The International Monetary System Pdf Bretton Woods System

01 Ifm Nixon Ends Bretton Woods International Monetary System Performance of the bretton woods system is timely. this paper presents an overview of the bretton woods experience. i analyze the system’s performance relative to earlier international monetary regimes as well as to the subsequent one and also its origins, operation, problems, and demise. In broad terms, the international monetary system involves the management of 5 three processes (1) the adjustment of balance of payments positions, including the establishment and alteration of exchange rates; (2) the financing of payments.

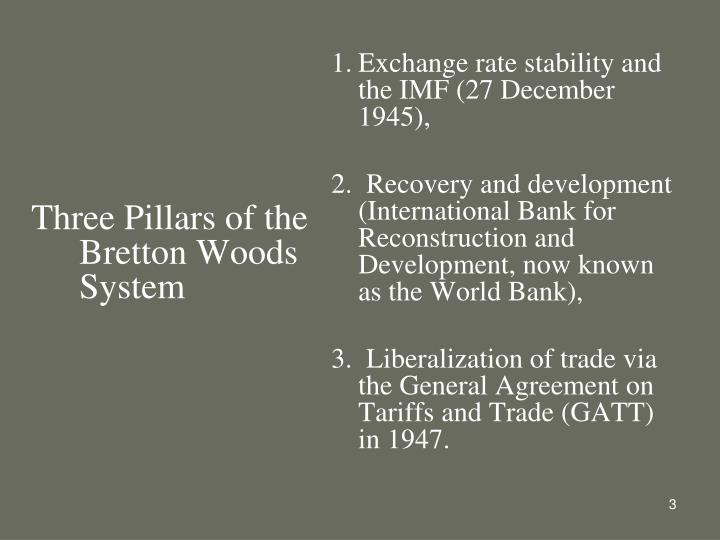

International Monetary System Pdf The bretton woods system was created by the 1944 articles of agreement to design a new international monetary order for the post war at a global conference organized by the us treasury at the mount washington hotel in bretton woods, new hampshire at the height of world war ii. Bretton woods system 1944–1973 • in july 1944, 44 countries met in bretton woods, nh, to design the bretton woods system: – a fixed exchange rate against the u.s. dollar and a fixed dollar price of gold ($35 per ounce). • they also established other institutions: 1. the international monetary fund 2. the world bank 3. It is time for a fundamental redesign and the introduction of a global reserve currency, to help stabilise international exchange rates, smooth commodity prices, promote international economic cooperation, and prevent future financial crises. The bretton woods system was structured around several key features to ensure global monetary stability. first, fixed exchange rates were established, where each country pegged its currency to the u.s. dollar, which itself was tied to gold at a fixed rate of $35 per ounce.

International Monetary Systems Download Free Pdf Bretton Woods It is time for a fundamental redesign and the introduction of a global reserve currency, to help stabilise international exchange rates, smooth commodity prices, promote international economic cooperation, and prevent future financial crises. The bretton woods system was structured around several key features to ensure global monetary stability. first, fixed exchange rates were established, where each country pegged its currency to the u.s. dollar, which itself was tied to gold at a fixed rate of $35 per ounce. The collapse of the bretton woods system in the early 1970s led to the introduction of the prevailing system of floating exchange rates, free capital flows and independent monetary policy in the major advanced economies. The bretton woods system that emerged from the conference saw the creation of two global institutions that still play important roles today, the international monetary fund (imf) and the world bank. it also instituted a fixed exchange rate system that lasted until the early 1970s. Abstract: this paper provides a historical background to contemporary debates on the international monetary system: their genesis, similarities, and differences of problems it has faced at different times. The bretton woods system was the first attempt to create an international monetary arrangement with fixed exchange rates based on international cooperation of central banks and supervised by a newly created international institution, the international.

Ppt The International Monetary System The Bretton Woods System 1945 The collapse of the bretton woods system in the early 1970s led to the introduction of the prevailing system of floating exchange rates, free capital flows and independent monetary policy in the major advanced economies. The bretton woods system that emerged from the conference saw the creation of two global institutions that still play important roles today, the international monetary fund (imf) and the world bank. it also instituted a fixed exchange rate system that lasted until the early 1970s. Abstract: this paper provides a historical background to contemporary debates on the international monetary system: their genesis, similarities, and differences of problems it has faced at different times. The bretton woods system was the first attempt to create an international monetary arrangement with fixed exchange rates based on international cooperation of central banks and supervised by a newly created international institution, the international.

Bretton Woods System Of Monetary Management Pdf Abstract: this paper provides a historical background to contemporary debates on the international monetary system: their genesis, similarities, and differences of problems it has faced at different times. The bretton woods system was the first attempt to create an international monetary arrangement with fixed exchange rates based on international cooperation of central banks and supervised by a newly created international institution, the international.

Comments are closed.