Property Tax Protest In Texas 2025

Harris County Property Tax Protest Deadline Is Today Abc13 Houston According to the texas comptroller website, the deadline to appeal an appraisal is may 15 or 30 days from the date the notices are delivered. In texas, property tax assessments are conducted annually, and if you believe your property's assessed value is inaccurate, you have the right to protest. the primary deadlines to be aware of are: may 15, 2025: this is the standard deadline for filing a property tax protest.

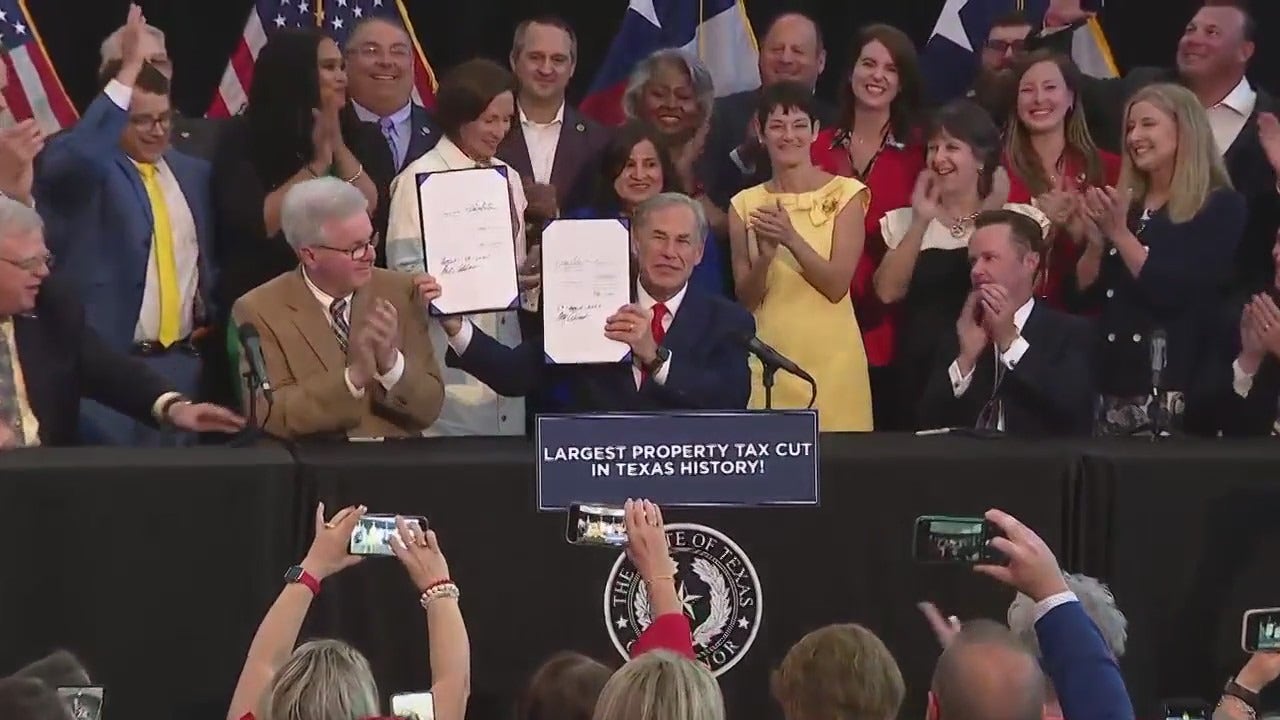

Texas The Issue Is Leaders Lawmakers Celebrate Property Tax Relief Please remember that the deadline to protest residential and commercial properties is on or before may 15, 2025, and business personal property is on or before june 12, 2025,. If your property tax assessment seems too high, you have the right to challenge it. successfully reducing your tax burden requires preparation, strategy, and professional guidance. txtpr specializes in helping homeowners navigate the protest process to achieve the best possible outcome. 1. understanding the importance of a protest. May 15, 2025: deadline to file a protest. if you feel the assessed value of your property is unfair, you must file a protest by this date. don’t wait until the last minute! timely filing is crucial for achieving a reduction in your taxes. this date will vary per appraisal district. Kxan’s will dupree and avery travis spoke to ownwell ceo colton pace on new data released by the company that shows around half of homeowners in texas are not aware of their right to protest.

What Happens When Texans Protest Their Mind Boggling Property Taxes May 15, 2025: deadline to file a protest. if you feel the assessed value of your property is unfair, you must file a protest by this date. don’t wait until the last minute! timely filing is crucial for achieving a reduction in your taxes. this date will vary per appraisal district. Kxan’s will dupree and avery travis spoke to ownwell ceo colton pace on new data released by the company that shows around half of homeowners in texas are not aware of their right to protest. Harris county harris county property owners have until may 15 to protest 2025 appraisal values appraised values, coupled with tax rates set by government entities such as cities, counties, school. To file a property tax protest in texas for 2025, you must submit your protest by may 15, 2025, or within 30 days of receiving your appraisal notice, whichever is later. Is your property tax too high? protest or spin the wheel of fortune or give up. the deadline is may 15. Learning how to protest property taxes and win may sound daunting, but this guide will walk you through every step, from automated and informal protests to formal hearings.

Texas House Passes Property Tax Bill Despite Gop Infighting Harris county harris county property owners have until may 15 to protest 2025 appraisal values appraised values, coupled with tax rates set by government entities such as cities, counties, school. To file a property tax protest in texas for 2025, you must submit your protest by may 15, 2025, or within 30 days of receiving your appraisal notice, whichever is later. Is your property tax too high? protest or spin the wheel of fortune or give up. the deadline is may 15. Learning how to protest property taxes and win may sound daunting, but this guide will walk you through every step, from automated and informal protests to formal hearings.

Texas Property Taxes State Lawmakers Include More Tax Cuts For Is your property tax too high? protest or spin the wheel of fortune or give up. the deadline is may 15. Learning how to protest property taxes and win may sound daunting, but this guide will walk you through every step, from automated and informal protests to formal hearings.

Comments are closed.