Utah Property Tax County S Tax Rates

Utah Property Tax County S Tax Rates The following documents show the tax rates listed by area. the final tax rates listed by area. Utah county treasurer tax rates. an official website of utah county government. 801 851 8255 utah county treasurer | please use the options below to search for your tax rates by district or year: search by district : year:.

Utah Property Tax County S Tax Rates The median utah property tax is $1,351.00, with exact property tax rates varying by location and county. Tax rates vary by district year to year. use this tool to calculate rates based on location. a list of all properties with outstanding taxes due from all years is available below. disclaimer : tax payoff is only for the given year (s) shown in the file. taxes due are as of the date of the file. The average effective tax rate across utah counties is 0.61%. san juan county has the highest rate at 1.02%. summit county has the lowest rate at 0.40%. the average median home value is $252,807. where property taxes go. property taxes in utah fund a wide range of vital public services, including: education: schools, libraries, and educational. Overview of utah taxes. utah’s average effective property tax rate is just 0.55%, good for eighth lowest in the country. here, the typical homeowner can expect to pay about $2,241 annually in property tax payments.

Utah Property Taxes By County 2024 The average effective tax rate across utah counties is 0.61%. san juan county has the highest rate at 1.02%. summit county has the lowest rate at 0.40%. the average median home value is $252,807. where property taxes go. property taxes in utah fund a wide range of vital public services, including: education: schools, libraries, and educational. Overview of utah taxes. utah’s average effective property tax rate is just 0.55%, good for eighth lowest in the country. here, the typical homeowner can expect to pay about $2,241 annually in property tax payments. The highest property tax rate, in utah is 0.84% in san juan county. the lowest property tax rate, is 0.34% in rich county and summit county. utah ( 0.55% ) has a 46.1% lower property tax rate, than the average of the us ( 1.02% ). Below, you can compare a utah county’s effective property tax rate to other counties in utah or the u.s. median property tax rate. for instance, uintah county has the highest effective property tax rate in utah, at 1.10%, while washington county has the lowest, at 0.40%. The average effective property tax rate in utah is 0.50%, but this can vary quite a bit depending on which county the home is in. *amounts are based on a $530,787 home, the typical home value in utah. remember that each county and municipality has its own formula for assessment rates and frequency. The median property tax (also known as real estate tax) in utah county is $1,287.00 per year, based on a median home value of $233,800.00 and a median effective property tax rate of 0.55% of property value.

