Jersey City Finalizes 32 Property Tax Increase

Jersey City Finalizes 32 Property Tax Increase Jersey city has finalized the 2022 tax rate, and it represents an unprecedented increase of 32% from its 2021 tax rate. remarkably, it is estimated that the average homeowner in jersey city will see an increase of $2,360 in their yearly property taxes. Jersey city finalized its property tax rate in october 2022 and set the rate at 2.118%, which represents a 32% increase over 2021. the increase is driven mainly from the board of education’s $973 million budget, a $159 million increase from the prior year budget.

Jersey City 6 Property Tax Rate Increase For 2023 When the jersey city 2024 budget was finalized, the city’s property owners received some rare news: there would be no additional cost to taxpayers. in fact, the final 2024 tax rate represents a .6% reduction from the 2023 rate. Jersey city, n.j. (pix11) – from the heights to downtown, jersey city homeowners are paying the price. on sites like reddit and nextdoor, people have voiced their disdain for a sharp. About one third of the city's annual budget is funded through property taxes. property taxes are calculated based on the total assessed value of the property (land value improvements value exemptions) divided by $100 and multiplied by the tax rate. Jersey city has just finalized the 2022 tax rate, and it represents an unprecedented increase of 32% from its 2021 tax rate! unfortunately, the deadline to….

Jersey City S 32 Property Tax Increase The Impact On Commercial About one third of the city's annual budget is funded through property taxes. property taxes are calculated based on the total assessed value of the property (land value improvements value exemptions) divided by $100 and multiplied by the tax rate. Jersey city has just finalized the 2022 tax rate, and it represents an unprecedented increase of 32% from its 2021 tax rate! unfortunately, the deadline to…. In 2023, jersey city saw a 6% increase in its property tax rate, bringing it to $2.247. this rise follows a staggering 32% increase from the previous year, making the current adjustment seem more manageable, even though it still surpasses the average growth rate across new jersey. This past week, jersey city’s municipal council passed its annual 2022 budget with a $112 million increase to the city levy. this action caps a year of change in jersey city’s property tax landscape; school tax and city tax have both increased. Jersey city has finalized the 2022 tax rate, and it represents an unprecedented increase of 32% from its 2021 tax rate. remarkably, it is estimated that the average homeowner in jersey city will see an increase of $2,360 in their yearly property taxes. City officials on wednesday would not estimate the average tax increase property owners will see in the fourth quarter bill. city spokeswoman kimberly wallace scalcione pointed out seven.

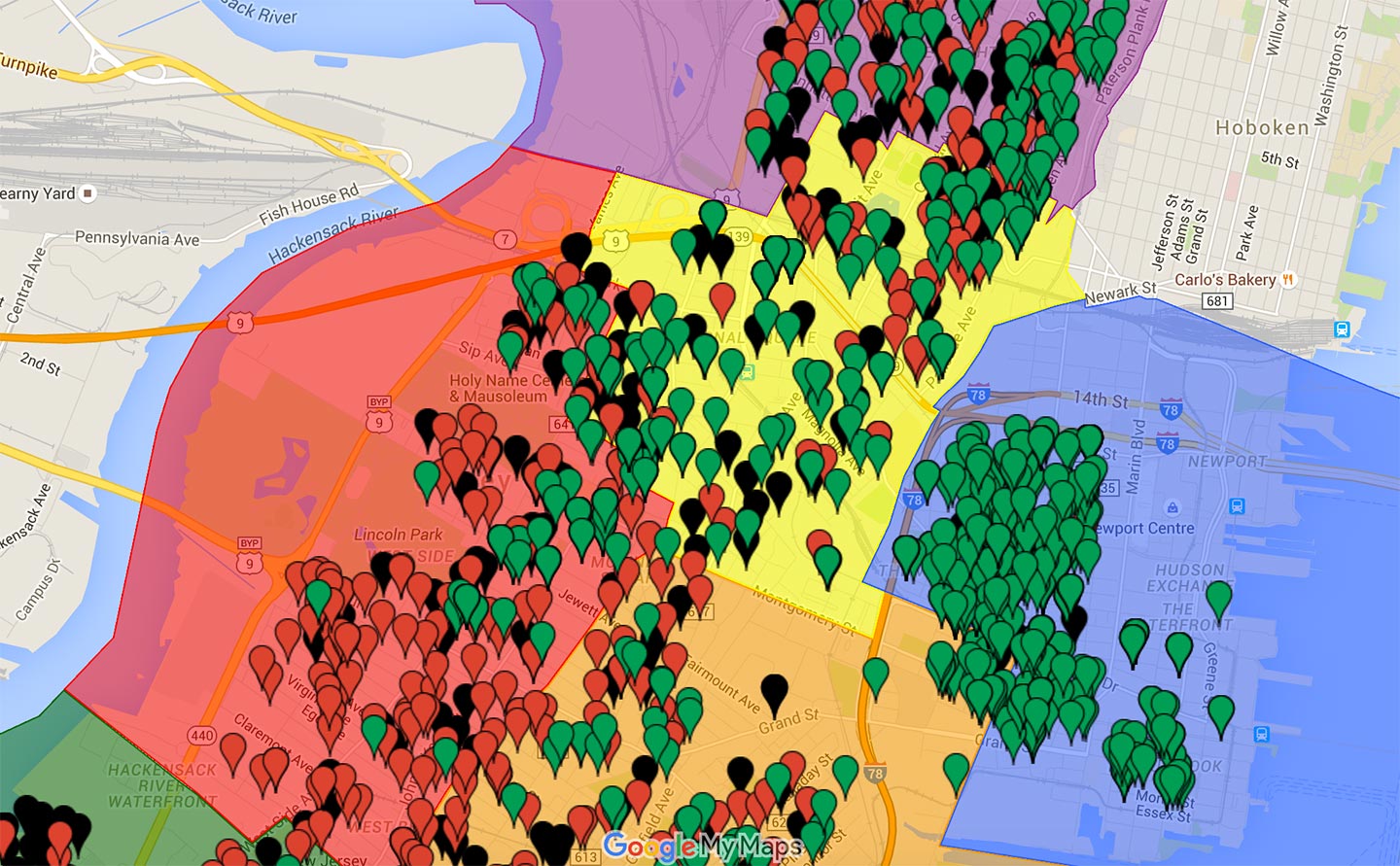

The Never Ending Reval Saga What Does It Mean For Homeowners Jersey In 2023, jersey city saw a 6% increase in its property tax rate, bringing it to $2.247. this rise follows a staggering 32% increase from the previous year, making the current adjustment seem more manageable, even though it still surpasses the average growth rate across new jersey. This past week, jersey city’s municipal council passed its annual 2022 budget with a $112 million increase to the city levy. this action caps a year of change in jersey city’s property tax landscape; school tax and city tax have both increased. Jersey city has finalized the 2022 tax rate, and it represents an unprecedented increase of 32% from its 2021 tax rate. remarkably, it is estimated that the average homeowner in jersey city will see an increase of $2,360 in their yearly property taxes. City officials on wednesday would not estimate the average tax increase property owners will see in the fourth quarter bill. city spokeswoman kimberly wallace scalcione pointed out seven.

New Jersey Anchor Property Tax Relief Program Deadline Is February 28 Jersey city has finalized the 2022 tax rate, and it represents an unprecedented increase of 32% from its 2021 tax rate. remarkably, it is estimated that the average homeowner in jersey city will see an increase of $2,360 in their yearly property taxes. City officials on wednesday would not estimate the average tax increase property owners will see in the fourth quarter bill. city spokeswoman kimberly wallace scalcione pointed out seven.

Comments are closed.