing a graduated rate income tax that he says will raise revenue and be more fair. the current flat tax rate in illinois is 4.95. Gov. jb pritzker on wednesday proposed growing state spending by about $1.8 billion in the upcoming fiscal year while making a handful of corporate, sports wagering and other tax changes to pay for the increase. Illinois lawmakers debated monday the merits of gov. jb pritzker's proposal to implement a progressive income tax plan that would revamp the state's tax code. Illinois governor jb pritzker proposed several new tax increases to help the state deal with a budget deficit, and one of them could affect your income tax filings. in 2023, the.

Comments are closed.