Which Cities Are Contemplating Property Tax Increases To Offset Covid

Which Cities Are Contemplating Property Tax Increases To Offset Covid Many municipalities are looking at raising property taxes in order to meet budget shortfalls caused by economic shutdowns related to the covid 19 pandemic. In 2024, the legislature passed another law putting a 4% cap on year to year property tax increases. call estimates that the pre cut residential property tax growth in park county this year was around 5% to 6%, which roughly falls in line with what the long term historical annual residential tax growth has been in wyoming.

A Tale Of Two Counties Facing Possible Property Tax Increases Graphic 2. indianapolis, in. this metro had a 19.8% increase in property taxes in the post pandemic years. though the median home price was down by 3.4% in april 2025, to a more reasonable $329,211. Homeowners in some cities saw far steeper spikes. in tampa, florida, for example, property taxes jumped by a whopping 23.3%, the most of any metro.indianapolis and dallas weren’t far behind. Cities aren’t just facing rising costs – they’re also losing revenues. in many u.s. cities, retail and commercial office economies are declining. developers have overbuilt commercial properties, creating an excess supply. more unleased properties will mean lower tax revenues. New jersey had the highest effective property tax rate at 2.2%, followed by illinois (2.18%), texas (2.15%), vermont (1.97%) and connecticut (1.92%).

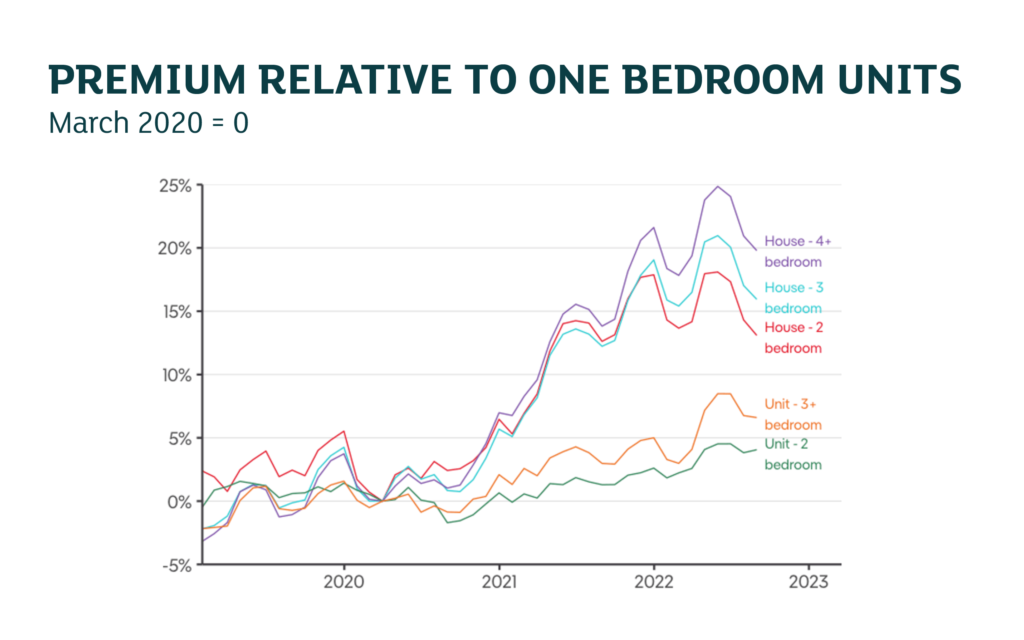

How Covid Changed The Property Market Connekt News Cities aren’t just facing rising costs – they’re also losing revenues. in many u.s. cities, retail and commercial office economies are declining. developers have overbuilt commercial properties, creating an excess supply. more unleased properties will mean lower tax revenues. New jersey had the highest effective property tax rate at 2.2%, followed by illinois (2.18%), texas (2.15%), vermont (1.97%) and connecticut (1.92%). Interim oakland mayor kevin jenkins has proposed a property tax increase to go on the june 2026 ballot to raise money to close oakland’s budget gap. $125 million to offset some of the city. Georgia adopted a proposition 13–like measure limiting annual residential property assessment increases (local governments can opt out, though). florida revised its homestead exemption,. More: which cities are contemplating property tax increases to offset covid 19 financial woes? “i call it the split roll initiative,” ms. cizmarik said, because it will split the tax roll. Vancouver and new york are currently weighing hikes to fill budget gaps.

Comments are closed.