These States Have The Highest Property Tax Rates Thestreet R Soyouknow

These States Have The Highest Property Tax Rates Thestreet R Soyouknow Here’s a chart of the 10 states with the highest property tax rates now and the projections for their future. you also might be interested in knowing what portion of your household income goes to. Discover the states where property taxes are the highest, as revealed by the tax foundation. see how your state compares. home values have skyrocketed in recent years, rising almost 27%.

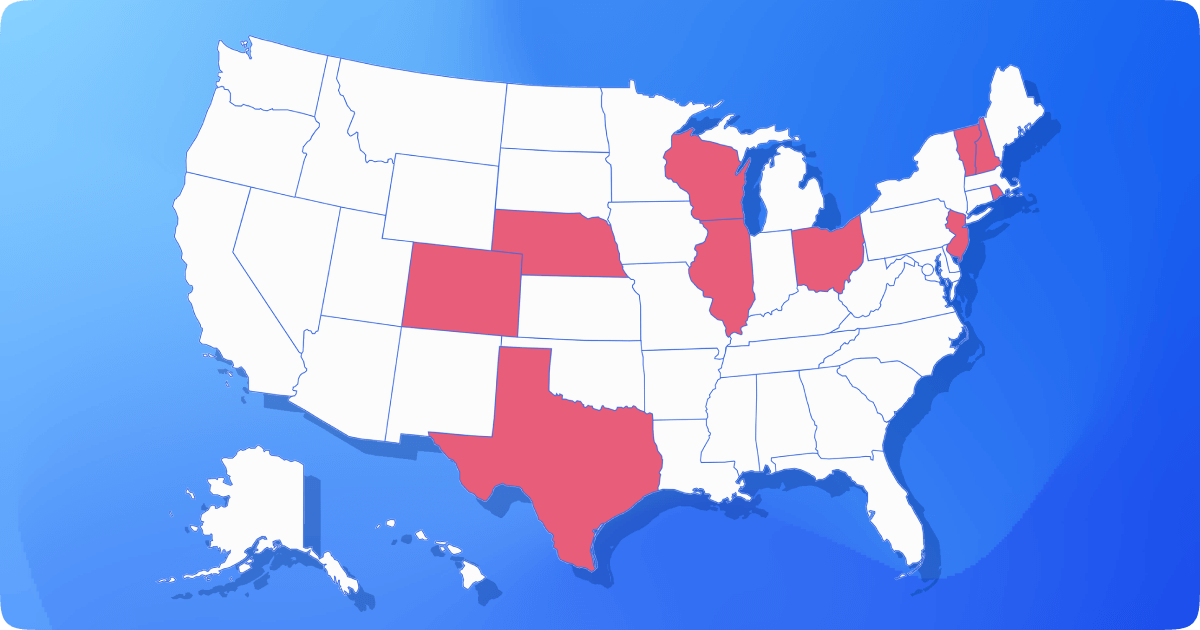

These States Have The Highest Property Tax Rates Thestreet New jersey was found to have the highest effective property tax rate in the country at 2.23%, with the average homeowners paying nearly $10,000 each year based on the state’s median home value. But you may be surprised to learn that 34 states have higher effective property tax rates than california and all of the states have higher effective rates than hawaii. effective tax rate is. Tax rates.org provides detailed statistics on the property taxes collected in every county in the united states, as well as aggregated data for each of the states. the table above shows the fifty states and the district of columbia, ranked from highest to lowest by annual property taxes as a percentage of the median home value. New jersey has the highest effective property tax rate , followed by illinois and connecticut. compare property taxes by county and state.

Top 10 U S States With The Highest Property Tax Rates Tax rates.org provides detailed statistics on the property taxes collected in every county in the united states, as well as aggregated data for each of the states. the table above shows the fifty states and the district of columbia, ranked from highest to lowest by annual property taxes as a percentage of the median home value. New jersey has the highest effective property tax rate , followed by illinois and connecticut. compare property taxes by county and state. 197 subscribers in the soyouknow community. your one stop community for the latest world affairs, filtered to keep you abreast of what’s going on…. Using data from the tax foundation, 24 7 wall st. identified the states where people pay the most in property taxes. states are ranked by the effective property tax rate, or the average amount. Here is a list of states in order of lowest ranking property tax to highest: sources: effective tax rate, tax foundation. median home value, u.s. census bureau 2022 american community survey looking at owner occupied housing units. while most u.s. homeowners must pay property taxes, some properties are exempt. Explore below the top 10 states with the highest property taxes in the u.s., according to the average effective tax rate. also included are the median state home value, the median real estate taxes paid and the median household income. 1.

States With Highest Property Tax Rates Dpgo 197 subscribers in the soyouknow community. your one stop community for the latest world affairs, filtered to keep you abreast of what’s going on…. Using data from the tax foundation, 24 7 wall st. identified the states where people pay the most in property taxes. states are ranked by the effective property tax rate, or the average amount. Here is a list of states in order of lowest ranking property tax to highest: sources: effective tax rate, tax foundation. median home value, u.s. census bureau 2022 american community survey looking at owner occupied housing units. while most u.s. homeowners must pay property taxes, some properties are exempt. Explore below the top 10 states with the highest property taxes in the u.s., according to the average effective tax rate. also included are the median state home value, the median real estate taxes paid and the median household income. 1.

Comments are closed.