Jersey City Residents See Property Tax Increased

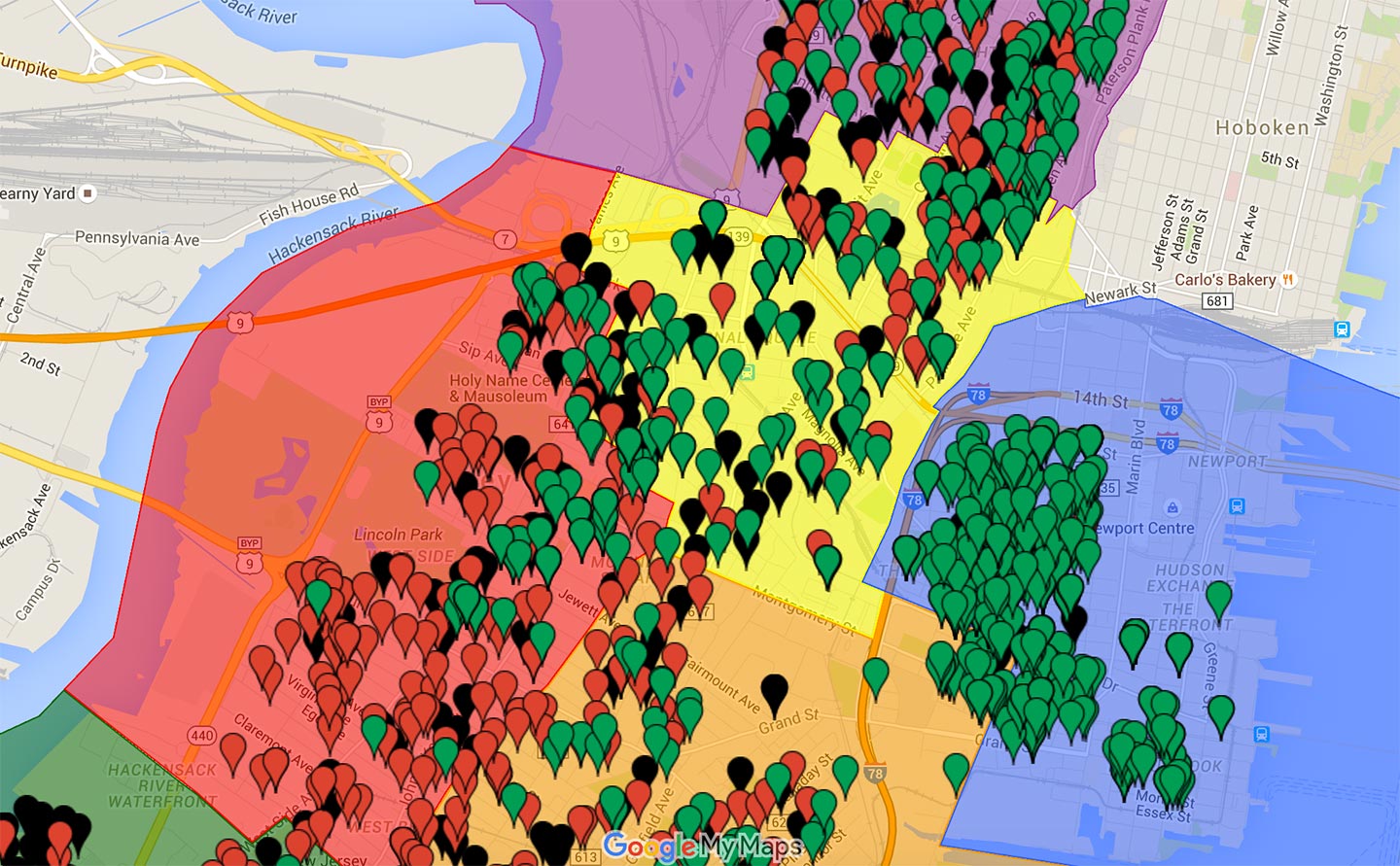

The Never Ending Reval Saga What Does It Mean For Homeowners Jersey When the jersey city 2024 budget was finalized, the city’s property owners received some rare news: there would be no additional cost to taxpayers. in fact, the final 2024 tax rate represents a .6% reduction from the 2023 rate. Jersey city, n.j. (pix11) – from the heights to downtown, jersey city homeowners are paying the price. on sites like reddit and nextdoor, people have voiced their disdain for a sharp.

Jersey City S 32 Property Tax Increase The Impact On Commercial Jersey city has seen significant property tax rate increases, impacting homeowners’ finances. there are various property tax relief programs available for eligible residents, especially seniors. understanding how to appeal tax assessments can help residents manage and potentially lower their property tax bills. The jersey city council will vote on a preliminary $724,219,250.40 budget with a 1.9 percent tax increase on wednesday, which mayor steven fulop is touting as a thorough and responsible spending plan. According to fuller, jersey city’s residential property owners would see an average annual increase of approximately $107 from $1,898 in 2024 to $2,005 in 2025. finance director cheryl fuller said the county balanced its draft budget with a larger property tax levy—$453.18 million, or about $24 million more than the current year’s budget. Sort by "hot" to see the "moving to jc" sticky post. the actual tax rate climbed from 1.6% to 2.11%. while this is a very sharp increase, the fact is it's actually still below average for our area of north jersey.

New Jersey Anchor Property Tax Relief Program What You Need To Know According to fuller, jersey city’s residential property owners would see an average annual increase of approximately $107 from $1,898 in 2024 to $2,005 in 2025. finance director cheryl fuller said the county balanced its draft budget with a larger property tax levy—$453.18 million, or about $24 million more than the current year’s budget. Sort by "hot" to see the "moving to jc" sticky post. the actual tax rate climbed from 1.6% to 2.11%. while this is a very sharp increase, the fact is it's actually still below average for our area of north jersey. Jersey city finalized its property tax rate in october 2022 and set the rate at 2.118%, which represents a 32% increase over 2021. the increase is driven mainly from the board of education’s $973 million budget, a $159 million increase from the prior year budget. We have successfully provided information as it was received so that residents could accurately see where and what has been done. today, we are providing the preliminary estimates to give residents a baseline about where we are headed. In a 6 3 vote, the council adopted the budget that raises municipal taxes by 2% and will cost the average homeowner an additional $70 in their property taxes. The jersey city council passed their $734,111,966.62 budget, which comes with a 1.9 percent property tax increase, at last night’s meeting. facebook photo. by daniel ulloa hudson county view.

Jersey City Finalizes 32 Property Tax Increase Jersey city finalized its property tax rate in october 2022 and set the rate at 2.118%, which represents a 32% increase over 2021. the increase is driven mainly from the board of education’s $973 million budget, a $159 million increase from the prior year budget. We have successfully provided information as it was received so that residents could accurately see where and what has been done. today, we are providing the preliminary estimates to give residents a baseline about where we are headed. In a 6 3 vote, the council adopted the budget that raises municipal taxes by 2% and will cost the average homeowner an additional $70 in their property taxes. The jersey city council passed their $734,111,966.62 budget, which comes with a 1.9 percent property tax increase, at last night’s meeting. facebook photo. by daniel ulloa hudson county view.

Property Tax Relief R Jerseycity In a 6 3 vote, the council adopted the budget that raises municipal taxes by 2% and will cost the average homeowner an additional $70 in their property taxes. The jersey city council passed their $734,111,966.62 budget, which comes with a 1.9 percent property tax increase, at last night’s meeting. facebook photo. by daniel ulloa hudson county view.

Comments are closed.