Utah County Commission Approves 67 Property Tax Hike To Balance Budget

Utah County Commission Approves 67 Property Tax Hike To Balance Budget County tax on a $532,000 residence will be raised from $190.78 to $282.33, a $91.55 increase, while the tax on a $532,000 business will go from $346.86 to $513.30, a $166.44 rise. the. The utah county commission approved a 47.99% property tax increase for 2025. the increase aims to address public safety, infrastructure and service deficits.

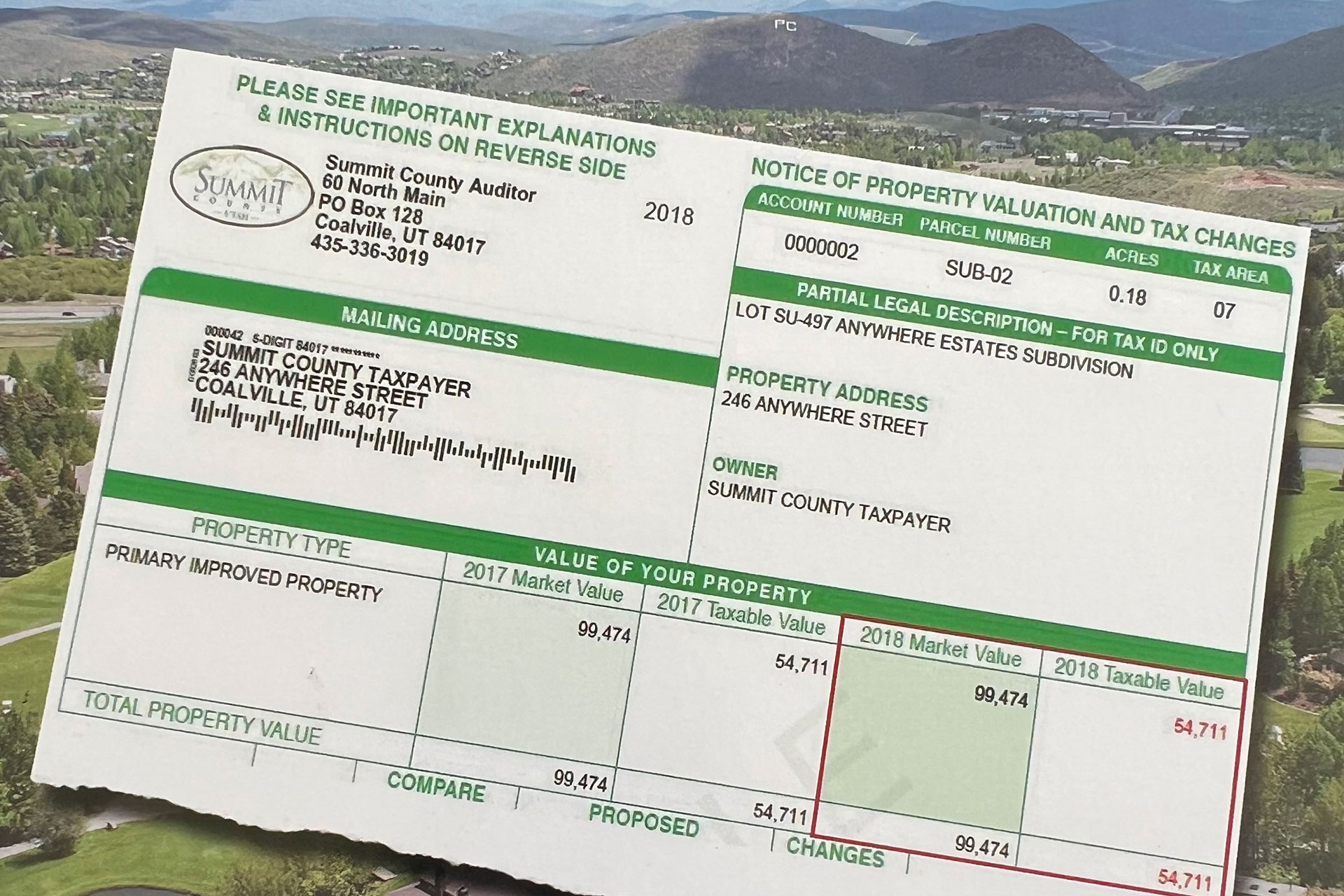

Utah County Commission Approves 2025 Budget That Includes Property Tax The county approved an increase of 47.99% for its portion of the property tax, plus a 10% increase on the assessing and collecting portion of the tax. this means the county property tax for an average home worth $532,000 would increase from $190.78 to $282.33, or about $91.55 a year. After going 23 years without an increase to property taxes, the utah county commission approved an increased budget that included a 67% property tax hike. peter watkins,. The utah county commission has approved its 2025 budget, which includes a property tax increase deemed 'absolutely necessary' by the commissioners. this decision aligns with recent trends in various counties across the united states, where local governments are implementing tax hikes to address budgetary needs. Provo, ut – on wednesday, the utah county commission finalized its budget for 2025, incorporating a notable rise in property taxes that the commissioners deemed “essential.” the county has sanctioned a significant rise of 47.99% in its share of the property tax, alongside a 10% hike in the assessing and collecting segment of the tax.

School Board Spotlight Utah County Commission Passes 2024 Budget The utah county commission has approved its 2025 budget, which includes a property tax increase deemed 'absolutely necessary' by the commissioners. this decision aligns with recent trends in various counties across the united states, where local governments are implementing tax hikes to address budgetary needs. Provo, ut – on wednesday, the utah county commission finalized its budget for 2025, incorporating a notable rise in property taxes that the commissioners deemed “essential.” the county has sanctioned a significant rise of 47.99% in its share of the property tax, alongside a 10% hike in the assessing and collecting segment of the tax. All three commission members voted in approval of