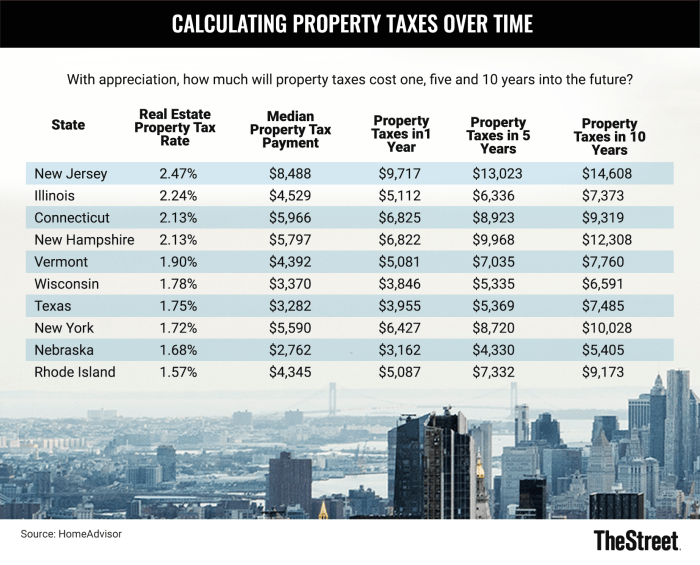

Top 5 States With The Highest Real Estate Property Tax Rate

These States Have The Highest Property Tax Rates Thestreet Here's a look at the top 5 states paying the highest property tax rates: 1. new jersey. garden state residents are paying the highest tax rates in the united states. for 2024, the. Here is a list of states in order of lowest ranking property tax to highest: sources: effective tax rate, tax foundation. median home value, u.s. census bureau 2022 american community survey looking at owner occupied housing units. while most u.s. homeowners must pay property taxes, some properties are exempt.

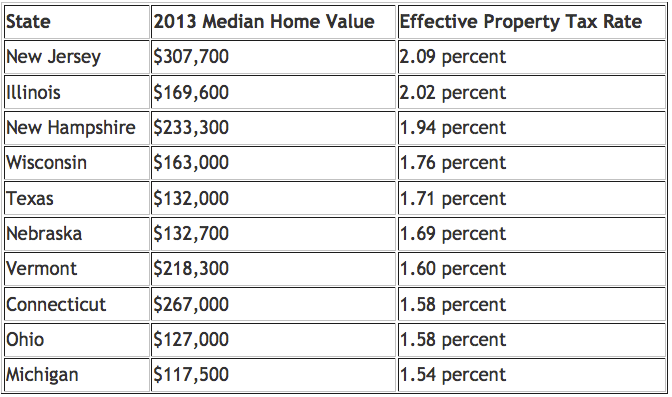

See Who Pays The Highest And Lowest Property Taxes The table above shows the fifty states and the district of columbia, ranked from highest to lowest by annual property taxes as a percentage of the median home value. taxes as percentage of home value can be a more useful comparison of the true property tax burden in an area, as any ranking using actual dollar amounts will be biased toward areas. Effective property tax rates range from an average of 0.27% in hawaii to 2.30% in new jersey. new jersey and new york are home to the counties with the highest property tax rates. the counties with. The states with lowest property tax include hawaii with the lowest property tax rate at 0.29%, followed by states like alabama, colorado, nevada, and louisiana. new jersey has the highest property tax rate at 2.47%, followed by illinois, connecticut, new hampshire, and vermont. Explore below the top 10 states with the highest property taxes in the u.s., according to the average effective tax rate. also included are the median state home value, the median real estate taxes paid and the median household income. 1.

States With Highest Property Tax Rates Dpgo The states with lowest property tax include hawaii with the lowest property tax rate at 0.29%, followed by states like alabama, colorado, nevada, and louisiana. new jersey has the highest property tax rate at 2.47%, followed by illinois, connecticut, new hampshire, and vermont. Explore below the top 10 states with the highest property taxes in the u.s., according to the average effective tax rate. also included are the median state home value, the median real estate taxes paid and the median household income. 1. Median property taxes paid in manhattan (new york county), san francisco, chicago (cook county), and miami (miami dade county) are two to three times higher than their state’s average. Effective property tax rate in fiscal 2023: 0.24% of home value property tax collections per capita in fiscal 2022: $1,602 (20th lowest of 50 states) median home value: $859,800 (the highest of 50. Here is a list of states in alphabetical order but includes the ranking position — 1 being the state with the lowest property tax rate and 51 (because the inclusion of d.c.) being the. In order to determine the states with the highest and lowest property taxes, wallethub compared the 50 states and the district of columbia by using u.s. census bureau data to determine real estate property tax rates and applying assumptions based on national auto sales data to determine vehicle property tax rates.

Comments are closed.