Property Tax And Full Budget 2023 2024

Salient Features Of Budget 2023 2024 Income Tax Vat Customs Fy24 planned budget assumed values would grow from $179.4b to $188.7b preliminary values as of may 2023 is $214.2b but will erode as appraisal districts resolve property owners’ protests. Property taxes account for roughly 57 percent of the general fund revenue. with continued growth in property values, this budget includes a property tax rate reduction for the eighth year in a row by 0.65¢. this will lower the property tax rate from 74.58¢ to 73.93¢ per $100 valuation.

Property Tax 2023 24 Pdf Unprecedented state revenues allowed texas lawmakers this year to propose reducing school property taxes by billions of dollars to help ease some of the burden on property owners through increased exemptions, reductions in school district tax rates and limitations on appraised values for certain properties. A deal on property tax relief was reached during the second special session with two bills and a joint resolution signed into law by gov. abbott on august 9th. this report offers a closer look at the bills passed and their potential impacts. Dallas city manager t.c. broadnax has proposed a $4.63 billion city budget for fiscal year 2023 24, with a general fund budget of $1.84 billion. the new general fund budget will include an. Dallas — dallas mayor eric johnson is endorsing a city councilmember’s plan to pass a budget featuring no new city revenue meaning a deep cut to the city’s tax rate after a 10.5 percent.

Property Tax And Full Budget 2023 2024 Dallas city manager t.c. broadnax has proposed a $4.63 billion city budget for fiscal year 2023 24, with a general fund budget of $1.84 billion. the new general fund budget will include an. Dallas — dallas mayor eric johnson is endorsing a city councilmember’s plan to pass a budget featuring no new city revenue meaning a deep cut to the city’s tax rate after a 10.5 percent. New data released by the texas comptroller’s office shows that property taxes increased for the second straight year, despite recent claims of property tax relief from politicians. figure 1 shows the total property tax levy for 2024 increased by $5.4 billion in 2024, up 6.6% over 2023. Property tax rates in dallas county. this notice concerns the 2024 property tax rates for dallas county. this notice provides information about two tax rates used in adopting the current tax year's tax rate. the no new revenue tax rate would impose the same amount of taxes as last year if you compare properties taxed in both years. Special attention is given to changes in eligibility requirements for property tax relief programs. a second focus concerns initiatives designed to improve housing affordability, such as tax incentives for new developments and support for low income owners and renters. The latest biennial property tax report from the texas comptroller confirms what many texas homeowners and fiscal watchdogs, like tfr, already suspected: property taxes did, in fact, increase in 2023 by $650 million despite promises of relief.

-1920w.jpg)

2023 2024 Budget New data released by the texas comptroller’s office shows that property taxes increased for the second straight year, despite recent claims of property tax relief from politicians. figure 1 shows the total property tax levy for 2024 increased by $5.4 billion in 2024, up 6.6% over 2023. Property tax rates in dallas county. this notice concerns the 2024 property tax rates for dallas county. this notice provides information about two tax rates used in adopting the current tax year's tax rate. the no new revenue tax rate would impose the same amount of taxes as last year if you compare properties taxed in both years. Special attention is given to changes in eligibility requirements for property tax relief programs. a second focus concerns initiatives designed to improve housing affordability, such as tax incentives for new developments and support for low income owners and renters. The latest biennial property tax report from the texas comptroller confirms what many texas homeowners and fiscal watchdogs, like tfr, already suspected: property taxes did, in fact, increase in 2023 by $650 million despite promises of relief.

Features Of Budget 2023 2024 Tax Parley Special attention is given to changes in eligibility requirements for property tax relief programs. a second focus concerns initiatives designed to improve housing affordability, such as tax incentives for new developments and support for low income owners and renters. The latest biennial property tax report from the texas comptroller confirms what many texas homeowners and fiscal watchdogs, like tfr, already suspected: property taxes did, in fact, increase in 2023 by $650 million despite promises of relief.

