Solved Problem 8 07 You Are Considering Two Stocks And Have Chegg

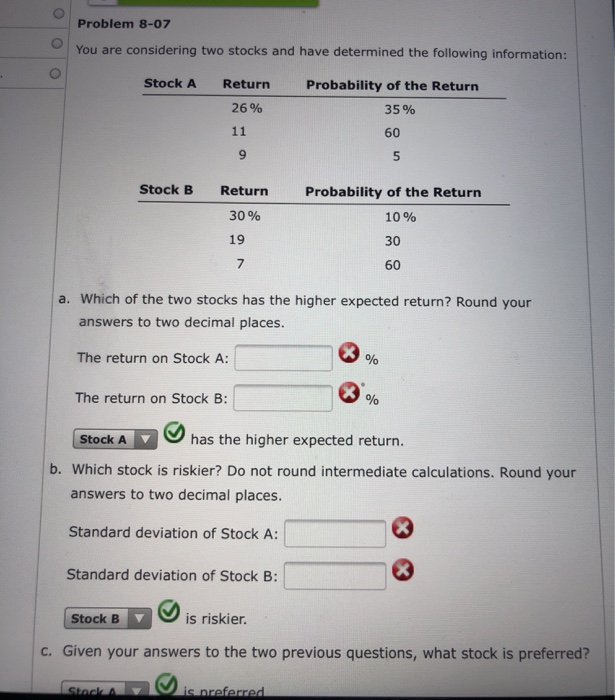

Solved Problem 8 07you Are Considering Two Stocks And Have Chegg Our expert help has broken down your problem into an easy to learn solution you can count on. which of the two stocks has the higher expected return? round your answers to two decimal places. does stock a or stock b 3 have the higher expected return? which stock is riskier? do not round intermediate calculations. The expected return for **stock **a is 23.80%, while the expected return for stock b is 25.60%. therefore, stock b has the higher expected return. to calculate the expected return, we multiply each possible return by its corresponding probability and sum up the results.

Solved Problem 8 07 You Are Considering Two Stocks And Have Chegg Consider two stocks. stock a has a standard deviation of 36% and stock b has a standard deviation of 40%. the stocks have a correlation of 0.49. you plan to invest $9,383 into stock a and $8,523 into stock b. what is the standard deviation of your two stock portfolio? (round weights to 3 decimal places and final answer to 2 decimal places). You are considering two stocks and have determined the following information: stock a return probability of the answered step by step solved by verified expert. Stock a; stock b; item 3 has the higher expected return. which stock is riskier? do not round intermediate calculations. round your answers to two decimal places. standard deviation of stock a: standard deviation of stock b: select stock a; stock b; item 6 is riskier. given your answers to the two previous questions, what stock is preferred. We need to find the expected returns for stock after giving this data. we need to find a standard deviation for stock exchange. we are going to make a single table for the calculation.

Solved Problem 8 07 You Are Considering Two Stocks And Have Chegg Stock a; stock b; item 3 has the higher expected return. which stock is riskier? do not round intermediate calculations. round your answers to two decimal places. standard deviation of stock a: standard deviation of stock b: select stock a; stock b; item 6 is riskier. given your answers to the two previous questions, what stock is preferred. We need to find the expected returns for stock after giving this data. we need to find a standard deviation for stock exchange. we are going to make a single table for the calculation. The problem with this alternative is that: ( choose one), a firm is considering a project which would decrease accounts receivable by $10,000, decrease accounts payable by $50,000 and increase inventory by $25,000. which of the following is true? ( choose one ), you are considering investing in two stocks to form a portfolio . Which of the two stocks has the higher expected return? round your answers to two decimal places. the return on stock a: 14.2 % the return on stock b: 14.6 % stock b has the higher expected return. Consider two stocks. stock a has a standard deviation of 21% and stock b has a standard deviation of 50%. the stocks have a correlation of 0.28. you plan to invest $8919 into stock a and $8642 into stock b. what is the standard deviation of your two stock portfolio?. To calculate the expected return for each stock, we multiply the probability of the return by the return itself. for stock a, the expected return is 19% × 1650 = 313.5. for stock b, the expected return is 210% × 1245 = 2614.5. therefore, stock b has a higher expected return.

Comments are closed.