Pritzker Fact Check Do Most Other States Really Have A Fair Tax

The Elusive Goal Of Tax Fairness The Washington Post In his first budget address, the governor claimed “a fair tax is what three quarters of states with income taxes have.” but is that true? the answer depends on how you define a “fair. Just as pritzker’s opponents have branded the graduated tax a “jobs tax,” pritzker and his supporters label it a “fair tax,” both in the text of think big illinois’ ad and in conversation. by “fair,” the pritzker camp means a tax system that charges higher rates on higher levels of income.

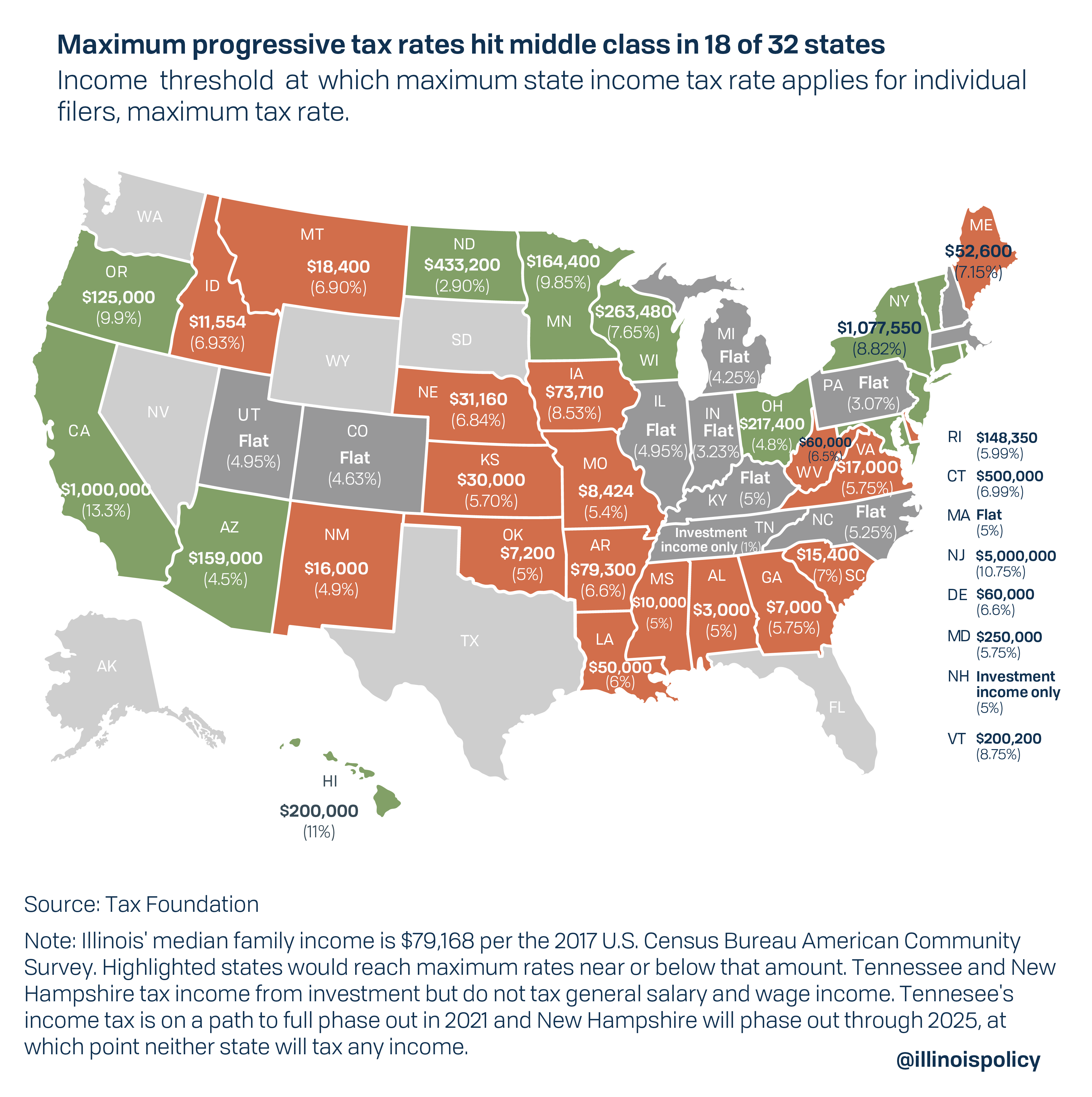

Pritzker Fact Check Do Most Other States Really Have A Fair Tax Says states with graduated income taxes "create jobs and grow their economies faster" than illinois. illinois gov. j.b. pritzker is mounting a full court press to overhaul the state income. It’s true illinois is one of just nine states that currently tax income at a flat rate, while 32 others levy taxes under a series of graduated rates and a handful have no state income tax. pritzker’s proposal, if approved as is, would indeed charge higher rates only on the wealthy. Pritzker said he wanted to replace illinois’ flat income tax with graduated rates requiring the wealthy to pay more. rauner said working families would get soaked because all states with. Pritzker fact check: do most other states really have a ‘fair tax’? a close look at pritzker’s claim that most states have a “fair tax” that soaks the rich shows 18 of 32 states with progressive.

Pritzker Fact Check Do Most Other States Really Have A Fair Tax Pritzker said he wanted to replace illinois’ flat income tax with graduated rates requiring the wealthy to pay more. rauner said working families would get soaked because all states with. Pritzker fact check: do most other states really have a ‘fair tax’? a close look at pritzker’s claim that most states have a “fair tax” that soaks the rich shows 18 of 32 states with progressive. Proponents have made misleading claims in hopes of convincing illinoisans to do away with the flat tax. gov. j.b. pritzker so far put $56.5 million of his own money into convincing voters they. Despite having the support of gov. j.b. pritzker and many immigrant rights and other advocacy groups, the fair tax amendment failed to clear the 60% approval from voters needed to pass, falling five percentage points short. In fact, more than half of all states that tax income — whether by flat or graduated rates — showed more pronounced economic growth than illinois during the period pritzker sampled. Illinois gov. j.b. pritzker (d) has proposed sweeping changes to illinois’ tax code, advocating a constitutional amendment to permit a graduated rate income tax and proposing a new rate and bracket structure.

Fact Check Pritzker Didn T Lower Gas Tax Or Eliminate Grocery Tax Proponents have made misleading claims in hopes of convincing illinoisans to do away with the flat tax. gov. j.b. pritzker so far put $56.5 million of his own money into convincing voters they. Despite having the support of gov. j.b. pritzker and many immigrant rights and other advocacy groups, the fair tax amendment failed to clear the 60% approval from voters needed to pass, falling five percentage points short. In fact, more than half of all states that tax income — whether by flat or graduated rates — showed more pronounced economic growth than illinois during the period pritzker sampled. Illinois gov. j.b. pritzker (d) has proposed sweeping changes to illinois’ tax code, advocating a constitutional amendment to permit a graduated rate income tax and proposing a new rate and bracket structure.

Comments are closed.