Owe Utah Back Taxes Consequences And Options

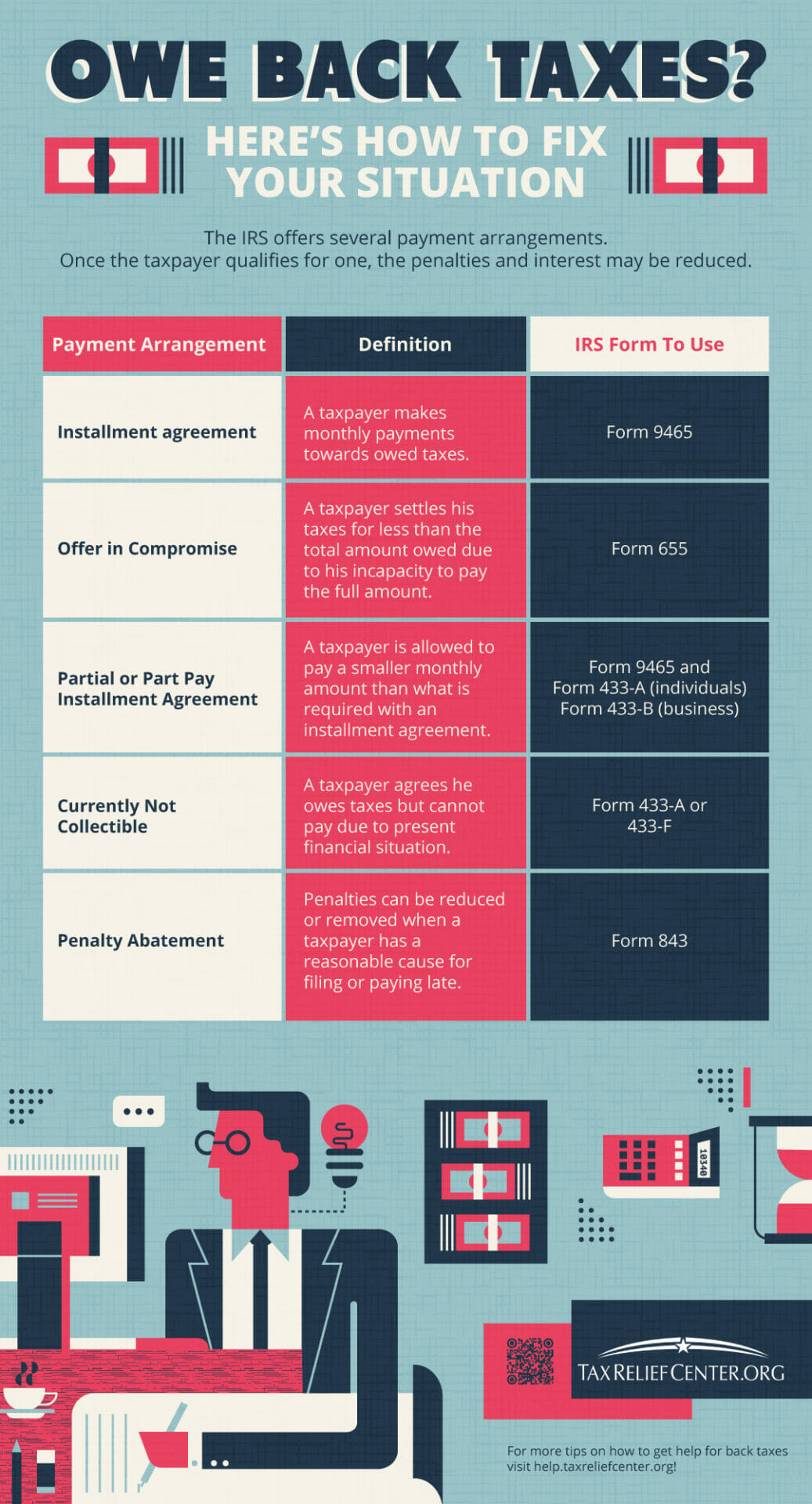

What To Do When You Owe Back Taxes Infographic Depending on your situation, you may qualify for a payment plan (monthly payments on back taxes), an offer in compromise (settle your tax debt for less than you owe), or other relief options. here is an overview of the state's relief options. Just like the irs, the utah state tax commission offers various alternatives to individuals to resolve state owed back taxes and other state specific tax problems. below are several remedies offered by the state of utah to help taxpayers get back into compliance with their tax obligations.

