Irs Releases New Tax Brackets For 2025 Daniel N Garcia

Irs Releases New Tax Brackets For 2025 Daniel N Garcia For single taxpayers and married individuals filing separately for tax year 2025, the standard deduction rises to $15,000 for 2025, an increase of $400 from 2024. for married couples filing jointly, the standard deduction rises to $30,000, an increase of $800 from tax year 2024. In its announcement on tuesday, the agency raised the income thresholds for each bracket, which applies to tax year 2025 for returns filed in 2026. the top rate of 37% applies to individuals.

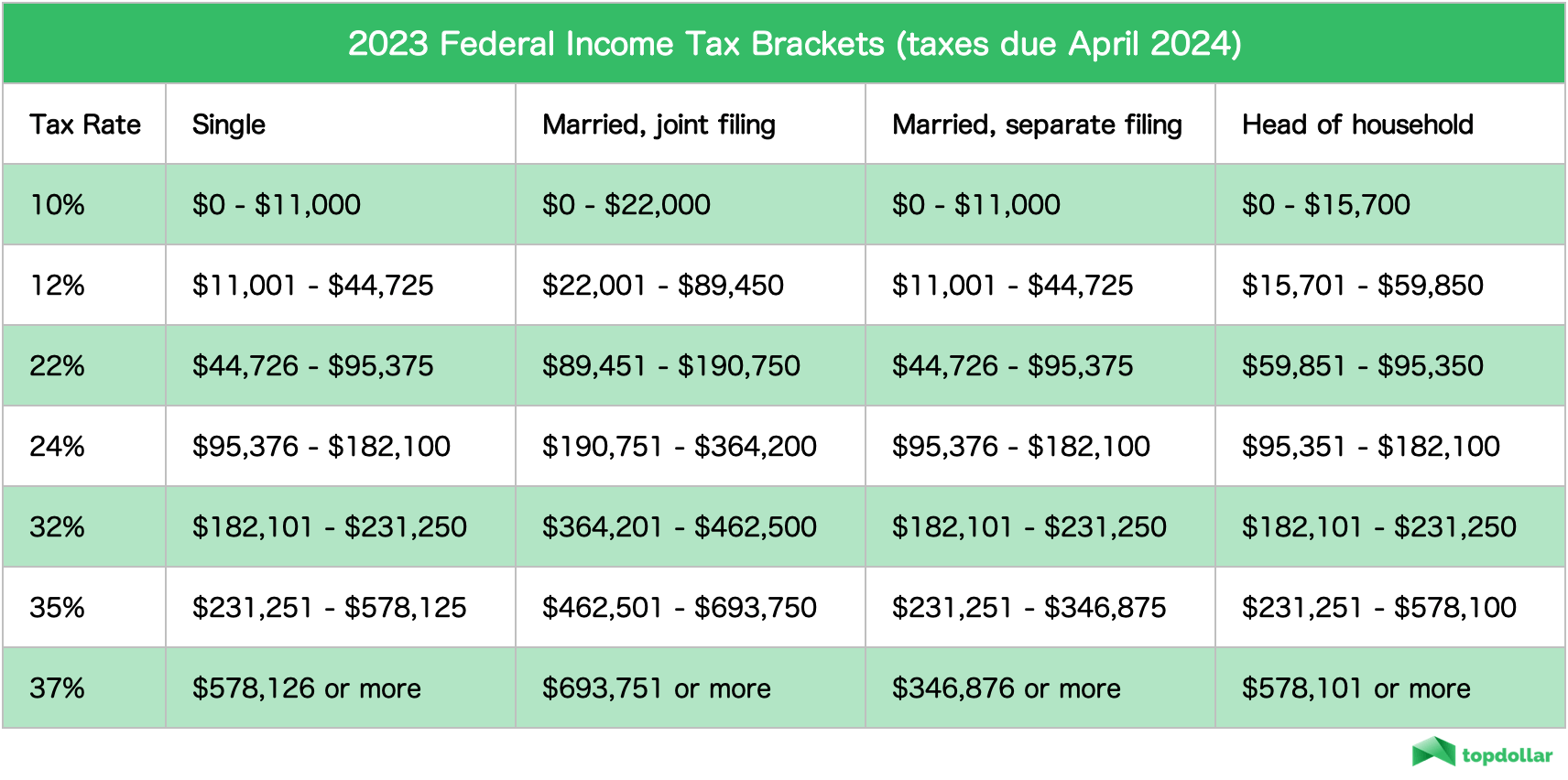

Irs Releases New Tax Brackets For 2025 Daniel N Garcia There are seven (7) tax rates in 2025. they are: 10%, 12%, 22%, 24%, 32%, 35% and 37% (there is also a zero rate). here's how those break out by filing status: your marginal tax rate. In 2025, the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows (table 1). the federal income tax has seven tax rates in 2025: 10 percent, 12 percent, 22 percent, 24 percent, 32 percent, 35 percent, and 37 percent. Tax brackets adjust upward, tax rates unchanged for 2025. the way the income tax system works in the united states is that the more you earn, the more you pay. how much you pay depends on what tax bracket you fall into. tax brackets are ranges of income that are taxed at specific tax rates. Internal revenue service. attn: cc:pa:01:pr (notice 2025 19) room 5203. p.o. box 7604. ben franklin station. washington, d.c. 20044. all recommendations for guidance submitted by the public in response to this notice will be available for public inspection and copying in their entirety.

Irs Rolls Out New 2025 Tax Brackets But Not Everything Is Changing Tax brackets adjust upward, tax rates unchanged for 2025. the way the income tax system works in the united states is that the more you earn, the more you pay. how much you pay depends on what tax bracket you fall into. tax brackets are ranges of income that are taxed at specific tax rates. Internal revenue service. attn: cc:pa:01:pr (notice 2025 19) room 5203. p.o. box 7604. ben franklin station. washington, d.c. 20044. all recommendations for guidance submitted by the public in response to this notice will be available for public inspection and copying in their entirety. The irs’s 2025 income tax bracket adjustments and standard deduction increases are designed to account for inflation and prevent taxpayers from being unintentionally pushed into higher brackets. Here's a look at the changes unveiled by the irs that will take effect for the 2025 tax year and returns that are filed in 2026. standard deduction: the standard deduction, which reduces the. Discover the updated tax rate 2025 tables and key thresholds for a clearer understanding of the internal revenue code. here are the updated 2025 tax tables for various key irs thresholds, including the tax rate 2025: capital gains tax rates 2025. filing status: 0% rate up to: 15% rate up to: single: $48,350: $533,400: married filing. The irs has updated its tax brackets, standard deduction, and other items for the 2025 tax year. dollar values have been adjusted to reflect inflation, with tax brackets rising about 2.8%.

Comments are closed.