Taxing Entities Equalization Tax Administration Utah County Auditor

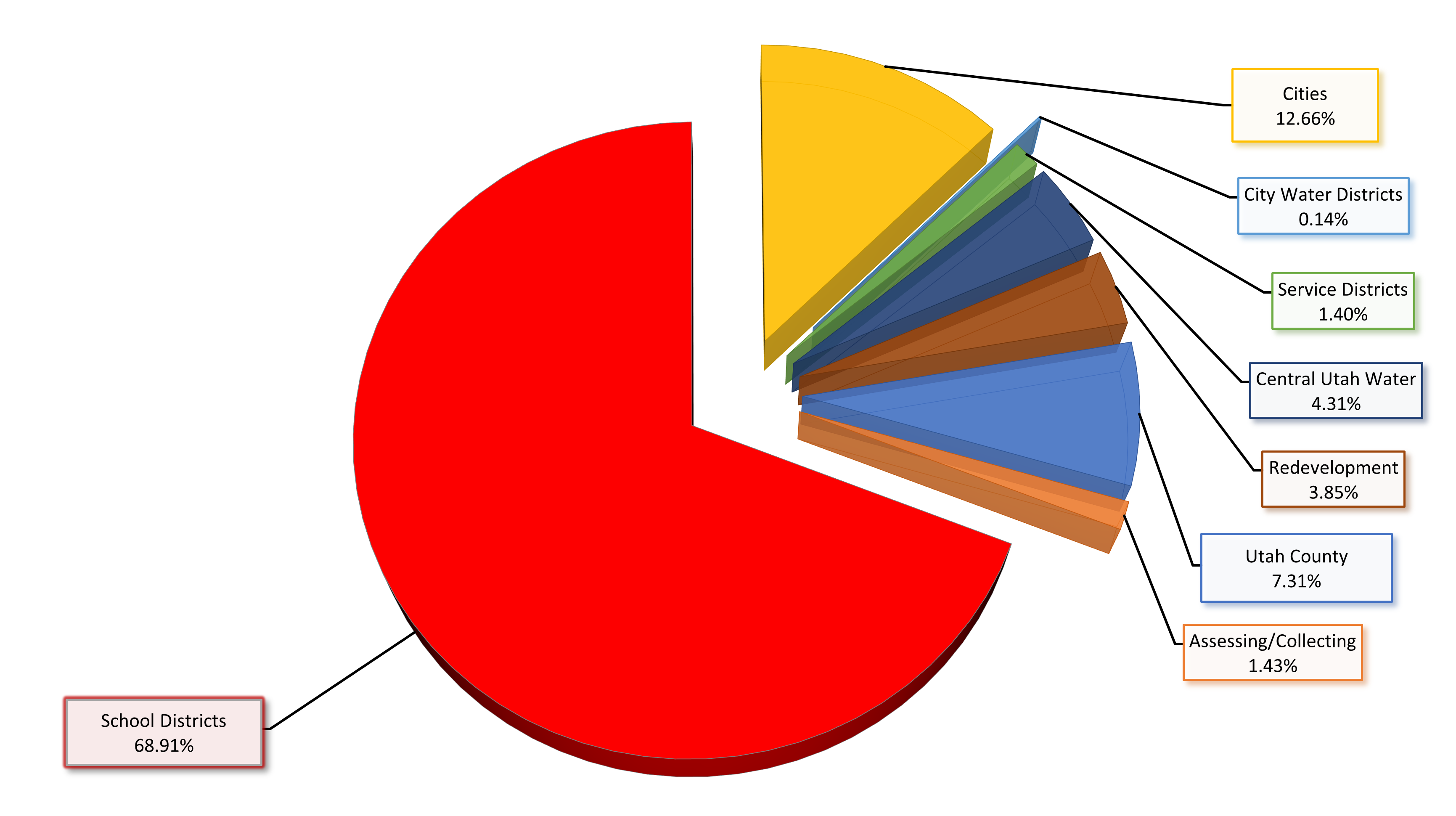

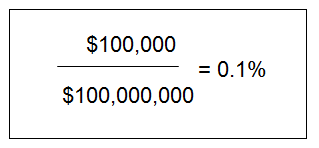

Taxing Entities Equalization Tax Administration Utah County Auditor In 2023, utah county residents paid a total of $761,114,148* in property taxes. those taxes were distributed to the various local governments in the following amounts: *data is courtesy of the treasurer 750 report available through the utah state tax commission tax rate website: taxrates.utah.gov. There are three elements in determining the property tax for each property: budget, taxable value, and tax rate. each element is explained in detail below. every property falls under several different taxing entities, which are then grouped together into a tax area.

Property Taxes Equalization Tax Administration Utah County Auditor File an appeal for your utah county property tax value. The county board of equalization shall meet and hold public hearings each year to examine the assessment roll and equalize the assessment of property in the county, including the assessment for general taxes of all taxing entities located in the county. (3) (a) except as provided in subsection (3)(d), a county board of equalization may:. Utah county board of equalization property appeals. valuation appeal system. sign in. sign in. property valuation appeal. email. about. careers history things to do. popular services. jail inmate search land records and maps marriage licenses property tax voter information. support. contact us holidays locations social media admin login. Centrally assessed property valuation process and timeline. the property tax division of the utah state tax commission is responsible for assessing mining properties and other properties that operate across county lines, such as utilities, telecommunications, or transportation companies.

Tax Equalization Pdf International Taxation Taxes Utah county board of equalization property appeals. valuation appeal system. sign in. sign in. property valuation appeal. email. about. careers history things to do. popular services. jail inmate search land records and maps marriage licenses property tax voter information. support. contact us holidays locations social media admin login. Centrally assessed property valuation process and timeline. the property tax division of the utah state tax commission is responsible for assessing mining properties and other properties that operate across county lines, such as utilities, telecommunications, or transportation companies. (i) the county