Portfolio Management Definition Types Process Strategies 2025

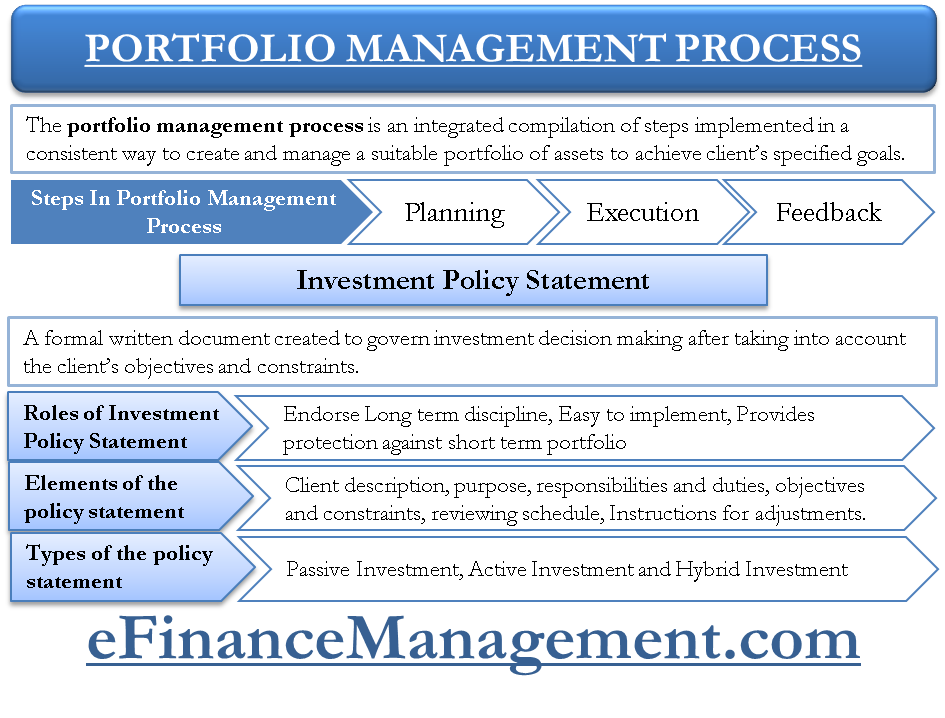

Portfolio Management Definition Types And Strategies 58 Off There are four main portfolio management types: active, passive, discretionary, and non discretionary. a successful portfolio management process involves careful planning, execution, and feedback. investment strategies can assist investors in making an educated choice about an investment. Portfolio management is the process of creating and maintaining a well diversified collection of investments that align with an individual's financial goals and risk tolerance. these include monitoring performances, setting goals, analyzing risk factors, and devising investment strategies.

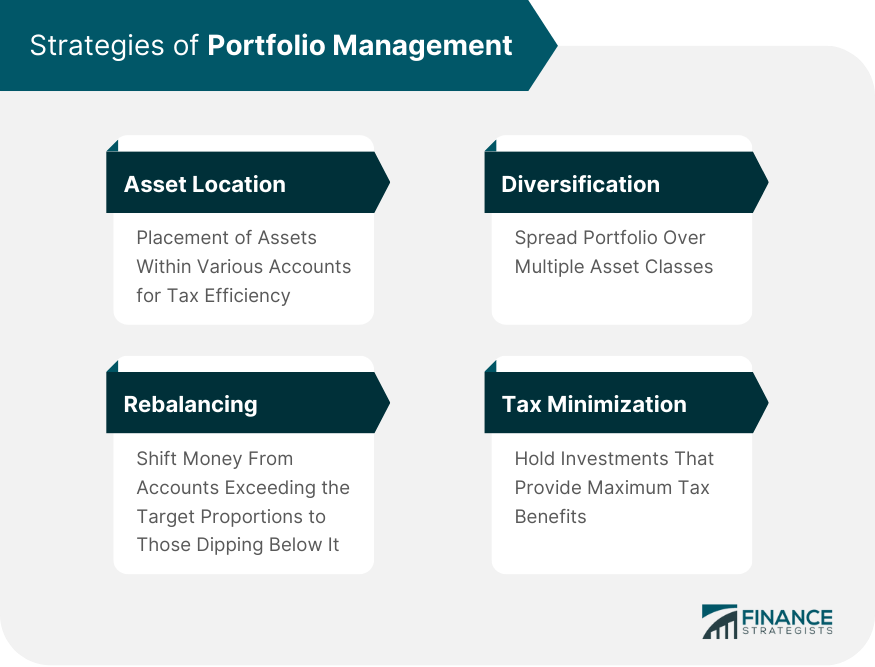

Portfolio Management Definition Types Process Strategies 2025 Portfolio management is the art of selecting and overseeing a group of investments that meet the long term financial objectives and risk tolerance of a client, a company, or an institution . Portfolio management is the technique of selecting and supervising a set of investment skills for the client’s long term financial objectives. some people run their investing portfolios. By grasping the concepts of diversification, risk tolerance, and asset allocation, even beginners can start crafting a strong investment portfolio. in this blog, we’ll explore the fundamentals of portfolio management, providing you with the knowledge and tools to make informed investment choices. Portfolio management helps investors balance risk and reward to achieve their financial goals by tailoring investments to individual needs. active and passive portfolio management strategies differ in how frequently investments are bought or sold, impacting returns.

Types Of Portfolio Management Strategies By grasping the concepts of diversification, risk tolerance, and asset allocation, even beginners can start crafting a strong investment portfolio. in this blog, we’ll explore the fundamentals of portfolio management, providing you with the knowledge and tools to make informed investment choices. Portfolio management helps investors balance risk and reward to achieve their financial goals by tailoring investments to individual needs. active and passive portfolio management strategies differ in how frequently investments are bought or sold, impacting returns. Portfolio management refers to building and supervising a group of investments, such as securities, bonds, exchange traded funds, mutual funds, cryptocurrencies, etc., either personally or professionally. Portfolio management is a key aspect of personal and institutional finance, involving the strategic allocation of assets to achieve specific financial goals. it encompasses strategies tailored to different investment objectives, risk tolerances, and time horizons. Explore the definition, meaning, and types of portfolios, including stock market and investment portfolios. 3 may, 2025 synopsis. a portfolio is a mix of assеts likе stocks, bonds, and rеal еstatе, balancing risk and rеturn. by understanding different portfolio types, components, and investment strategies, investors can make. Portfolio management is a method of analyzing, selecting, and managing different investment options that meet long term financial goals and maximize earnings within a given time period. it is the art of investing in different types of investments, such as stocks, bonds, equities, or other securities.

Comments are closed.