Truth In Taxation Hearings On Property Tax Hikes To Start

The New Tax Law The Path To The Tax Overhaul Wsj After publishing the required notice, taxpayers have the opportunity to express their views on tax increases at hearings. 1 the type of taxing unit determines the hearing requirements. small taxing units have no public hearing requirement. 2 school districts, water districts and all other taxing units must hold one public hearing. 3. Four states restrict local governments’ authority to impose large property tax increases, even after following other truth in taxation requirements for disclosure and public hearings. the limit on the increase varies from state to state, from more than 3.5 percent to 15 percent above the prior year levy.

The Hidden Tax Rise In The Autumn Statement Truth in taxation is a concept embodied in the texas constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to limit tax increases. Across utah, communities will hold a series of "truth in taxation" hearings as municipalities, water districts, school districts and even library boards propose increases in property taxes . If the same tax rate as last year is proposed, are public hearings and quarter page ads required? last year’s tax rate is not relevant to the current year’s truth in taxation requirements. Salt lake city — across utah, communities will hold a series of "truth in taxation" hearings as municipalities, water districts, school districts and even library boards propose increases in.

Truth In Taxation Hearings On Property Tax Hikes To Start This Month If the same tax rate as last year is proposed, are public hearings and quarter page ads required? last year’s tax rate is not relevant to the current year’s truth in taxation requirements. Salt lake city — across utah, communities will hold a series of "truth in taxation" hearings as municipalities, water districts, school districts and even library boards propose increases in. Truth in taxation is a texas constitutional requirement directing local taxing units to make taxpayers aware of tax rate proposals and provide an opportunity for taxpayers to roll back or limit property tax increases. •four principles to truth in taxation •property owners right to know •taxing units are required to publish effective and rollback rates before adopting rate •notice and public hearing(s) must be held before adopting a rate that exceeds the lower of the rollback or effective tax rate. Truth in taxation is a concept embodied in the texas constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to roll back or limit tax increases. The notices below comply with truth in taxation requirements when holding public hearings, considering budgets and setting rates to impose property taxes. note: the type and number of notices required may vary from year to year depending on the statutes in place at that time.

Truth In Taxation Tax Rate Elections Ptad Learning Portal Truth in taxation is a texas constitutional requirement directing local taxing units to make taxpayers aware of tax rate proposals and provide an opportunity for taxpayers to roll back or limit property tax increases. •four principles to truth in taxation •property owners right to know •taxing units are required to publish effective and rollback rates before adopting rate •notice and public hearing(s) must be held before adopting a rate that exceeds the lower of the rollback or effective tax rate. Truth in taxation is a concept embodied in the texas constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to roll back or limit tax increases. The notices below comply with truth in taxation requirements when holding public hearings, considering budgets and setting rates to impose property taxes. note: the type and number of notices required may vary from year to year depending on the statutes in place at that time.

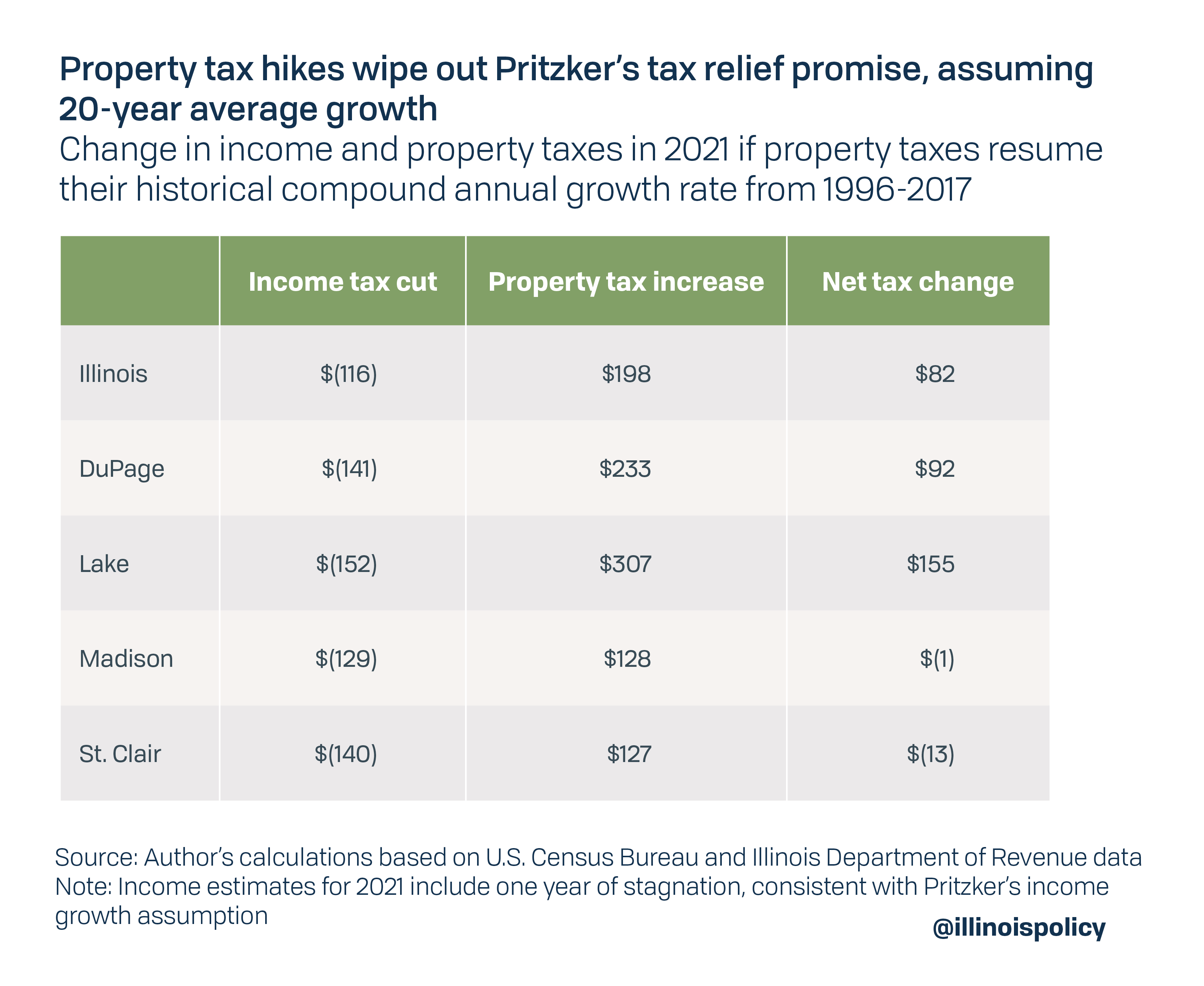

Property Tax Hikes Wipe Out Pritzker S Tax Relief Promise Truth in taxation is a concept embodied in the texas constitution that requires local taxing units to make taxpayers aware of tax rate proposals and to afford taxpayers the opportunity to roll back or limit tax increases. The notices below comply with truth in taxation requirements when holding public hearings, considering budgets and setting rates to impose property taxes. note: the type and number of notices required may vary from year to year depending on the statutes in place at that time.

Property Tax Assistance

Comments are closed.