Solved You Are Considering Two Stocks And Have Determined Chegg

Solved You Are Considering Two Stocks And Have Determined Chegg Given your answers to the two previous questions, what stock is preferred? there are 2 steps to solve this one. refer the fol not the question you’re looking for? post any question and get expert help quickly. Consider two stocks. stock a has a standard deviation of 21% and stock b has a standard deviation of 50%. the stocks have a correlation of 0.28. you plan to invest $8919 into stock a and $8642 into stock b. what is the standard deviation of your two stock portfolio?.

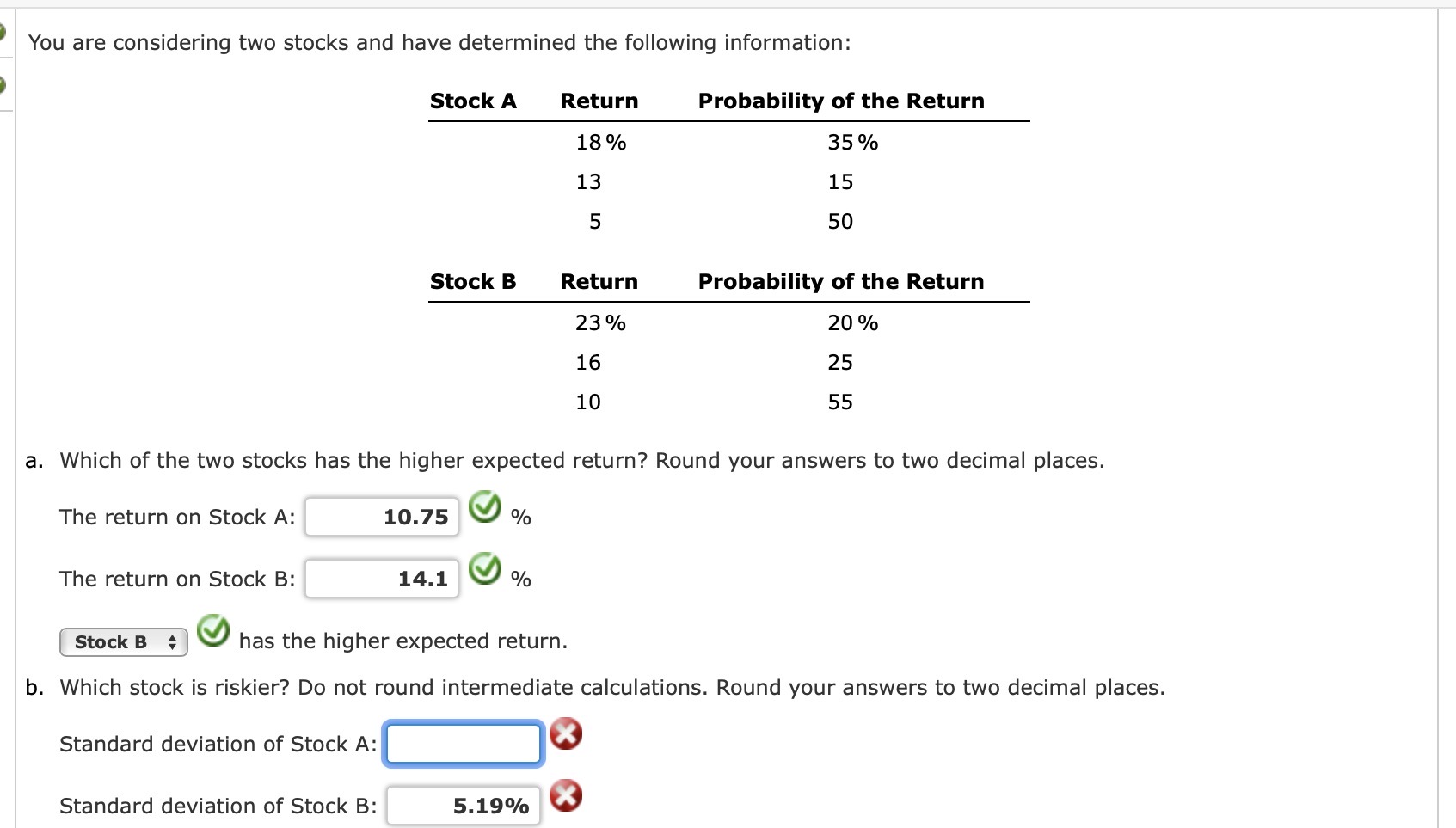

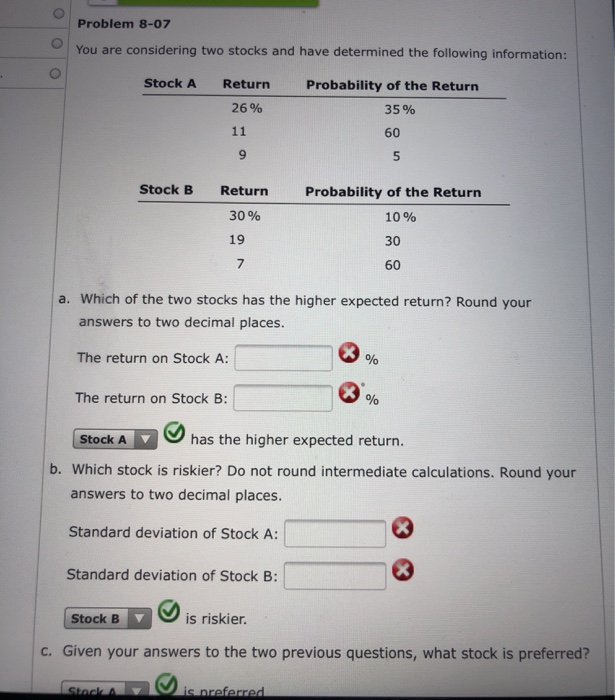

Solved Problem 8 07you Are Considering Two Stocks And Have Chegg To determine which stock has the higher expected return, we need to calculate the expected return for both stock a and stock b using the formula for expected return: \[ \text{expected return} = \sum (\text{return} \times \text{probability}) \]. You are considering two stocks and have determined the following information: stock a return probability of the answered step by step solved by verified expert. Answer for part a: stock b has the higher expected return of 22.4%. step 3: calculate the variance for stock a: variance for stock a = [(28% 13.5%)^2 * 0.25] [(16% 13.5%)^2 * 0.20] [(6% 13.5%)^2 * 0.55] = 0.0365 0.005 0.33075 = 0.37225. Study with quizlet and memorize flashcards containing terms like consider two stocks. stock a has a standard deviation of 36% and stock b has a standard deviation of 40%. the stocks have a correlation of 0.49. you plan to invest $9,383 into stock a and $8,523 into stock b. what is the standard deviation of your two stock portfolio?.

