Top 10 States With The Highest Property Tax Rate

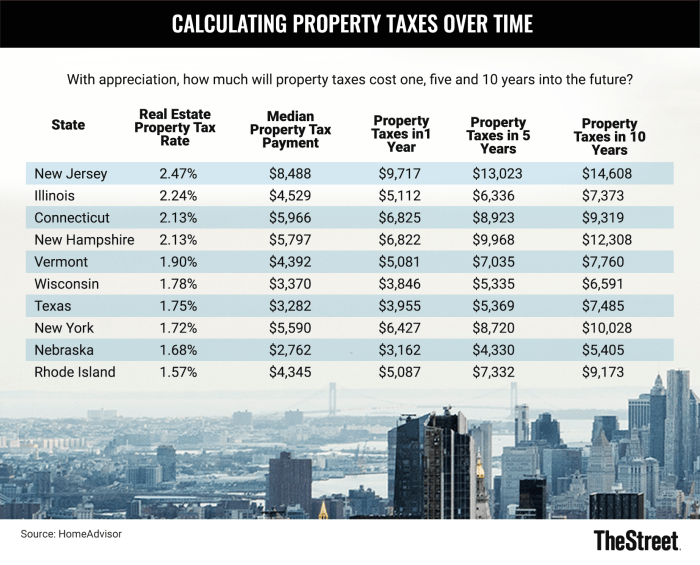

These States Have The Highest Property Tax Rates Thestreet Here’s the effective property tax rate of each state, alongside the median property taxes paid and median home value. the counties in alabama with the highest effective property tax rates are. On tax rates.org, our data allows you to compare property taxes across states and counties by median property tax in dollars, median property tax as percentage of home value, and several other benchmarks.

States With Highest Property Tax Rates Dpgo Explore below the top 10 states with the highest property taxes in the u.s., according to the average effective tax rate. also included are the median state home value, the median real estate taxes paid and the median household income. Here is a list of states in order of lowest ranking property tax to highest: sources: effective tax rate, tax foundation. median home value, u.s. census bureau 2022 american community survey looking at owner occupied housing units. while most u.s. homeowners must pay property taxes, some properties are exempt. Effective property tax rate in fiscal 2023: 0.24% of home value property tax collections per capita in fiscal 2022: $1,602 (20th lowest of 50 states) median home value: $859,800 (the highest of 50. Here is a list of states in alphabetical order but includes the ranking position — 1 being the state with the lowest property tax rate and 51 (because the inclusion of d.c.) being the state with.

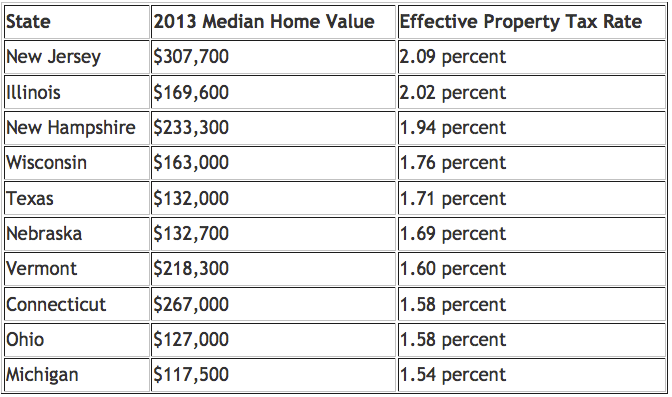

See Who Pays The Highest And Lowest Property Taxes Effective property tax rate in fiscal 2023: 0.24% of home value property tax collections per capita in fiscal 2022: $1,602 (20th lowest of 50 states) median home value: $859,800 (the highest of 50. Here is a list of states in alphabetical order but includes the ranking position — 1 being the state with the lowest property tax rate and 51 (because the inclusion of d.c.) being the state with. In calendar year 2022 (the most recent data available), new jersey had the highest effective rate on owner occupied property at 2.08 percent, followed by illinois (1.95 percent) and connecticut (1.78 percent). We took a look at recent u.s. property tax figures broken down by state and ranked the 15 current highest below, including the median home value for the state, to give you a clearer idea of housing costs in these areas. 1. illinois. average property tax rate: 1.825% median home value: $289,000. 2. new jersey. average property tax rate: 1.773%. The states with lowest property tax include hawaii with the lowest property tax rate at 0.29%, followed by states like alabama, colorado, nevada, and louisiana. new jersey has the highest property tax rate at 2.47%, followed by illinois, connecticut, new hampshire, and vermont. Property taxes stand out as one. here are the 10 states with the highest median tax bill. number 10, washington state at 4, 158. number 9, california at 4, 700. number 8, rhode.

5 Lowest Property Tax States Unveiled In calendar year 2022 (the most recent data available), new jersey had the highest effective rate on owner occupied property at 2.08 percent, followed by illinois (1.95 percent) and connecticut (1.78 percent). We took a look at recent u.s. property tax figures broken down by state and ranked the 15 current highest below, including the median home value for the state, to give you a clearer idea of housing costs in these areas. 1. illinois. average property tax rate: 1.825% median home value: $289,000. 2. new jersey. average property tax rate: 1.773%. The states with lowest property tax include hawaii with the lowest property tax rate at 0.29%, followed by states like alabama, colorado, nevada, and louisiana. new jersey has the highest property tax rate at 2.47%, followed by illinois, connecticut, new hampshire, and vermont. Property taxes stand out as one. here are the 10 states with the highest median tax bill. number 10, washington state at 4, 158. number 9, california at 4, 700. number 8, rhode.

Top 12 High Property Tax States In The U S The states with lowest property tax include hawaii with the lowest property tax rate at 0.29%, followed by states like alabama, colorado, nevada, and louisiana. new jersey has the highest property tax rate at 2.47%, followed by illinois, connecticut, new hampshire, and vermont. Property taxes stand out as one. here are the 10 states with the highest median tax bill. number 10, washington state at 4, 158. number 9, california at 4, 700. number 8, rhode.

Comments are closed.