Portfolio Management Definition Types And Strategies 49 Off

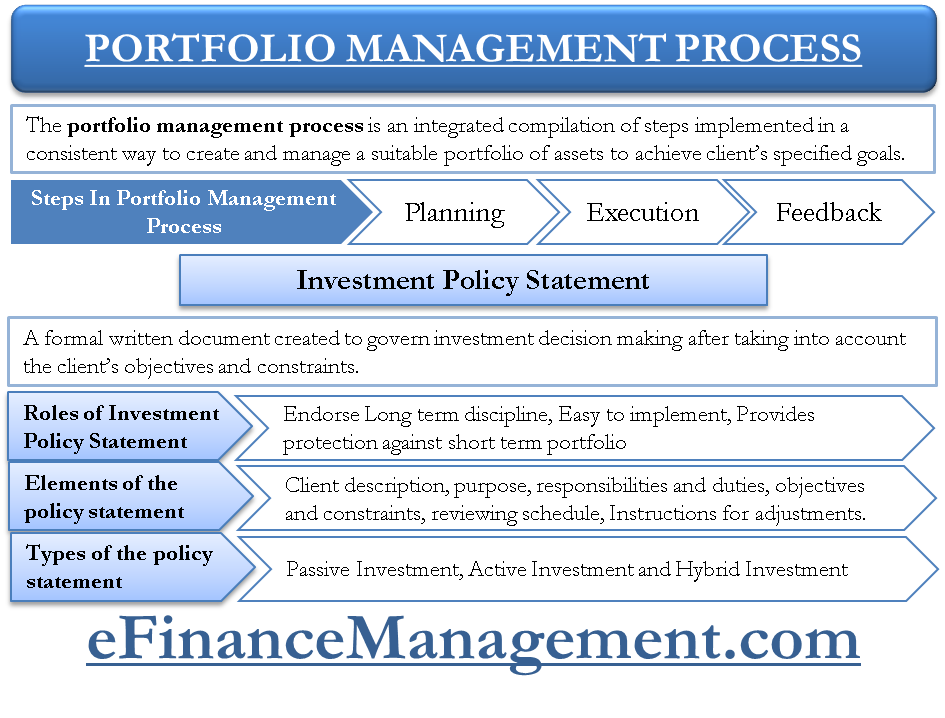

Portfolio Management Definition Types And Strategies 49 Off Portfolio management is a critical investment practice used by two types of entities: individual and institutional investors. these categories have distinct strategies, goals, and resources. There are four main portfolio management types: active, passive, discretionary, and non discretionary. a successful portfolio management process involves careful planning, execution, and feedback. investment strategies can assist investors in making an educated choice about an investment.

Portfolio Management Definition Types And Strategies 58 Off Portfolio management helps investors balance risk and reward to achieve their financial goals by tailoring investments to individual needs. active and passive portfolio management strategies differ in how frequently investments are bought or sold, impacting returns. Are you wondering about portfolio management? it’s the practice of strategically managing investments to achieve financial goals while balancing risk. There are several ways people can manage their investment portfolios. the four distinct types of portfolio management are active, passive, discretionary and non discretionary. Portfolio management is the process of constructing and maintaining a collection of investments to meet specified goals. portfolio management applies modern portfolio theory principles to find the optimal risk return tradeoff for each investor.

:max_bytes(150000):strip_icc()/Term_Defination_Financial.Portfolio-367fc73212ac456aa607ad135db4ffa0.jpg)

Portfolio Management Definition Types And Strategies 46 Off There are several ways people can manage their investment portfolios. the four distinct types of portfolio management are active, passive, discretionary and non discretionary. Portfolio management is the process of constructing and maintaining a collection of investments to meet specified goals. portfolio management applies modern portfolio theory principles to find the optimal risk return tradeoff for each investor. Portfolio management is the process of overseeing and directing a group of investments to meet financial objectives. there are myriad ways a portfolio can be managed using active, passive and factor based styles, all of which can be implemented using aggressive, conservative or balanced strategies. Discover the meaning of portfolio management, its process, types, and strategies. learn how to optimize your investments and achieve financial goals effectively. There are several types of portfolio management strategies, each with its own objectives, risk tolerance, and investment approach. here are some of the most common types: 1. passive management: objective: to track the performance of a specific market index, such as the s&p 500 or the nifty 50. Portfolio management is the process of managing a collection of investments to achieve a specific financial goal. it involves selecting assets, balancing risks and returns, and adjusting the portfolio over time. there are two main types of portfolios: active management and passive management.

Comments are closed.