What Is Business Personal Property Tax

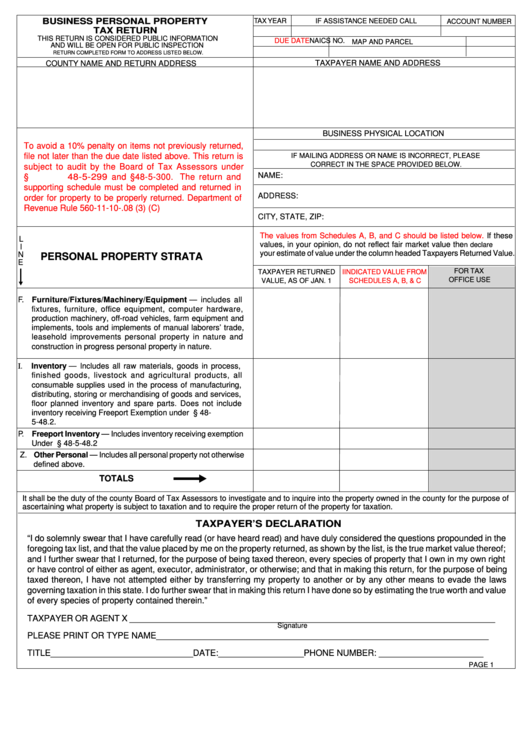

What Is Business Personal Property Tax Pdf Property Tax Taxes Business personal property tax (bpp) is a tax on the furniture, fixtures, and equipment that are owned and used in a business. any assets that are claimed on the business' income taxes should be reported on the bpp tax return. Neglecting business personal property tax can lead to compliance issues, tax penalties, and missed planning opportunities. this guide defines business personal property, lists states without a business personal property tax, and gives a broad overview of how business personal property taxes work.

Business Personal Property Tax Learn about business personal property (bpp) tax and how it affects your business. alamo ad valorem provides expert guidance with bpp taxation. Learn about personal property taxes, including what qualifies as taxable property, how taxes are assessed & payment requirements. get insights into exemptions & how to manage your personal property tax obligations. Who needs to file business personal property tax returns? all businesses with a physical location in richland county that own or use assets of fixtures, furniture, and equipment need to file business personal property tax returns. Business personal property tax is a tax assessed on tangible personal property businesses own. this type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land.

Business Personal Property Tax Taxops Who needs to file business personal property tax returns? all businesses with a physical location in richland county that own or use assets of fixtures, furniture, and equipment need to file business personal property tax returns. Business personal property tax is a tax assessed on tangible personal property businesses own. this type of property includes equipment, furniture, computers, machinery, and inventory, among other items not permanently attached to a building or land. Learn what business property tax is, how to calculate it, and how to deduct it from your taxes. find out the difference between business property tax and business personal property tax, and how they affect your business. For federal tax purposes, your business's personal property can be divided into two categories: items that will be used up in one year or less, and items that will last for more than one year. the irs treats these two categories differently. Business personal property taxes vary depending on your locality. your local tax authority may require you to pay an annual personal property tax in addition to your business property taxes. or, they may lump your business personal property and regular business property taxes together. Business property tax is a tax that you pay on the assessed value of real property, like land or real estate, that your business owns. your tax rate will be based on the assessed value of your business’s land or real estate, as opposed to the fair market value.

Fillable Business Personal Property Tax Return Form Printable Pdf Learn what business property tax is, how to calculate it, and how to deduct it from your taxes. find out the difference between business property tax and business personal property tax, and how they affect your business. For federal tax purposes, your business's personal property can be divided into two categories: items that will be used up in one year or less, and items that will last for more than one year. the irs treats these two categories differently. Business personal property taxes vary depending on your locality. your local tax authority may require you to pay an annual personal property tax in addition to your business property taxes. or, they may lump your business personal property and regular business property taxes together. Business property tax is a tax that you pay on the assessed value of real property, like land or real estate, that your business owns. your tax rate will be based on the assessed value of your business’s land or real estate, as opposed to the fair market value.

Business Personal Property Tax Modern Tax Group Business personal property taxes vary depending on your locality. your local tax authority may require you to pay an annual personal property tax in addition to your business property taxes. or, they may lump your business personal property and regular business property taxes together. Business property tax is a tax that you pay on the assessed value of real property, like land or real estate, that your business owns. your tax rate will be based on the assessed value of your business’s land or real estate, as opposed to the fair market value.

Comments are closed.