board of equalization meets; and (ii) the taxing entity holds a public hearing on the proposed increase in the certified tax rate; (b) be on a form that is: (i) approved by the commission; and (ii) uniform in content in all counties in the state; and (c) contain for each property:. Taxing entities subject to rate increase procedures hold hearings on proposed tax increases, adopt final budgets and final tax rates, and report information to the county auditor and the tax commission in the form of a resolution.59 2 920. The county board of equalization shall meet and hold public hearings each year to examine the assessment roll and equalize the assessment of property in the county, including the assessment for general taxes of all taxing entities located in the county. • considerable knowledge of utah state and utah county tax laws, rules and ordinances. governing property tax administration • knowledge of statutory abatement, exemption, and tax relief processes and procedures.

Hours Tax Administration Utah County Auditor (i) the county board of equalization meets; and (ii) the taxing entity holds a public hearing on the proposed increase in the certified tax rate; (b) be on a form that is: (i) approved by the commission; and (ii) uniform in content in all counties in the state; and (c) contain for each property:. Taxing entities subject to rate increase procedures hold hearings on proposed tax increases, adopt final budgets and final tax rates, and report information to the county auditor and the tax commission in the form of a resolution.59 2 920. The county board of equalization shall meet and hold public hearings each year to examine the assessment roll and equalize the assessment of property in the county, including the assessment for general taxes of all taxing entities located in the county. • considerable knowledge of utah state and utah county tax laws, rules and ordinances. governing property tax administration • knowledge of statutory abatement, exemption, and tax relief processes and procedures.

Tax Relief Tax Administration Utah County Auditor The county board of equalization shall meet and hold public hearings each year to examine the assessment roll and equalize the assessment of property in the county, including the assessment for general taxes of all taxing entities located in the county. • considerable knowledge of utah state and utah county tax laws, rules and ordinances. governing property tax administration • knowledge of statutory abatement, exemption, and tax relief processes and procedures.

Comments are closed.