Protesting Property Taxes In Texas Providence Title Company Of Texas

Protesting Property Taxes In Texas Providence Title Company Of Texas If you are unable to do so, here are steps for protesting your property taxes: • file a written protest by may 15 or no later than 30 days after the appraisal district notice of appraised value is delivered to you, according to section 25.19. Protesting property taxes in texas a providence title office near you providence title has almost 30 local offices in dallas fort worth, houston, san antonio and across the great state of texas.

How To Protest Property Taxes Patten Title Company A comprehensive guide to navigating the texas property tax protest process, from understanding timelines to presenting evidence effectively. That’s a reason to protest your tax appraisal in texas. statistics from bexar county in texas reveal that about 90% of tax protests are usually successful, and across the state, those who protested typically save an average of $527. even better, a professional tax protest company can do it for you, so you hardly lift a finger. Tips for protesting property taxes in texas: 11 things to do now for a successful protest. homeowners should protest their property taxes every year to ensure their property’s tax appraised value aligns with the real estate market. many factors can affect property values year to year, such as changes in neighborhood, renovations, or damages. How to protest property taxes in texas before the may 2025 deadline. marley malenfant, austin american statesman. fri, may 9, 2025 at 11:01 am utc. 2 min read.

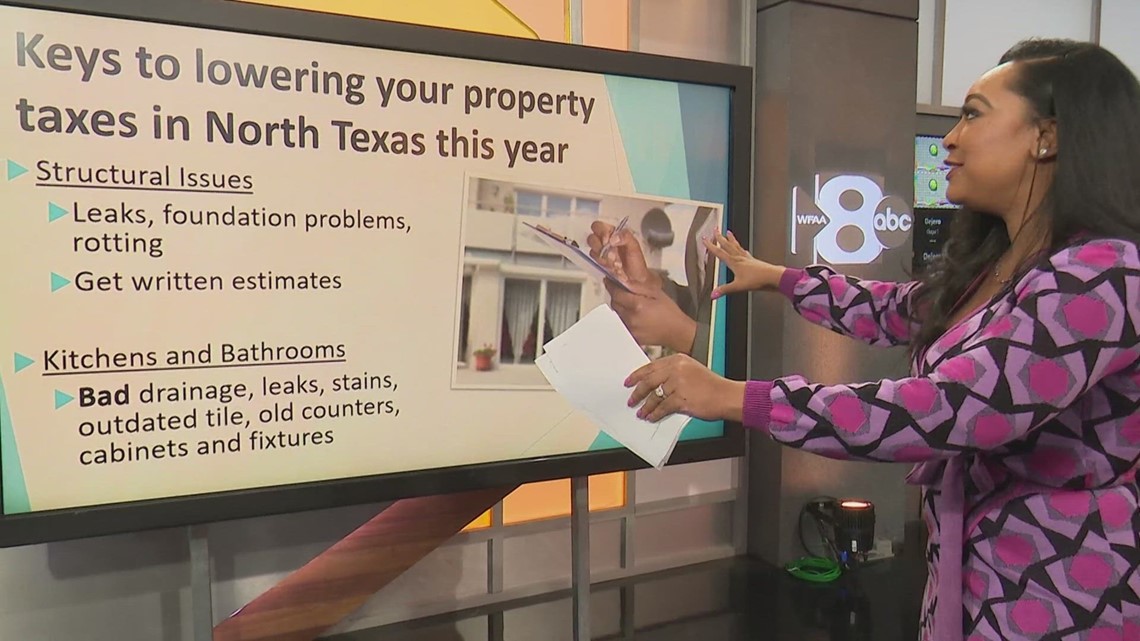

What To Know About Protesting Your Property Taxes In North Texas Wfaa Tips for protesting property taxes in texas: 11 things to do now for a successful protest. homeowners should protest their property taxes every year to ensure their property’s tax appraised value aligns with the real estate market. many factors can affect property values year to year, such as changes in neighborhood, renovations, or damages. How to protest property taxes in texas before the may 2025 deadline. marley malenfant, austin american statesman. fri, may 9, 2025 at 11:01 am utc. 2 min read. Many texas homeowners feel stuck with inflated assessments simply because they’re unsure how to respond or where to begin, but protesting your property taxes can turn the tide. you can challenge your valuation and potentially lower your tax bill with the proper evidence and a focused strategy. Texans may file an appeal or formal protest of their assessed property taxes with the appraisal review board in the county where the real estate is located. Protesting property taxes in texas is a legal process that homeowners can use to challenge their property tax appraisal. by doing so, homeowners can potentially lower their property tax bill and save money. There are many reasons to protest property taxes in texas, but the biggest one is that it could save you money annually. your property taxes are calculated by using the tax appraised value determined by your county appraisal district (cad). many cads use mass appraisal methods, which can lead to your property taxes being higher than they should be.

Protest Texas Property Taxes Susanna Latham Many texas homeowners feel stuck with inflated assessments simply because they’re unsure how to respond or where to begin, but protesting your property taxes can turn the tide. you can challenge your valuation and potentially lower your tax bill with the proper evidence and a focused strategy. Texans may file an appeal or formal protest of their assessed property taxes with the appraisal review board in the county where the real estate is located. Protesting property taxes in texas is a legal process that homeowners can use to challenge their property tax appraisal. by doing so, homeowners can potentially lower their property tax bill and save money. There are many reasons to protest property taxes in texas, but the biggest one is that it could save you money annually. your property taxes are calculated by using the tax appraised value determined by your county appraisal district (cad). many cads use mass appraisal methods, which can lead to your property taxes being higher than they should be.

The Pros And Cons Of Protesting Texas Property Taxes Yourself Protesting property taxes in texas is a legal process that homeowners can use to challenge their property tax appraisal. by doing so, homeowners can potentially lower their property tax bill and save money. There are many reasons to protest property taxes in texas, but the biggest one is that it could save you money annually. your property taxes are calculated by using the tax appraised value determined by your county appraisal district (cad). many cads use mass appraisal methods, which can lead to your property taxes being higher than they should be.

Comments are closed.