Understanding Your Colorado Property Tax Statement

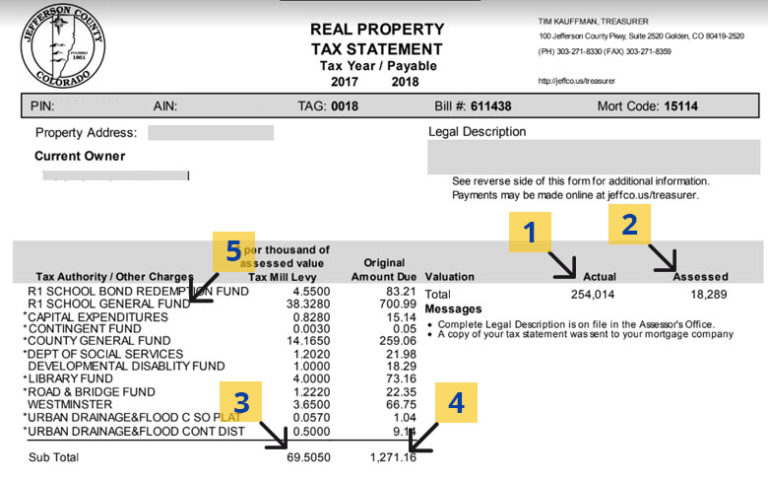

Understanding Your Colorado Property Tax Statement Property tax calculations consist of several components: property is classified by the assessor according to its actual use on january 1. the property’s classification determines the rate at which the property will be assessed. residential property is valued using only the market approach to value. Find the assistance and resources needed to determine if your property is eligible for property tax relief. the annual report to the governor and the general assembly provides annual statistical and summary property tax information for the state of colorado.

Understanding The Property Tax Building A Better Colorado For property tax year 2025, residential property is assessed at 7.05% for schools and 6.25% for local governments. 2025 residential assessment rates are assuming a 2024 to 2025 statewide actual value growth of less than or equal to 5%. Easily estimate your property taxes, view local taxing districts, and explore last year’s data—all in one easy, accessible tool. Understand colorado property tax laws, including valuation, exemptions, and the appeals process, to navigate tax obligations with confidence. Fax: 303 271 8359. hours monday thursday 7:30 a.m. through 5 p.m. friday closed . pay or view property taxes. if you are unable to access any of the content of the treasurer documents, please complete our digital accessibility request form or call 303 271 8455 for assistance treasurer's customer satisfaction survey.

Understanding The Property Tax Building A Better Colorado Understand colorado property tax laws, including valuation, exemptions, and the appeals process, to navigate tax obligations with confidence. Fax: 303 271 8359. hours monday thursday 7:30 a.m. through 5 p.m. friday closed . pay or view property taxes. if you are unable to access any of the content of the treasurer documents, please complete our digital accessibility request form or call 303 271 8455 for assistance treasurer's customer satisfaction survey. Colorado is rolling out a revamped online map to help homeowners estimate their property taxes this year as notices of valuation begin to hit their doorsteps. the initiative, announced by gov. jared polis and the department of local affairs, aggregates data provided to the state by local governments.

Colorado Property Tax Colorado is rolling out a revamped online map to help homeowners estimate their property taxes this year as notices of valuation begin to hit their doorsteps. the initiative, announced by gov. jared polis and the department of local affairs, aggregates data provided to the state by local governments.

Colorado Property Tax

Colorado Property Tax

Comments are closed.