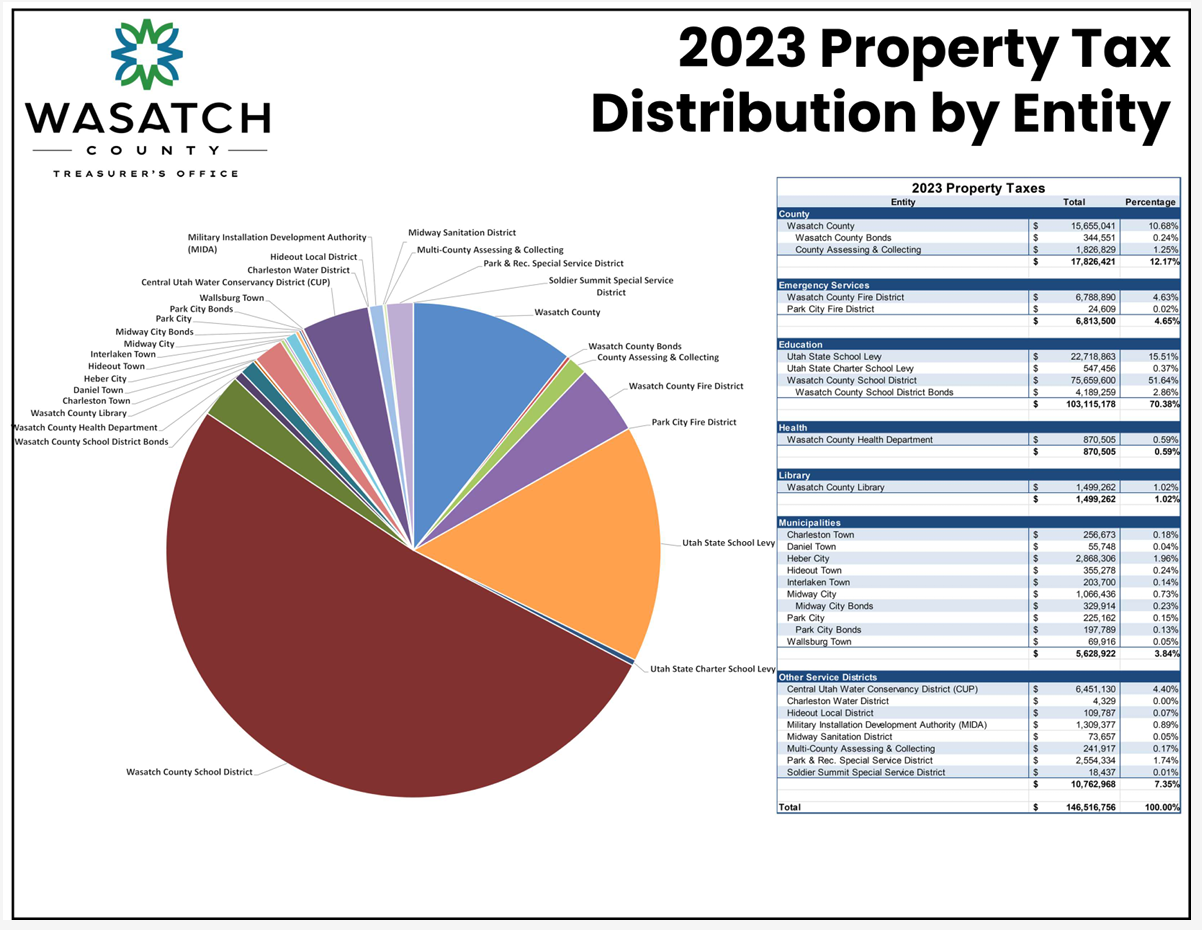

Utah S Property Tax System Wasatch County The highest property tax rate, in utah is 0.84% in san juan county. the lowest property tax rate, is 0.34% in rich county and summit county. utah ( 0.55% ) has a 46.1% lower property tax rate, than the average of the us ( 1.02% ). Below, you can compare a utah county’s effective property tax rate to other counties in utah or the u.s. median property tax rate. for instance, uintah county has the highest effective property tax rate in utah, at 1.10%, while washington county has the lowest, at 0.40%. The average effective property tax rate in utah is 0.50%, but this can vary quite a bit depending on which county the home is in. *amounts are based on a $530,787 home, the typical home value in utah. remember that each county and municipality has its own formula for assessment rates and frequency. The median property tax (also known as real estate tax) in utah county is $1,287.00 per year, based on a median home value of $233,800.00 and a median effective property tax rate of 0.55% of property value.

Utah Property Tax 2024 2025 The average effective property tax rate in utah is 0.50%, but this can vary quite a bit depending on which county the home is in. *amounts are based on a $530,787 home, the typical home value in utah. remember that each county and municipality has its own formula for assessment rates and frequency. The median property tax (also known as real estate tax) in utah county is $1,287.00 per year, based on a median home value of $233,800.00 and a median effective property tax rate of 0.55% of property value.

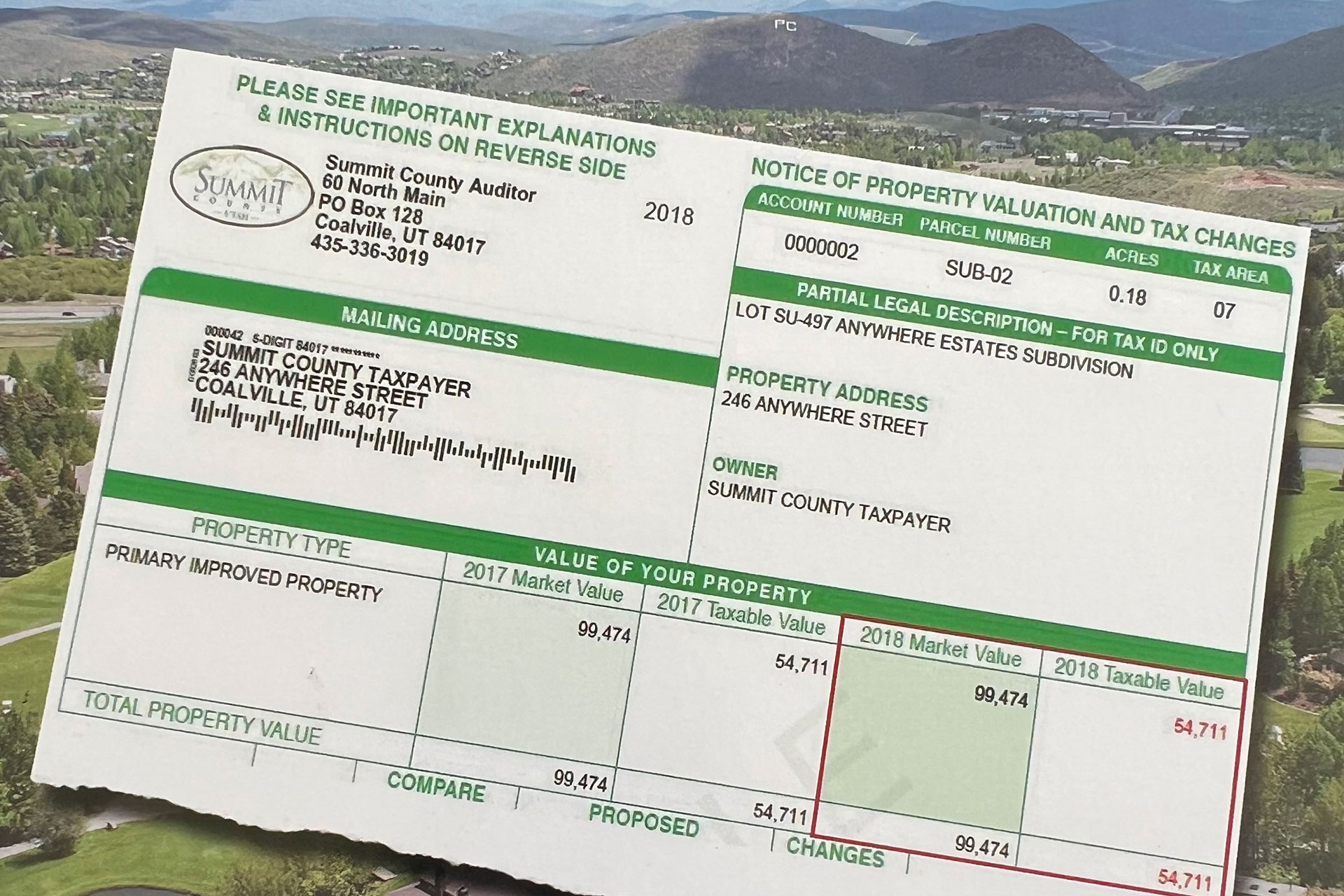

Summit And Wasatch County Utah Property Tax Appeals

Comments are closed.