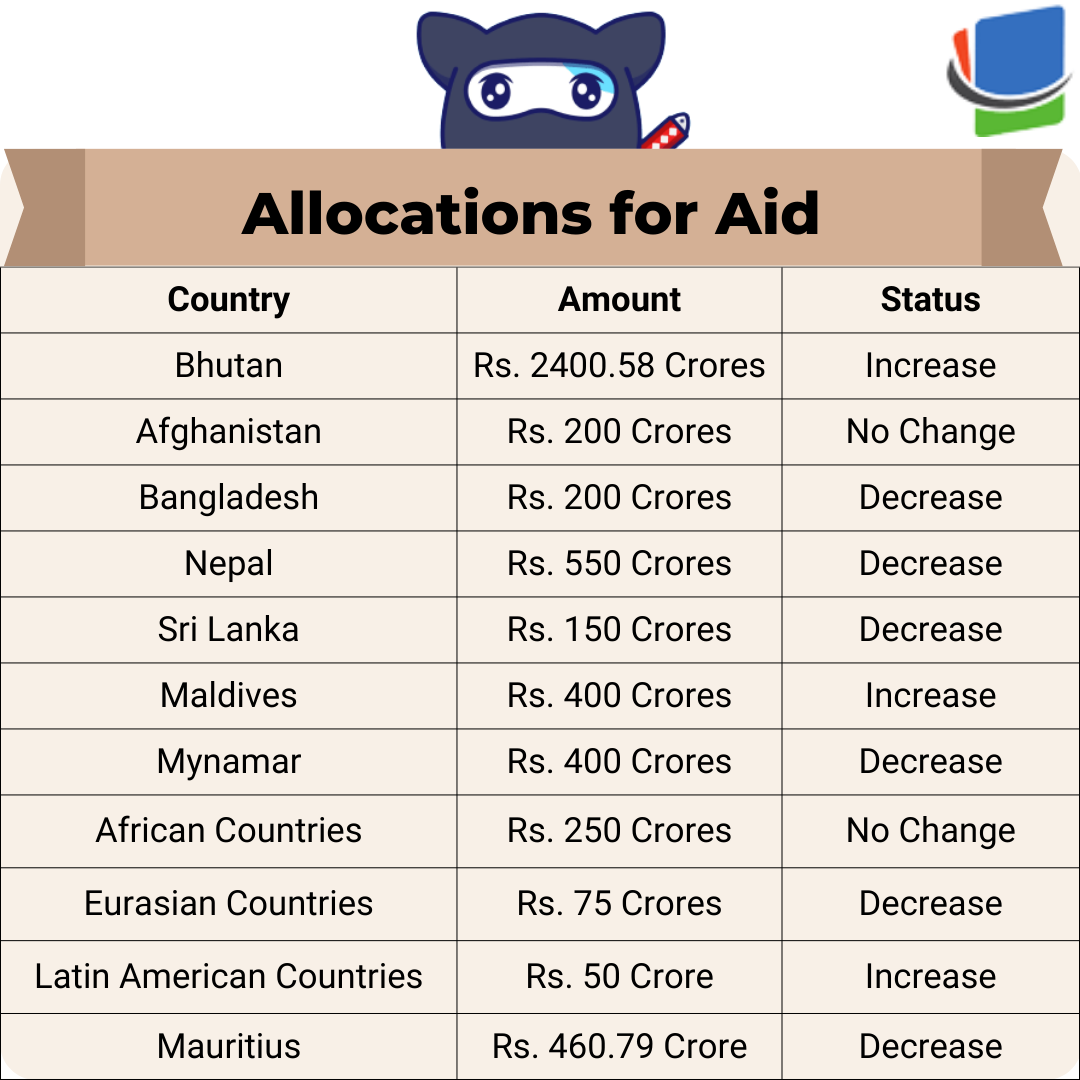

Budget 2023 2024 Key Highlights Tax Ninja Serving Knowledge Digitally

Comments are closed.