Top 10 U S States With The Highest Property Tax Rates

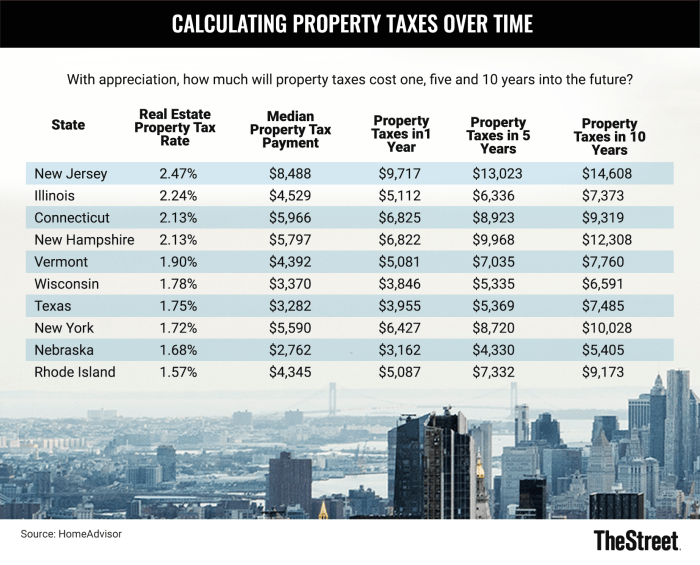

These States Have The Highest Property Tax Rates Thestreet The table above shows the fifty states and the district of columbia, ranked from highest to lowest by annual property taxes as a percentage of the median home value. The states with the highest effective property tax rates are new jersey (2.30%), illinois (2.18%), connecticut (2.00%), new hampshire (1.88%), and texas (1.79%).

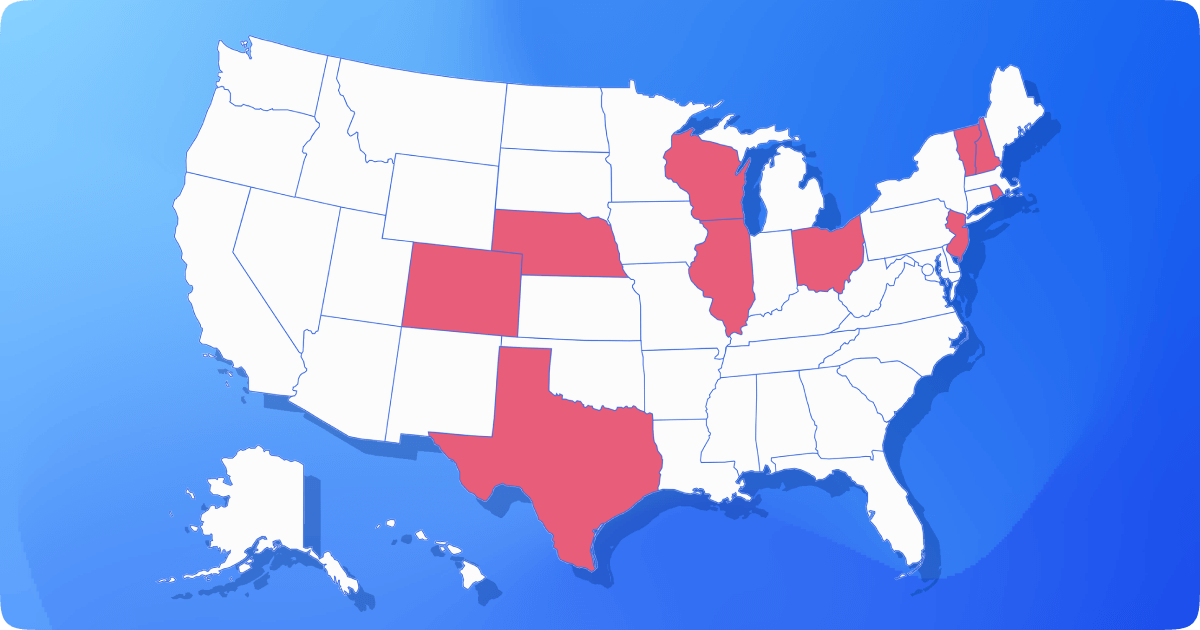

Top 10 U S States With The Highest Property Tax Rates Explore below the top 10 states with the highest property taxes in the u.s., according to the average effective tax rate. also included are the median state home value, the median real estate taxes paid and the median household income. Across the 50 states, effective property tax rates range from less than 0.25% of home values, to over 2%. for context, the average effective property tax rate nationwide stands at 0.93%. According to the tax foundation, an american tax policy research and analysis firm, new jersey tops the list of 11 counties with the highest median property tax bills exceeding $10,000. the property tax rate in new jersey in 2023 was 2.23%. Median property taxes paid vary widely across (and within) the 50 states. the average countywide amount of property taxes paid in 2023 across the united states was $1,889 (with a standard deviation of $1,426). the lowest property tax bills in the country are in 11 counties or county equivalents with median property taxes of less than $250 a year:.

