Technical Analysis Candlestick Patterns Lupon Gov Ph

Technical Analysis Candlestick Patterns Lupon Gov Ph Candlesticks patterns are used by traders to gauge the psychology of the market and as potential indicators of whether price will rise, fall or move sideways. some patterns are referred. Over the centuries, candlestick patterns have evolved to become an integral part of technical analysis, transcending geographical and cultural boundaries. today, traders worldwide utilize these patterns to gain invaluable insights into market dynamics and make informed trading decisions.

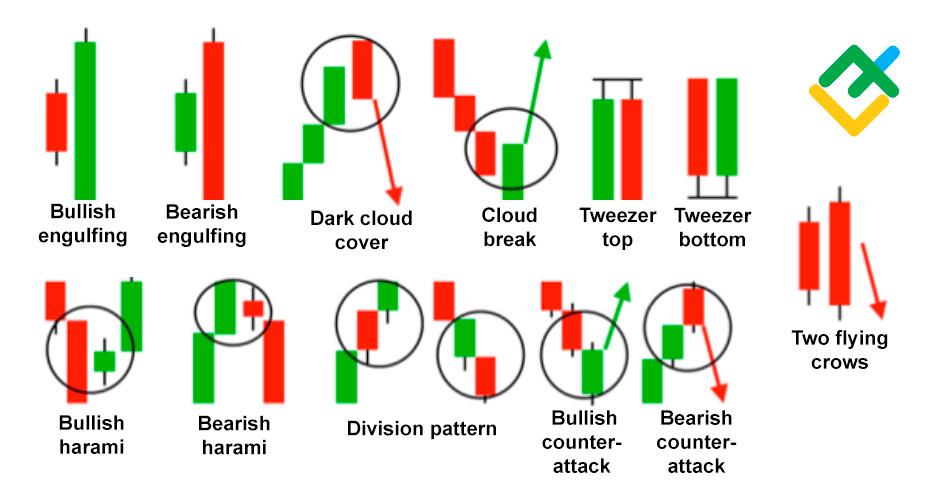

Technical Analysis Candlestick Patterns Chart Digital Download In this blog, we’ll cover the basics of candlesticks, explore key patterns, and show you how to use them in your trading. anatomy of a candlestick: a single candlestick provides four key pieces of information about price movement during a specific time period: open: the price at which the asset started trading during the period. Candlestick patterns are a cornerstone of technical analysis. however, to achieve a robust trading strategy, integrating them with other technical tools is crucial. think of candlesticks as the “raw data” of a company's performance report, while other tools represent the analysis and insights. Traders use candlesticks to help them make better trading decisions by studying patterns that forecast a market’s short term direction. a candlestick is a chart that shows a specific period of time that displays the prices opening, closing, high and low of a security, for example, a forex pair. By identifying recurring candlestick patterns, traders can anticipate future price movements and develop effective trading strategies. this comprehensive guide will delve into the intricacies of candlestick trading patterns, empowering traders with the knowledge to decipher market conditions and make informed decisions.

Technical Analysis Candlestick Patterns Poster Lupon Gov Ph Traders use candlesticks to help them make better trading decisions by studying patterns that forecast a market’s short term direction. a candlestick is a chart that shows a specific period of time that displays the prices opening, closing, high and low of a security, for example, a forex pair. By identifying recurring candlestick patterns, traders can anticipate future price movements and develop effective trading strategies. this comprehensive guide will delve into the intricacies of candlestick trading patterns, empowering traders with the knowledge to decipher market conditions and make informed decisions. When conducting technical analysis, it's often advisable use more than one signal, pattern or indicator to inform your trades. the markets don't always follow chart patterns, and every potential breakout could turn into a fakeout. Today, we will talk about moving averages and candlestick patterns. in technical analysis, you should know that support and resistance are horizonal areas used in your charts. mostly, it is plotted on ranging markets. Analyze patterns: look for candlestick or chart patterns that might indicate when to enter or exit a trade. make a decision: using all the information gathered, decide whether to buy, sell, or hold. always keep in mind that technical analysis provides options but does not guarantee success. This guide provides a comprehensive overview of three powerful trading tools: candlestick patterns, fibonacci retracement, and chart patterns. learn how to utilize these tools to identify potential trading opportunities, manage risk, and enhance your trading strategies.

Comments are closed.