Portfolio Management 101 Definition Types Process And Approaches

The Process Of Portfolio Management Pdf Investing Investment Within portfolio management, we always think of some basic or common portfolio approaches of investing such as diversification, minimum risk, composition rules and downside protection. let's discuss about each approach one by one. Portfolio management is a critical investment practice used by two types of entities: individual and institutional investors. these categories have distinct strategies, goals, and.

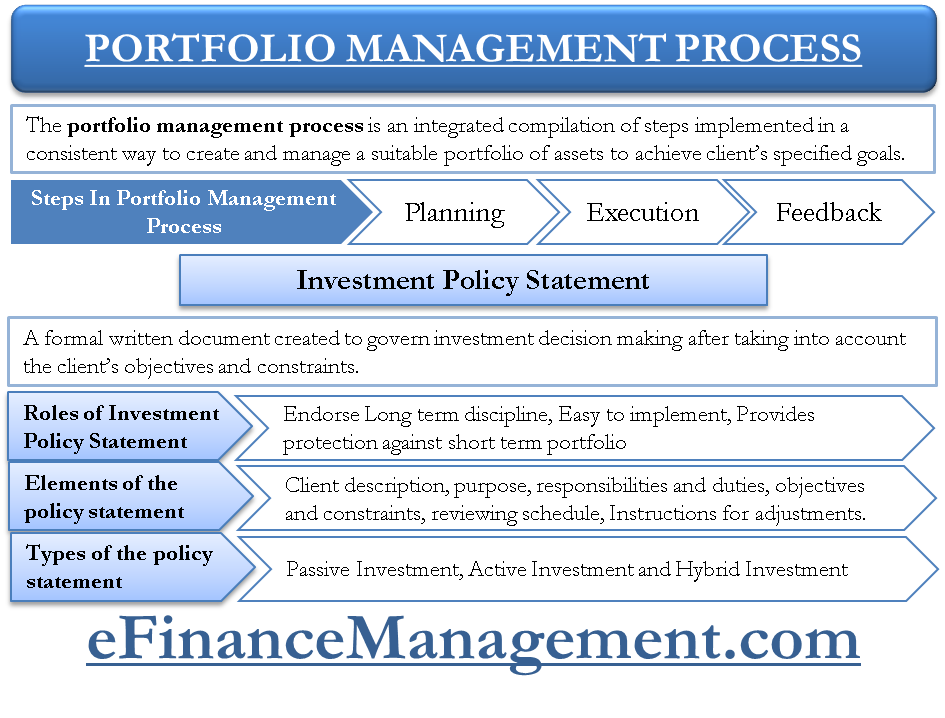

Portfolio Management Meaning And Important Concepts Pdf Modern Portfolio management is the process of creating and maintaining a well diversified collection of investments that align with an individual's financial goals and risk tolerance. these include monitoring performances, setting goals, analyzing risk factors, and devising investment strategies. Portfolio management aims to meet the long term financial objectives of the investors within the given timeline while minimizing the degree of market risk. Portfolio management is a well planned investing strategy based on an investor’s objectives and risk tolerance. portfolio management entails selecting and monitoring investments such as stocks, bonds, and mutual funds. There are several ways people can manage their investment portfolios. the four distinct types of portfolio management are active, passive, discretionary and non discretionary.

Portfolio Management Definition Types And Strategies 49 Off Portfolio management is a well planned investing strategy based on an investor’s objectives and risk tolerance. portfolio management entails selecting and monitoring investments such as stocks, bonds, and mutual funds. There are several ways people can manage their investment portfolios. the four distinct types of portfolio management are active, passive, discretionary and non discretionary. Discover the meaning of portfolio management, its process, types, and strategies. learn how to optimize your investments and achieve financial goals effectively. Portfolio management refers to building and supervising a group of investments, such as securities, bonds, exchange traded funds, mutual funds, cryptocurrencies, etc., either personally or professionally. Portfolio management is the art of investing in a collection of assets, such as stocks, bonds, or other securities, to diversify risk and achieve greater returns. it includes asset allocation, security selection, risk management, and ongoing monitoring and adjustment of the portfolio. With reference to mutual funds, there are two types of portfolio management, namely– active management and passive management. trading of securities and attempting to generate better returns than market, and simultaneously considering the fund’s objectives and asset class limitations is known as active management.

Portfolio Management Definition Types And Strategies 58 Off Discover the meaning of portfolio management, its process, types, and strategies. learn how to optimize your investments and achieve financial goals effectively. Portfolio management refers to building and supervising a group of investments, such as securities, bonds, exchange traded funds, mutual funds, cryptocurrencies, etc., either personally or professionally. Portfolio management is the art of investing in a collection of assets, such as stocks, bonds, or other securities, to diversify risk and achieve greater returns. it includes asset allocation, security selection, risk management, and ongoing monitoring and adjustment of the portfolio. With reference to mutual funds, there are two types of portfolio management, namely– active management and passive management. trading of securities and attempting to generate better returns than market, and simultaneously considering the fund’s objectives and asset class limitations is known as active management.

Portfolio Management Process Project Portfolio Management Portfolio management is the art of investing in a collection of assets, such as stocks, bonds, or other securities, to diversify risk and achieve greater returns. it includes asset allocation, security selection, risk management, and ongoing monitoring and adjustment of the portfolio. With reference to mutual funds, there are two types of portfolio management, namely– active management and passive management. trading of securities and attempting to generate better returns than market, and simultaneously considering the fund’s objectives and asset class limitations is known as active management.

Comments are closed.