a resolution to hold a truth in taxation hearing in august. the proposal is for a tax increase of about 48% or $91.54 a year on the average. The county’s tax proposal is for an increase of about 48%, or $91.55, on the average home valued at $532,000, with utah county assessing and collecting proposing about a 10% increase, which is. Utah county is proposing a hike that would boost its portion of property taxes on a home worth $532,000 by 48%, from $190.78 to $282.33. this would equate to about $8 a month from each. The average utah county property owner will pay about $83 more each year under a new tax rate approved tuesday. that’s a 67% increase. the county commission voted 2 1 to increase the county’s portion of the tax for the first time in 23 years. “it’s very unpopular politically to do this,” said utah county commission chair tanner ainge.

Utah Property Tax County S Tax Rates All three commission members voted in approval of a resolution to hold a truth in taxation hearing in august. the proposal is for a tax increase of about 48% or $91.54 a year on the average. The county’s tax proposal is for an increase of about 48%, or $91.55, on the average home valued at $532,000, with utah county assessing and collecting proposing about a 10% increase, which is. Utah county is proposing a hike that would boost its portion of property taxes on a home worth $532,000 by 48%, from $190.78 to $282.33. this would equate to about $8 a month from each. The average utah county property owner will pay about $83 more each year under a new tax rate approved tuesday. that’s a 67% increase. the county commission voted 2 1 to increase the county’s portion of the tax for the first time in 23 years. “it’s very unpopular politically to do this,” said utah county commission chair tanner ainge.

Summit And Wasatch County Utah Property Tax Appeals Utah county is proposing a hike that would boost its portion of property taxes on a home worth $532,000 by 48%, from $190.78 to $282.33. this would equate to about $8 a month from each. The average utah county property owner will pay about $83 more each year under a new tax rate approved tuesday. that’s a 67% increase. the county commission voted 2 1 to increase the county’s portion of the tax for the first time in 23 years. “it’s very unpopular politically to do this,” said utah county commission chair tanner ainge.

The Utah Legislature Approved Another Tax Cut Here S What Taxpayers

Comments are closed.