Solved Problem 8 07 You Are Considering Two Stocks And Have Chegg Answer for part a: stock b has the higher expected return of 22.4%. step 3: calculate the variance for stock a: variance for stock a = [(28% 13.5%)^2 * 0.25] [(16% 13.5%)^2 * 0.20] [(6% 13.5%)^2 * 0.55] = 0.0365 0.005 0.33075 = 0.37225. Study with quizlet and memorize flashcards containing terms like consider two stocks. stock a has a standard deviation of 36% and stock b has a standard deviation of 40%. the stocks have a correlation of 0.49. you plan to invest $9,383 into stock a and $8,523 into stock b. what is the standard deviation of your two stock portfolio?. You are considering two stocks and have determined the following information: a. which of the two stocks has the higher expected return? b. which stock is riskier? c. given your answers to the two previous. Study with quizlet and memorise flashcards containing terms like assume you are considering two assets for your portfolio: a risk free t bill and a stock. the expected return is 3% on the t bill and 10% on the stock. The return on stock b: % select stock a; stock b; item 3 has the higher expected return. which stock is riskier? do not round intermediate calculations. round your answers to two decimal places. standard deviation of stock a: standard deviation of stock b: select stock a; stock b; item 6 is riskier. given your answers to the two previous. The expected return is calculated by multiplying the return by the probability and summing them up. for stock a: expected return = 24% * 0.4596 = 0.1103 for stock b: expected return = 15.83% * 0.30901 = 0.0489 so, the expected return for stock a is higher than show more….

Comments are closed.