States With Highest Property Tax Rates Dpgo According to the tax foundation, an american tax policy research and analysis firm, new jersey tops the list of 11 counties with the highest median property tax bills exceeding $10,000. the property tax rate in new jersey in 2023 was 2.23%. Median property taxes paid vary widely across (and within) the 50 states. the average countywide amount of property taxes paid in 2023 across the united states was $1,889 (with a standard deviation of $1,426). the lowest property tax bills in the country are in 11 counties or county equivalents with median property taxes of less than $250 a year:. We took a look at recent u.s. property tax figures broken down by state and ranked the 15 current highest below, including the median home value for the state, to give you a clearer idea of housing costs in these areas. 1. illinois. average property tax rate: 1.825% median home value: $289,000. 2. new jersey. average property tax rate: 1.773%. New jersey was found to have the highest effective property tax rate in the country at 2.23%, with the average homeowners paying nearly $10,000 each year based on the state’s median home value. Tampa, fla., has seen some of the highest hikes in property taxes. becoming a homeowner can be challenging and high property taxes only add to the hurdles homebuyers face. according to a recent survey from online lending marketplace lendingtree, property taxes rose by an average of 10.4% to a median. In 2024, illinois and new jersey recorded the highest effective property tax rates on single family homes, at 1.87% and 1.59% respectively, according to attom data. average u.s. property taxes.

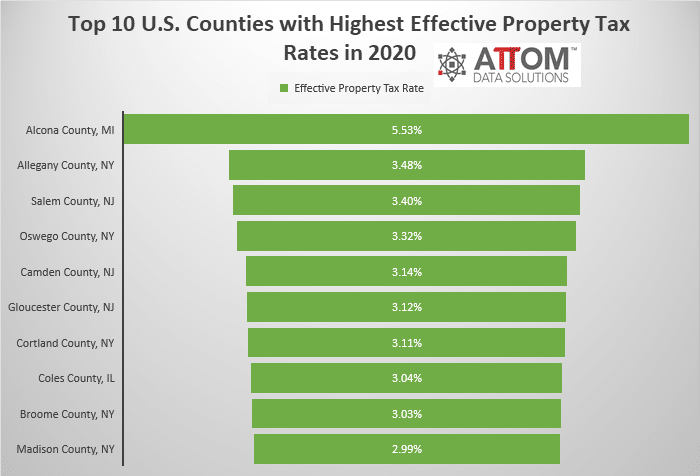

Top 10 U S Counties With Highest Effective Property Tax Rates Attom We took a look at recent u.s. property tax figures broken down by state and ranked the 15 current highest below, including the median home value for the state, to give you a clearer idea of housing costs in these areas. 1. illinois. average property tax rate: 1.825% median home value: $289,000. 2. new jersey. average property tax rate: 1.773%. New jersey was found to have the highest effective property tax rate in the country at 2.23%, with the average homeowners paying nearly $10,000 each year based on the state’s median home value. Tampa, fla., has seen some of the highest hikes in property taxes. becoming a homeowner can be challenging and high property taxes only add to the hurdles homebuyers face. according to a recent survey from online lending marketplace lendingtree, property taxes rose by an average of 10.4% to a median. In 2024, illinois and new jersey recorded the highest effective property tax rates on single family homes, at 1.87% and 1.59% respectively, according to attom data. average u.s. property taxes.

Top 12 High Property Tax States In The U S Tampa, fla., has seen some of the highest hikes in property taxes. becoming a homeowner can be challenging and high property taxes only add to the hurdles homebuyers face. according to a recent survey from online lending marketplace lendingtree, property taxes rose by an average of 10.4% to a median. In 2024, illinois and new jersey recorded the highest effective property tax rates on single family homes, at 1.87% and 1.59% respectively, according to attom data. average u.s. property taxes.

Comments are closed.