Summit And Wasatch County Utah Property Tax Appeals

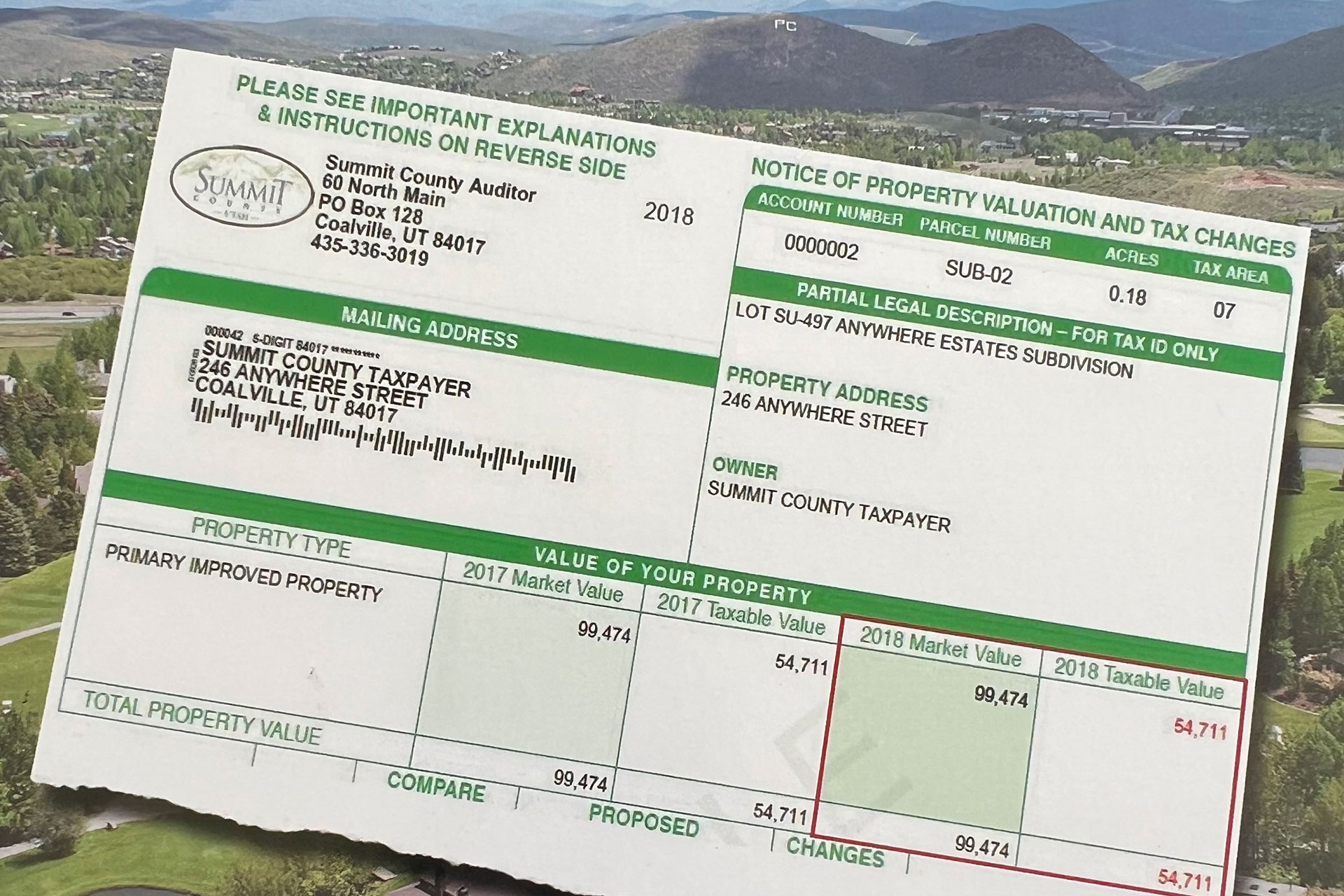

Summit And Wasatch County Utah Property Tax Appeals This publication is designed to help you determine if the market value set for your property is correct and, if necessary, how to file an appeal with the county board of equalization. the property tax on your property is the result of several factors; the value of the property, the tax rate, and certain exemptions that apply in some cases. File your appeal within 45 days of receiving your property tax notice. for summit county, download the board of equalization appeal form here and either email it to [email protected] or mail it to summit county boe, po box 128, coalville, ut 84017. for wasatch county, use the online board of equalization appeal form here.

Summit And Wasatch County Utah Property Tax Appeals The county auditor also hears property valuation appeals with the board of equalization. utah’s truth in taxation system uses assessed values to keep property tax fair. each tax entity sets the revenues it will need from property taxes in its budget process. If you believe that the assessed market value of your property is incorrect, you may appeal to the summit county board of equalization by filing an appeal via email (preferred method), mail, or in person with the summit county auditor. see more information below. For summit county, this can be accomplished by downloading this board of equalization appeal form and either emailing it to [email protected] or mailing it to summit county boe, po box 128, coalville, ut 84017. for wasatch county, use this online board of equalization appeal form. File an appeal through the board of equalization (boe) by 5:00 pm on september 15. to file an appeal online or to download the appeal form visit: summitcounty.org boe. some taxpayers may be eligible for property tax relief or deferral. for information on these programs, click here.

Summit County Utah Property Tax 101 Understanding Property For summit county, this can be accomplished by downloading this board of equalization appeal form and either emailing it to [email protected] or mailing it to summit county boe, po box 128, coalville, ut 84017. for wasatch county, use this online board of equalization appeal form. File an appeal through the board of equalization (boe) by 5:00 pm on september 15. to file an appeal online or to download the appeal form visit: summitcounty.org boe. some taxpayers may be eligible for property tax relief or deferral. for information on these programs, click here. Taxpayers who wish to appeal their centrally assessed property valuations must file a formal request for agency action with the utah state tax commission pursuant to utah code annotated 59 2 1007. Has that been your experience when you’ve gotten your tax assessment in the last couple weeks? valen lindner and jamison frost at parkcity360 are getting inundated with client calls and instagram dms asking for help to figure out how to appeal these tax assessments. Taxpayers may dispute their property assessment by filing an appeal with the board of equalization in the county where the property is located. late filed appeals are accepted under criteria specified in statute and administrative rule. If you would like to appeal your property, call the summit county assessor's office at (435) 336 3248 and ask for a property tax appeal form. keep in mind that property tax appeals are generally only accepted in a 1 3 month window each year.

Comments are closed.