What To Do When You Owe Back Taxes Infographic If you’re a utah homeowner trying to figure out whether you can sell your house with back taxes owed, the short answer is: yes, you can. even if the county has placed a tax lien on your property, you still have options. Options for resolving back taxes. taxpayers have several options to resolve back taxes, depending on their financial situation and the amount owed: 1. file past due tax returns. if back taxes are due because of unfiled tax returns, the first step is to file them as soon as possible. the irs typically requires taxpayers to file at least the last. $5,000 is the key threshold for the ustc when dealing with back taxes. if you owe less than $5,000 the ustc, utah should give yo up to 24 months to pay off your tax liability in monthly installments. Learn how to get help with back taxes, explore tax relief options and understand irs programs to manage your tax debt effectively. trending if you owe back business taxes, you can apply for a.

What To Do When You Owe Back Taxes Infographic $5,000 is the key threshold for the ustc when dealing with back taxes. if you owe less than $5,000 the ustc, utah should give yo up to 24 months to pay off your tax liability in monthly installments. Learn how to get help with back taxes, explore tax relief options and understand irs programs to manage your tax debt effectively. trending if you owe back business taxes, you can apply for a. Failing to file your tax returns or pay the taxes you owe can lead to significant financial and legal consequences. filing back taxes involves completing and submitting tax returns for the years you missed. here’s a step by step guide to help you navigate the process:. Back taxes: taxes that are overdue from previous years. tax penalties: fees imposed by the irs for late payments. interest charges: additional charges added by the irs for unpaid taxes. tax liens: legal claims against your property for unpaid taxes. tax levies: seizure of your property by the irs to cover unpaid taxes. Back taxes and tax debt can accumulate quickly due to missed payments, underreporting income, or failure to file returns. unresolved tax debt can lead to tax levies, liens, and wage garnishments. There are several payment solutions available if you owe back taxes: extension of time to pay: you may be eligible for a short extension of time to pay of up to 120 days. this might be a desirable option for you if are able to pay the taxes in full within the extended timeframe.

What To Do When You Owe Back Taxes Infographic Failing to file your tax returns or pay the taxes you owe can lead to significant financial and legal consequences. filing back taxes involves completing and submitting tax returns for the years you missed. here’s a step by step guide to help you navigate the process:. Back taxes: taxes that are overdue from previous years. tax penalties: fees imposed by the irs for late payments. interest charges: additional charges added by the irs for unpaid taxes. tax liens: legal claims against your property for unpaid taxes. tax levies: seizure of your property by the irs to cover unpaid taxes. Back taxes and tax debt can accumulate quickly due to missed payments, underreporting income, or failure to file returns. unresolved tax debt can lead to tax levies, liens, and wage garnishments. There are several payment solutions available if you owe back taxes: extension of time to pay: you may be eligible for a short extension of time to pay of up to 120 days. this might be a desirable option for you if are able to pay the taxes in full within the extended timeframe.

Help Owe Back Taxes Abebooks Back taxes and tax debt can accumulate quickly due to missed payments, underreporting income, or failure to file returns. unresolved tax debt can lead to tax levies, liens, and wage garnishments. There are several payment solutions available if you owe back taxes: extension of time to pay: you may be eligible for a short extension of time to pay of up to 120 days. this might be a desirable option for you if are able to pay the taxes in full within the extended timeframe.

Owe Taxes This Year Here S How To Lower Your Balance Due In The Future

Comments are closed.